Nov 2019 Q2 c.

Outline the stages of group development. (5 marks)

View Solution

- Forming

- Storming

- Norming

- Performing

Outline the stages of group development. (5 marks)

Explain the following in relation to the motivation of employees: (4 marks)

i) Extrinsic rewards

Extrinsic rewards are those which are external or separate from the job itself and depend on the decision of others. Examples of extrinsic rewards are salary, benefits and working conditions which are usually beyond the control of workers and are determined by managers.

ii) Intrinsic rewards

Intrinsic rewards relate to the concept of job satisfaction and include satisfaction associated with the successful accomplishment of a particular task or status associated with a certain job or position. Intrinsic rewards are therefore psychological rather than material.

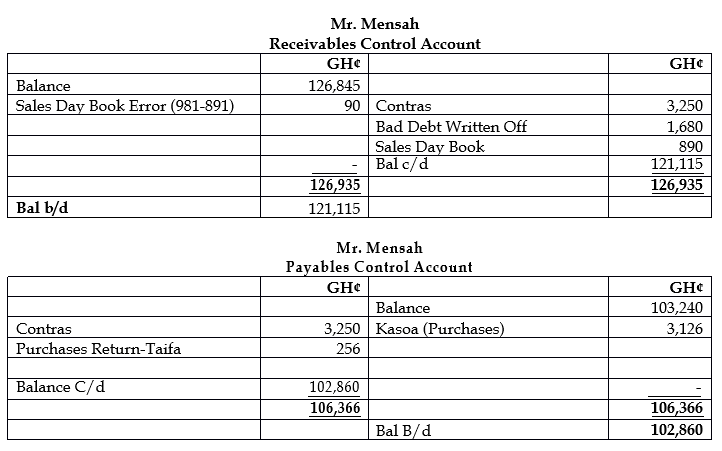

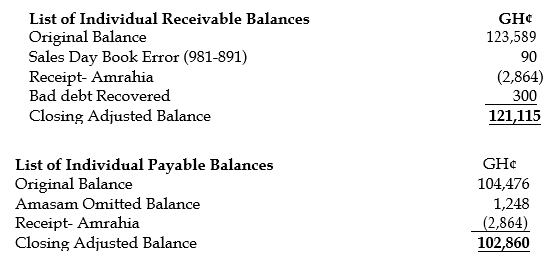

Mr. Patrick Mensah, a sole trader, has asked you to prepare the receivable and payable control accounts and ensure that the closing balances match with the list of balances. Currently, the closing balances as at 30 October 2017 are as follows:

GH¢

Receivables Control Account 126,845

Payables Control Account 103,240

Receivables list of balances 123,589

Payables list of balances 104,476

On investigation, the following have been discovered:

ii) Prepare a statement reconciling the list of balances with the revised control accounts for Receivables and Payables for the year-ended 30 October 2017. (2 marks)

It is universally accepted that leadership is a vital factor that influences an organization’s success. However, it is very difficult to lay down general rules for effective leadership to fit all situations.

Required:

i) Explain the term Leadership. (2 marks)

Leadership can be defined as the ability to influence the behavior of others. It refers to the capacity of the leader to exert influence within a working group in order that the group may achieve group tasks or objectives. Followers perform willingly to the best of their abilities without any form of coercion by the leader.

ii) Explain the following Theories of Leadership: (9 marks)

The Trait theory of leadership assumes that an effective leader possesses some innate characteristics. These qualities include intelligence, initiative, self-assurance, courage and decisiveness, among others. Thus, the crux of this theory is that any person without these qualities cannot be an effective leader. A major criticism of the theory is that it ignores the situation in which leadership is exercised.

Style theory of leadership concentrates on the behavior or style of the leader rather than his personal attributes. That is, it concentrates on how the leader manages his followers. The assumption underlying this theory is that the employee will work harder for managers who employ a particular style than they will for those managers who use other styles.

The Contingency theory of leadership takes the view that leadership effectiveness depends on a range of factors, particularly the task to be accomplished, the work group and the position of the leader within the work group. Proponents of this theory believe that group performance depends on the manager adopting a style appropriate to the situation in which he finds himself.

Identify FOUR users of financial statements and explain their information needs. (6 marks)

The people who might be interested in financial information about the company may be classified as follows.

Accountancy is the language of business and the only profession that teaches students about business. A business primarily exist to make profit and one of the jobs of an Accountant is to prepare financial statements and to determine the profitability of a business.

Required:

What is a business? (4 marks)

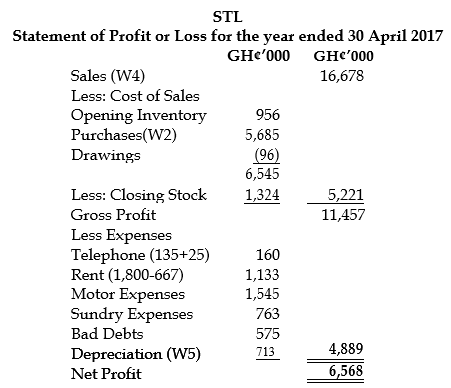

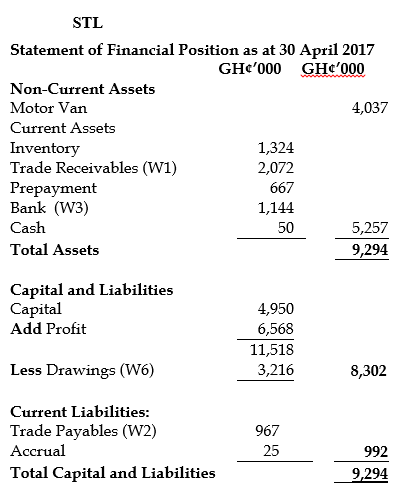

STL has been in business for a number of years. In the past year, she has been busy training for the Olympics and has not kept proper records for her business. She has given you some information.

The balances as at 1 May 2016 are as follows:

GH¢

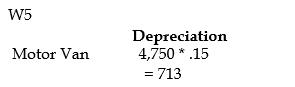

Motor vehicle (carrying amount) 4,750

Inventories 956

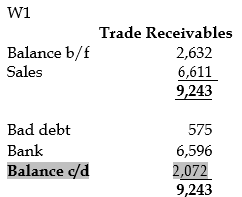

Trade receivables 2,632

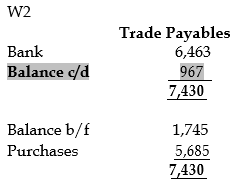

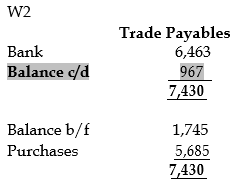

Trade payables 1,745

Cash in hand 50

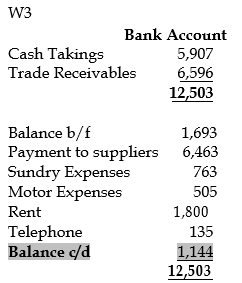

Cash at bank (overdrawn) 1,693

Capital 4,950

The bank statements for the year to 30 April 2017 are summarised as follows:

GH¢

Payments to suppliers 6,463

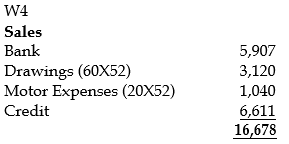

Cash takings 5,907

Sundry expenses 763

Motor expenses 505

Rent 1,800

Telephone 135

The balance on the bank statement at 30 April 2017 was GH¢1,144. There were no timing differences.

You are given the following additional information:

i) Closing inventory is valued at GH¢1,324.

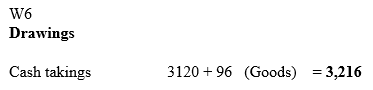

ii) STL took goods which had a cost of GH¢96 and would have been sold for GH¢124 for her own personal use.

iii) A telephone bill was received on 7 July 2017 for GH¢75, this related to the quarter ended 30 June 2017.

iv) Rent includes GH¢1,000 paid on 1 January 2017 for the year to 31 December 2017.

v) STL takes GH¢60 every week out of the takings before banking them. She also spends GH¢20 every week on petrol for the company van.

vi) Depreciation is to be charged at 15% reducing balance.

vii) Closing trade receivables and payables were GH¢2,072 and GH¢967 respectively. However, one customer, Caroline, has vanished and her debt of GH¢575 is not likely to be paid.

viii) STL always keeps a cash float of GH¢50.

ix) STL makes sales to cash and credit customers. Customers taking credit always pay by cheque or bank transfer.

Required:

a) Prepare the statement of profit or loss for STL for the year ended 30 April 2017. (12 marks)

b) Prepare the statement of financial position for STL as at 30 April 2017. (8 marks)

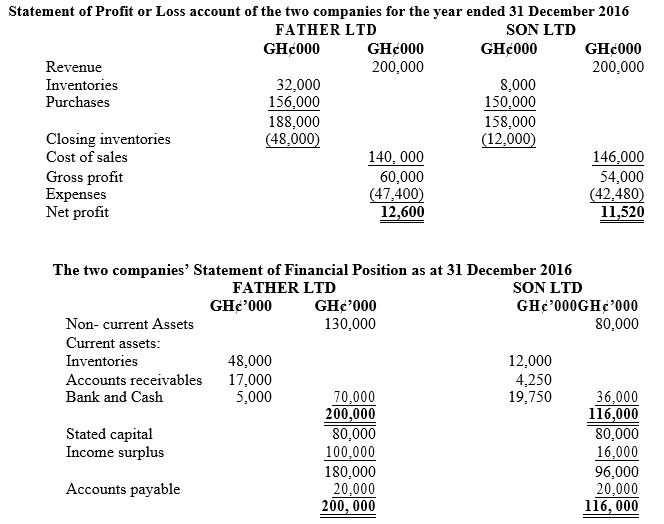

The following is a summary of the Financial Statements of two companies in the retailing business.

Required: (10 marks)

a) Calculate the following ratios for each company:

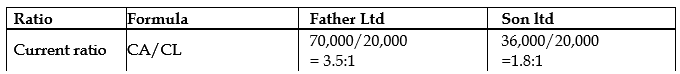

i) Current ratio

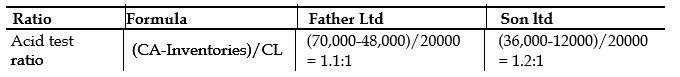

ii) Acid Test ratio

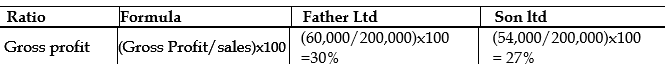

iii) Gross profit margin

iv) Return on capital employed

v) Trade Payable period

vi) Receivable collection period

b) Using the information in (a) above, interprete the results of the ratios under three broad categories of profitability, liquidity and efficiency. (10 marks)

Liquidity:

Liquidity is the ability of an entity to be able to pay for its short term obligations as and when they fall due without any difficulties. Again, this payment should not affect the working capital of the firm and as a result the company continues to operate without any operational difficulties. Applying this understanding to both Father and Son limited above suggest that the current assets of Father limited can pay for its current liabilities about 3.5 times as opposed to 1.8 times of Sons limited. However, adjusting for inventories the quick ratios of both companies shows 1.1:1 and 1.2:1 respectively for Father and Son. This suggests that inventories forms a significant part of the current assets of Father limited and may not be convertible into cash very quickly. The quick ratio indicates that slightly Son limited is better off with respect to its liquidity position. At the moment both companies can meet their current short-term obligations but Father Limited may have difficulty going forward with its significant nature of inventories.

Profitability:

Every business wants to make the highest profit possible for its shareholders but care needs to be taken that profit is not equal to cash.

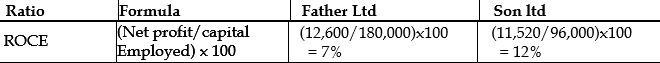

Looking at the gross margin of both Father and Son Limited, the gross margin is 30% and 27% respectively with the same level of sales. Better management of cost of sales may be key to the differences in the margins as depicted by the calculations above. This may also be partly due to the credit policies of both companies. On the face value it may not be fair to say that Father limited is doing well because it has 3% more than that of Sons Limited. Return on capital employed really looks at the efficiency in the utilization of capital in earning or generating profit in percentage terms. The higher this ratio the better management would have better utilize capital invested by shareholders and vice versa. Father Limited from that calculation has return on capital of 7% compared with 12% of Sons Limited. This suggests that Sons Limited is better using every pesewa invested by its shareholders efficiently and effectively as opposed to Father Limited. Father limited may need to change this situation as a matter of urgency.

Efficiency:

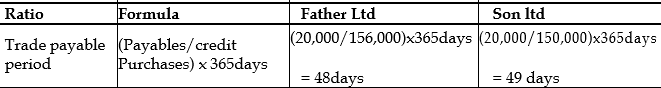

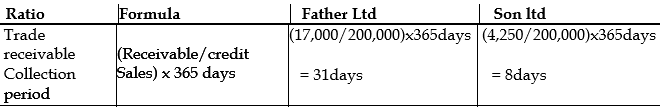

Activity or efficiency ratios assesses how efficient and effective an entity is with respect to its credit policies as well as general operational decision making processes. The receivable collection period indicate the time period it takes for management of an entity to be able to collect its debts from credit customers or debtors. Generally, the shorter time it takes the entity to do that the better since this will enhance the liquidity position of the entity. Looking at the ratios above Son Limited collect its debts within 8 days as opposed 31days for Father limited. This suggests that a huge amount of sale of Father Limited is on credit. This cannot be said of Son Limited as significant amount of its sales appears to be in cash sales and therefore it is not surprising that it is slightly better off with respect to its liquidity position. Similarly, trade payable period is the time an entity uses to settle its suppliers. A better supplier relationship could allow for a longer period for payment and this is a very good source of finance to the entity. Both companies seem to have relatively the same period of 48days and 49days for Father and Son Limited respectively.

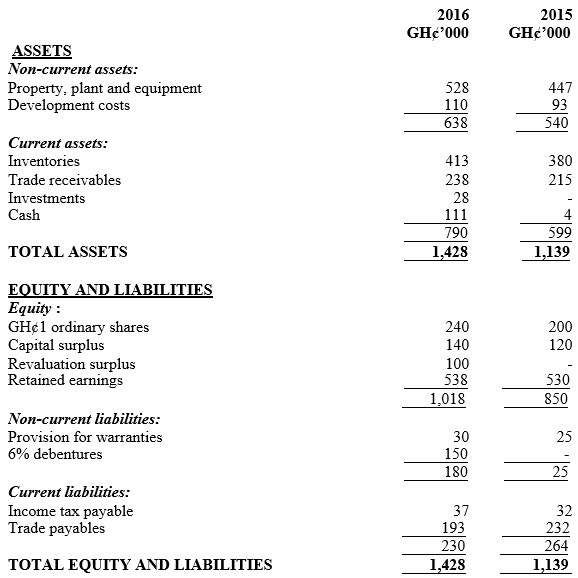

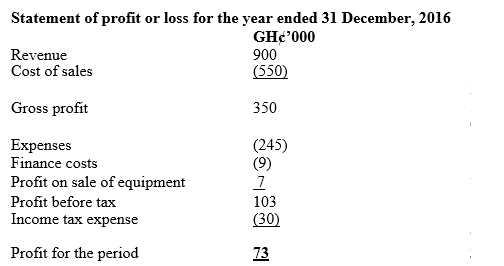

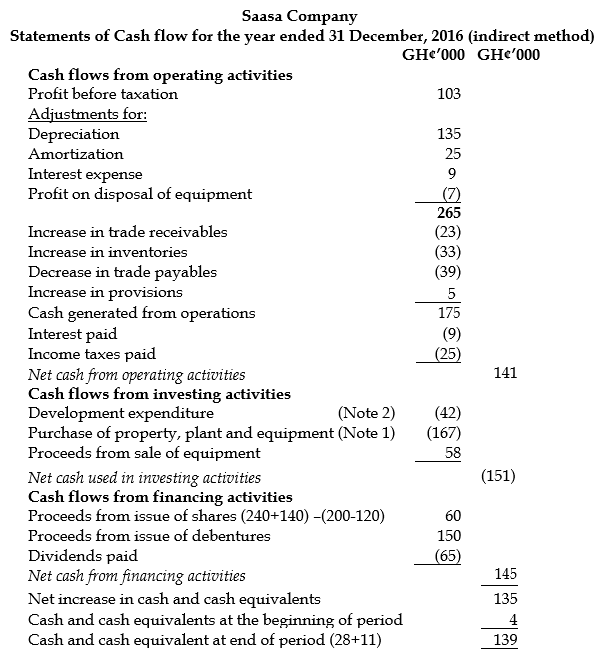

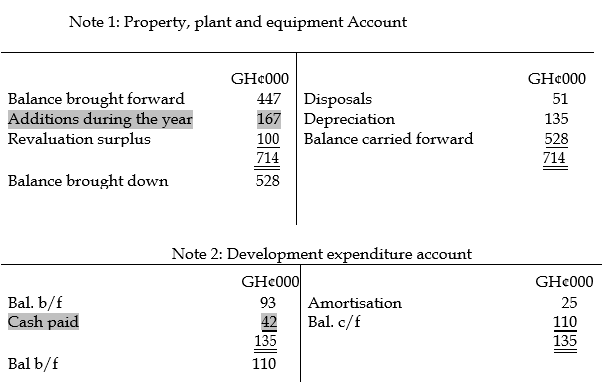

Below are the statement of financial position for Saasa Company Limited at 31 December 2015 and 31 December 2016 and the income statement for the year ended 31 December, 2016.

Additional information:

i) Deferred development expenditure amortized during 2016 was GH¢25,000.

ii) Additions to property, plant and equipment totaling GH¢167,000 were made. Proceeds from the sale of equipment were GH¢58,000, giving rise to a profit of GH¢7,000. No other items of property, plant and equipment were disposed of during the year.

iii) Finance costs represent interest paid on the new 6% debentures (2016-2022) issued on 1 January 2016.

iv) Current asset investments represent treasury bills acquired. The company deems these to represent cash equivalents.

v) Dividends paid during the year amounted to GH¢65,000.

Required:

Prepare a statement of cash flow for Saasa Company for the year ended 31 December 2016, using the indirect method in accordance with IAS 7: Statement of Cash Flows. (20 marks)

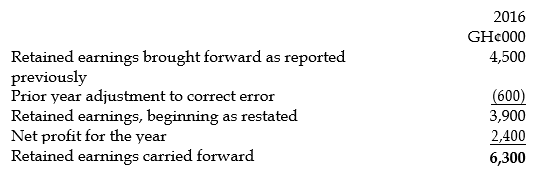

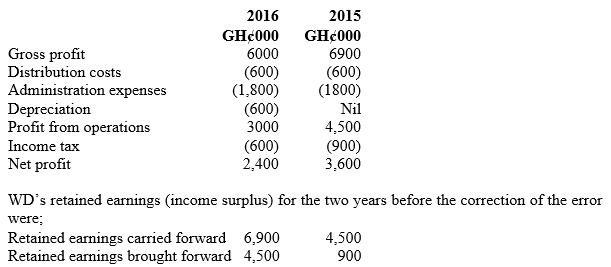

WD noted in 2016 that in 2015 it had omitted to record a depreciation expense on an asset amounting to GH¢600. Its accounts before the correction of the error are;

Required:

Describe how the above error should be corrected in accordance with IAS 8: Accounting policies, changes in accounting estimates and errors. (4 marks)

According to IAS 8 (revised) states that the correction of an error that relates to prior periods should be shown as an adjustment in the opening balance of retained earnings. As a result, in 2014 accounts (ignoring all tax implications):

Dr retained earnings brought forward GH¢600

Cr Accumulated depreciation GH¢600

It is important to notice that this will have no impact on the current income statement but is shown as a prior period adjustment in the statement of changes in equity: