May 2019 Q2 b.

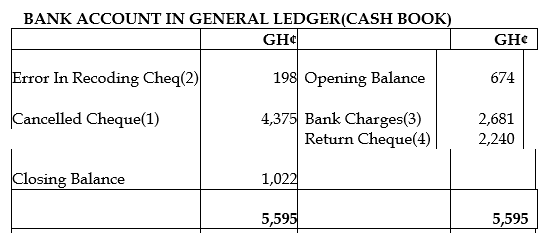

Nyantakyi Ltd (Nyantakyi) was preparing its reconciliation for the month of November 2018 and noted a difference between its bank statement balance and the balance on the bank account in its general ledger. The bank statement shows a balance of GH¢1,596 cash at bank. The balance on the bank account (cash book) in the general ledger was GH¢674(credit).

The following reasons accounted for the difference:

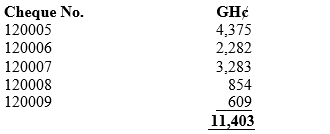

- Five cheques paid to suppliers have not yet been presented at the bank. These are:

- Cheque number 120005 was lost in the post and was cancelled. Nyantakyi have not yet recorded the cancellation of the cheque.

- Cheque number 120010 was incorrectly recorded in Nyantakyi’s cash book as GH¢2,957. The cheque was correctly debited to the bank statement on 5 November 2018 as GH¢2,759.

- Bank Charges of GH¢2,681 was debited by the bank on 29 November 2018.

- A customer’s cheque amounting to GH¢2,240 was returned by the bank in November as the customer had insufficient funds in his account. Nyantakyi is yet to record the returned cheque in their books.

- A deposit of GH¢5,950 entered in Nyantakyi’s cash book on 30 November 2018 was cred-ited on the bank statement on 3 December 2018.

- The bank has incorrectly credited Nyantakyi’s account with an interest of GH¢1,540. This is interest on a deposit account held by the Managing Director personally. The bank had not corrected the error by 30 November 2018.

Required:

i) Prepare Nyantakyi’s adjusted cash book including the necessary correcting entries as at 30th November 2018. (The answer format must clearly indicates whether each entry is a debit or credit) (5 marks)

View Solution

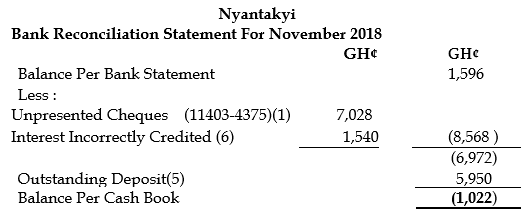

ii) Prepare a reconciliation of the bank statement balance to agree with the cash book balance as at 30th November 2018. (5 marks)

View Solution