May 2019 Q2 a.

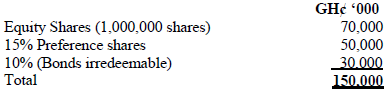

M&E Ltd, recognised as the leader in steel manufacturing, has received an invitation to supply steel for the construction of rail lines to connect the ECOWAS countries, starting from Nigeria. The contract will be for 10 years, and management is considering appraising the investment to enable them present their proposals for the contract. The following information was extracted from the recently published accounts of M&E Ltd.

The Treasury unit of M&E Ltd has estimated that it will require GH¢ 10 million to finance the new project. The total amount would be raised through 10% Irredeemable bonds at the current market price. The cost of Preference shares and Bonds will not change but equity shareholders will demand an increase of 20% on the current cost of equity.

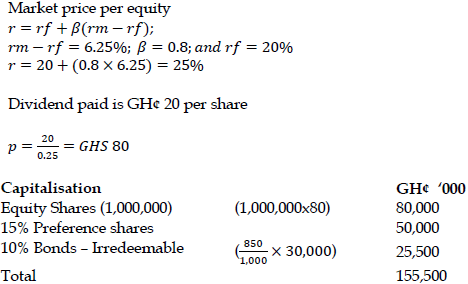

M&E Ltd has a beta of 0.8, the market risk premium for the steel industry is 6.25%, and the Government of Ghana Bond rate is 20%. The current market price for Irredeemable Bonds of GH¢1,000 nominal value is GH¢850.

M&E Ltd’s dividend policy is to pay constant dividend and this policy will not change into the foreseeable future. The recent dividend paid was GH¢20 per share. M&E Ltd is a Free Zones Company and therefore pays tax at a rate of 8%.

Required:

i) Calculate the current market capitalization of M&E Ltd. (5 marks)

View Solution

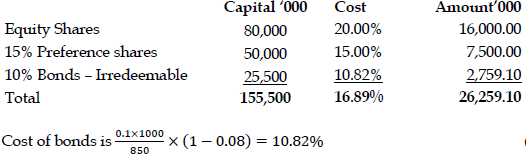

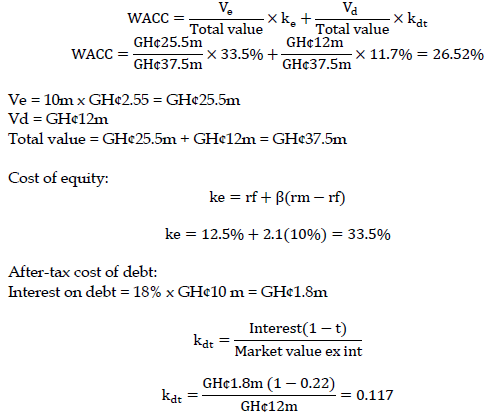

ii) Calculate the Weighted Average Cost of Capital (WACC) prior to the consideration of the finance for the proposed project. (9 marks)

View Solution

WACC = 26,259.10/155,500 =16.89%