May 2017 Q4 c.

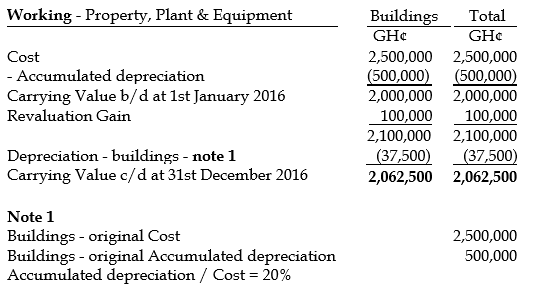

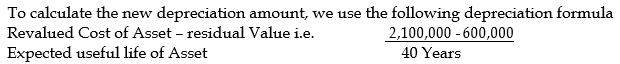

Otiko Ltd’s head office building is the only building it owns. Using professional valuers, it revalued this building on 1 January 2016, at GH¢2,100,000. Otiko Ltd has adopted a revaluation policy for buildings from this valuation date and has decided that the original useful life of buildings has not changed as a result of the revaluation. The building was acquired on 1 January 2006. The cost of the building on acquisition was GH¢2,500,000 and the accumulated depreciation to the 31 December 2015 amounted to GH¢500,000. The depreciation up to 1 January 2016 was depreciated evenly since acquisition. The professional valuer believes that the residual value on the building would be GH¢600,000 at the end of its useful life.

Required:

Calculate the depreciation amount of the building for the year ended 31st December 2016 based on the information provided in the above scenario. (6 marks)

View Solution

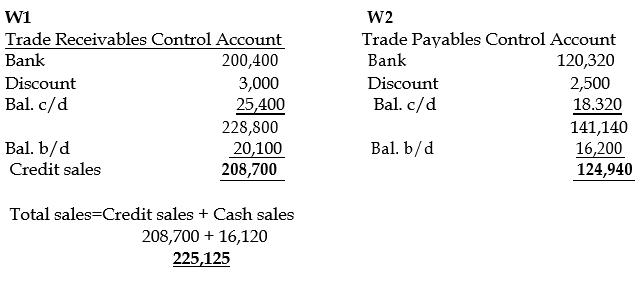

Building has been depreciated by 20% over 10 years (01.01.06 – 31.12.15) so annual rate of depreciation has been 2% i.e. 20% / 10 years as asset has been depreciated evenly since acquistion. Therefore the original useful life is 50 years i.e. 100% / 2% and the remaining useful life is 40 years. Therefore, the remaining useful life is 10 years.

Depreciation = 37,500