May 2021 Q4 b.

Describe management’s responsibility for subsequent events occurring between:

i) The year-end date and the date the Auditor’s report is signed

View Solution

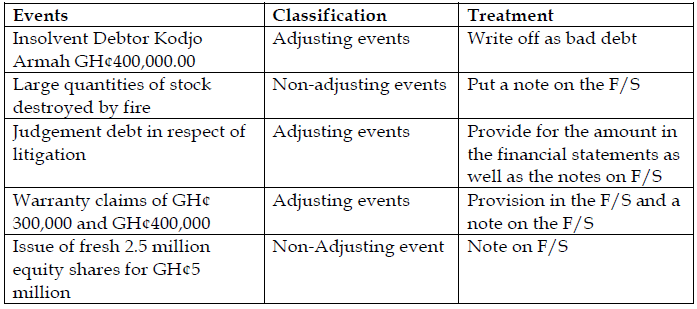

IAS 10 states that if an entity obtains information about an adjusting event after the reporting period, it should update the financial statements to allow for this new information. Accordingly, an entity shall adjust the amounts recognised in its financial statements to reflect the adjusting events after the reporting period.

Non-adjusting events after the reporting period are treated differently. IAS 10 states that an entity shall not adjust the amounts recognised in its financial statement to reflect non-adjusting events after the reporting period. If a non-adjusting event is a material, it must be disclosed. If it is not disclosed it could influence the economic decisions taken by users of the financial information.

The disclosure should include.

- The nature of the event and

- An estimate of its financial effect or a statement that such an estimate cannot be made.

ii) The date the Auditor’s report is signed and the date the financial statements are issued. (6 marks)

View Solution

After the Auditor’s report is signed but before the financial statements are issued

after the Auditor’s report is signed but before the financial statements are issued, it is the responsibility of management to bring any such events to the attention of the Auditor and make the necessary adjustments or disclosure to the financial statements for the Auditor to validate the amendment and issue a fresh report on the financial statement which will bear a date after the amended financial statement are approved by management. Failure to amend the financial statements may result in the Auditor withdrawing the audit report and issuing a new report or prevent further reliance on the report depending on whether the report is still with the Auditor or has been released to management.