May 2016 Q5

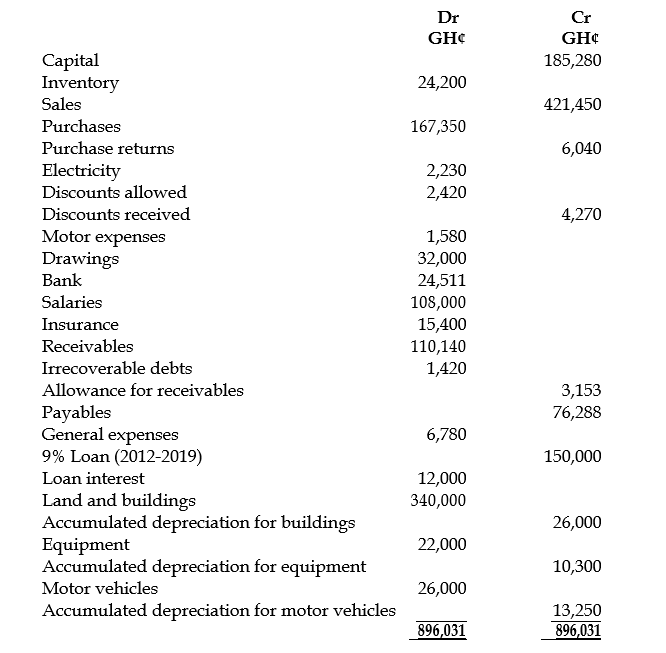

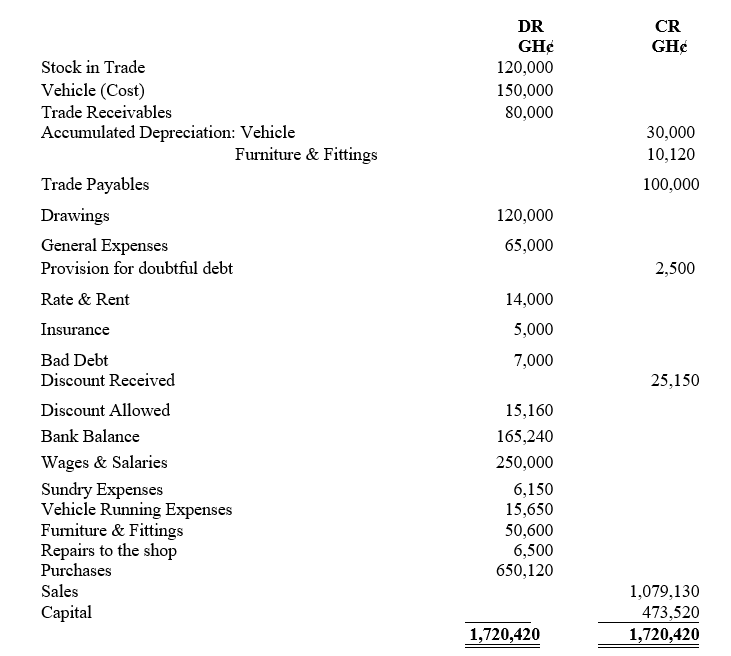

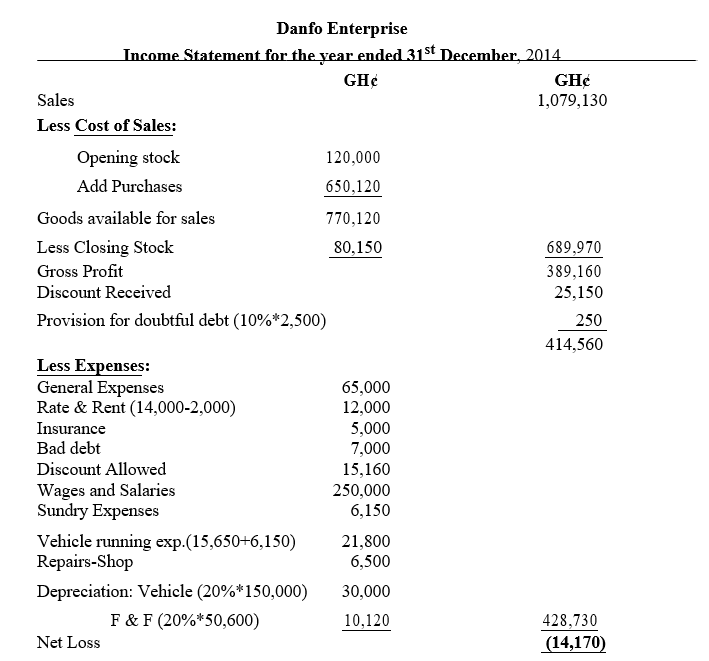

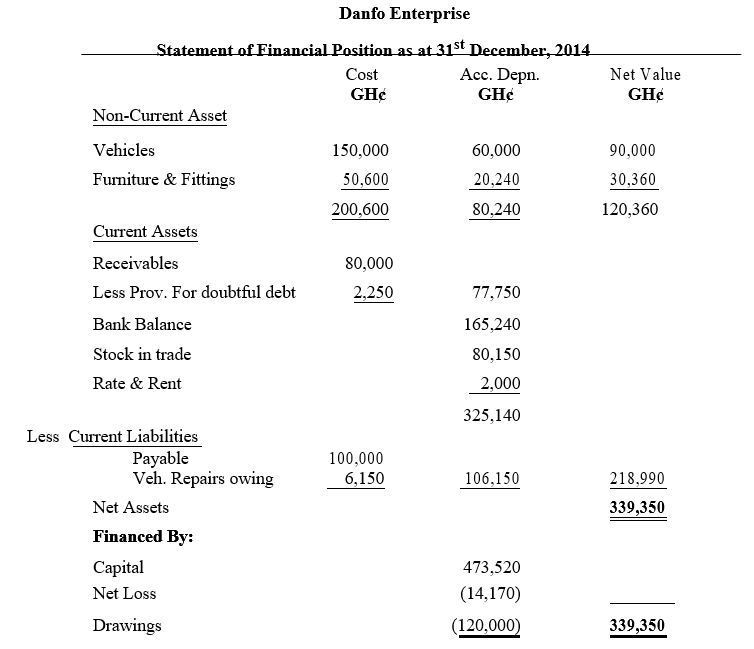

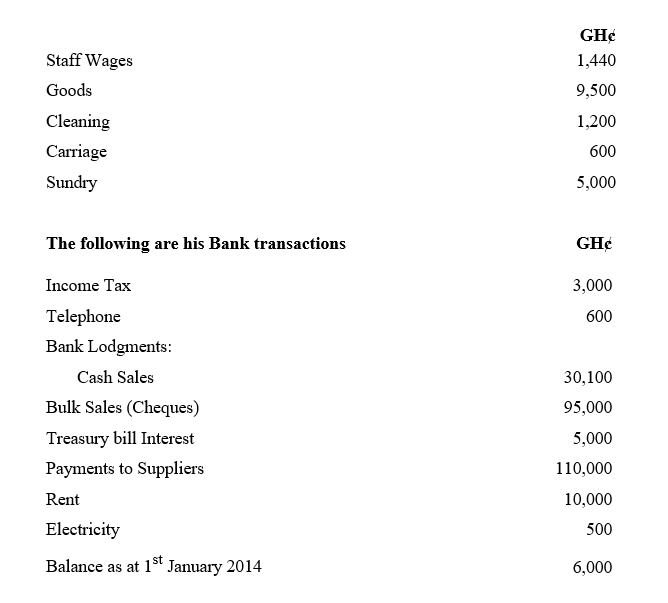

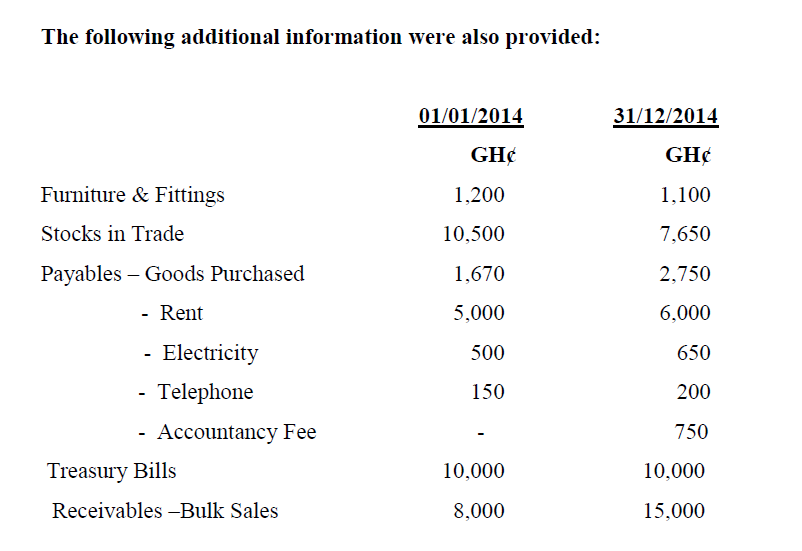

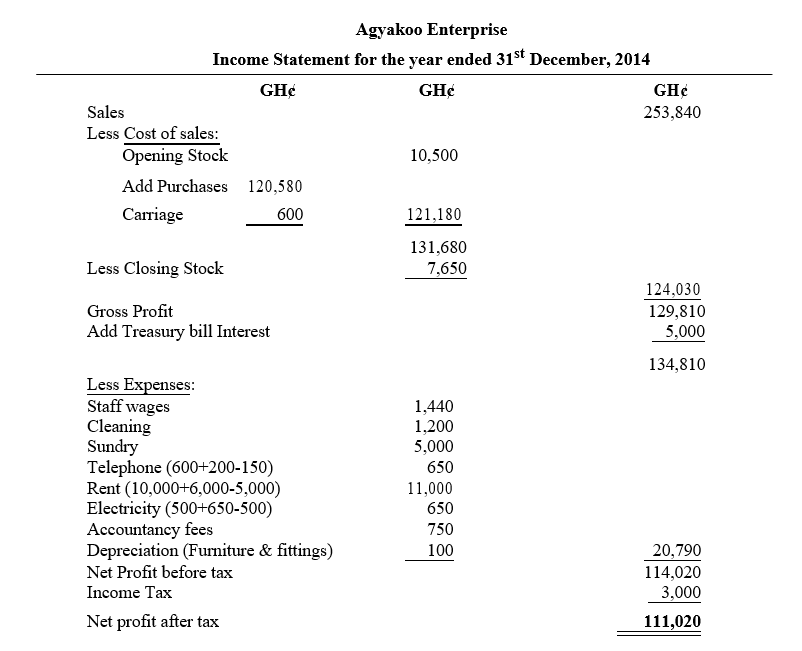

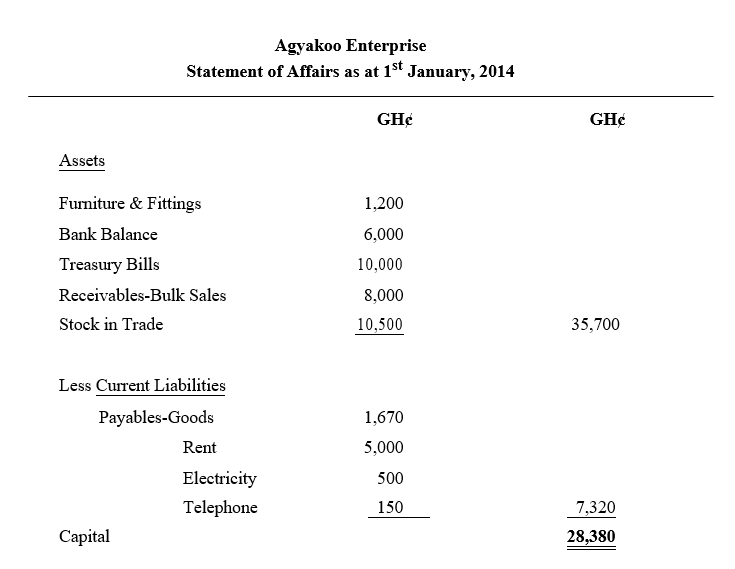

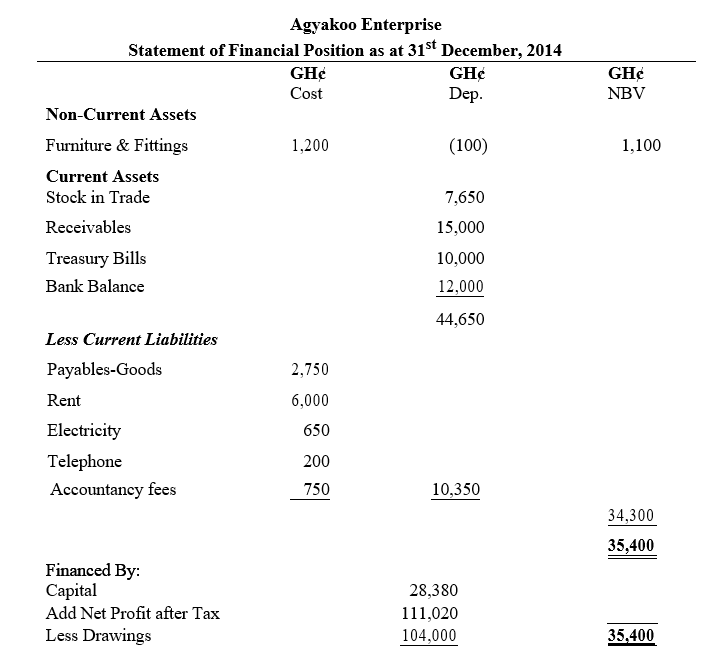

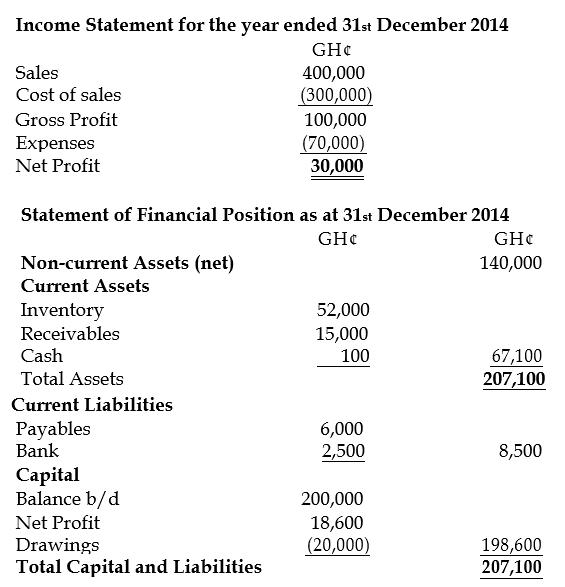

BB is the owner of a business supplying goods to other traders. He has just received the financial accounts for his business for the year ended 31st December 2014 from his accountant. These are reproduced below.

Note: Inventory on 1st January 2014 was valued at GH¢48,000.

BB has also obtained comparative information about a competitor for the year ended 31st December 2014.

Net profit margin 6%

Return on capital employed 10.50%

Current ratio 4.2:1

Liquid (acid test) ratio 0.3:1

Rate of inventory turnover 4 times

Required:

a) Calculate for BB each of the following ratios for the year ended 31st December 2014 (where appropriate, calculations should be approximated to two decimal places):

i) Net profit margin. (2 marks)

ii) Return on capital employed (using the closing year end value for capital employed) (2 marks)

iii) Current ratio. (2 marks)

iv) Liquid (acid test) ratio. (2 marks)

v) Rate of inventory turnover. (2 marks)

View Solution

- net profit margin = 4.65%

- return on capital employed = 15.11%

- current ratio = 7.89:1

- liquid (acid test) ratio = 1.78:1

- rate of inventory turnover = 6 times

b) Based on the ratios calculated in part (a) and all other information provided, demonstrate the performance (profitability and liquidity) of BB’s business. (10 marks)

View Solution

- The net profit as a percentage of sales is lower than the competitor, this may be because the cost of the goods is higher for BB, or he is not marking his purchases up as much as his competitor. It could also be caused by his expenses being higher than his competitor.

- BB’s ROCE is better than his competitor at 15.11% compared to 10.50%, this means that he is making more profit per cedi on investment in the company.

- The current ratio of 7.89:1 is extremely high, the current ratio of his competitor is also on the high side as the generally accepted ratio should be around 2:1, in BB’s case this is probably caused by high inventory holding.

- The acid test ratio at 1.78:1 is also a little high as here the generally accepted ratio is 1:1, however the ratio of his competitor of 0.3:1 is very low and may not be making the best use of resources.

- BB’s inventory-turnover is higher than his competitor which means that he is selling it more frequently than his competitor. This is a better performance than that of his competitor, since he is selling his inventory more frequently than them.

- This means that he makes a profit on every item he sells this contributes to the profitability to a greater extent than his competitor.

- Although BB’s net profit ratio is lower than that of his competitor his other ratios are all better, and his liquidity position is healthier than that of his competitor, in fact his competitor does look to have very poor liquidity which may lead to serious cash flow problems.