Nov 2015 Q5 b.

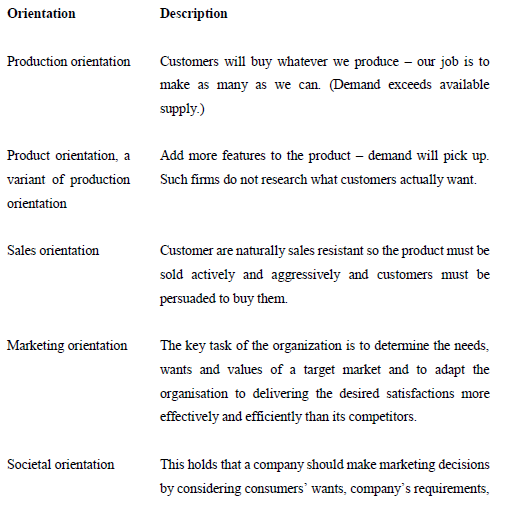

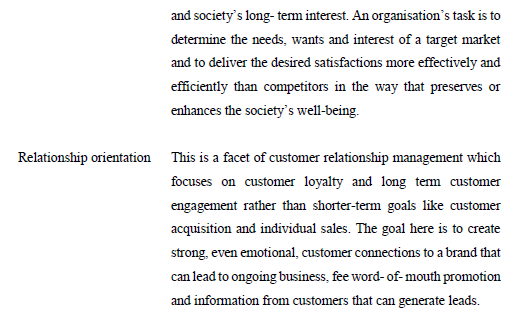

Explain the FOUR (4) different orientations organisations have towards customers. [8marks]

View Solution

Explain the FOUR (4) different orientations organisations have towards customers. [8marks]

Strategic management is a cross-functional activity. The production function for example, has relationship with other functions of a company. Explain how the production function can be integrated with other functions in company. [4marks]

Longer term decisions, particularly relating to design and the innovation of improved products, cannot be taken by the production department alone; its activities must be integrated with other functions in the firm.

Reporting on corporate governance is one way of ensuring transparency. Based on recent corporate governance concerns, explain FIVE (5) issues that are contained in corporate governance reports. [10marks]

All corporate governance reports (included Ghana’s Code of Best Practices in Corporate Governance) state that board directors should explain their responsibility for preparing accounts. They should report that the business is a going concern, with supporting assumptions and qualifications as necessary.

In addition, further statements required include:

1. Information about the board of directors: the composition of the board in the year, the role and effectiveness of the board, information about the independence of the non-executives, frequency of, and attendance at, board meetings, how the board’s performance has been evaluated. For example, the South African King Report suggests a charter of responsibilities should be disclosed.

2. Brief report on the remuneration, audit and nomination committees covering terms of reference, composition and frequency of meetings.

3. Information about relations with auditors, including reasons for change and steps taken to ensure auditor objectivity and independence when non-audit services have been provided (Ghana’s code requires that audit and non-audit fees are disclosed).

4. A statement that the directors have reviewed the effectiveness of internal controls, including risk management. Also sufficient disclosures should be given for shareholders to understand the main features of the risk management and internal control processes. Board should also give details of, or at least confirm, any action taken to remedy significant failings or weaknesses. (This is required by Ghana’s Code).

5. A statement on relations and dialogue with shareholders.

6. A statement that the company is a going concern. (This is required by Ghana’s Code).

7. Sustainability reporting, defined by the King Report as including the nature and extent of social, transformation, ethical, safety, health and environmental management policies and practices.

8. A business review

9. A statement detailing the compliance by the organisation with corporate governance, legal and statutory requirements. (This is required by Ghana’s Code)

10. Ghana’s Code of Best Practices in Corporate Governance also requires the following disclosure:

The board should also ensure that information is disclosed on the following matters in the annual report insofar as they are relevant to the period under review –

(a) All management fees paid by the corporate body with details of the names of the parties and their relationship to the compote body;

(b) The identities and percentage holdings of substantial shareholders;

(c) significant cross shareholding relationships;

(d) Related party transactions;

(e) Details of incentive schemes, such as stock option scheme;

(f) The fees paid to the auditors of the corporate body for audit and non-audit related work; and

(g) Any other material issues concerning employees and other stakeholders such as creditors and suppliers.

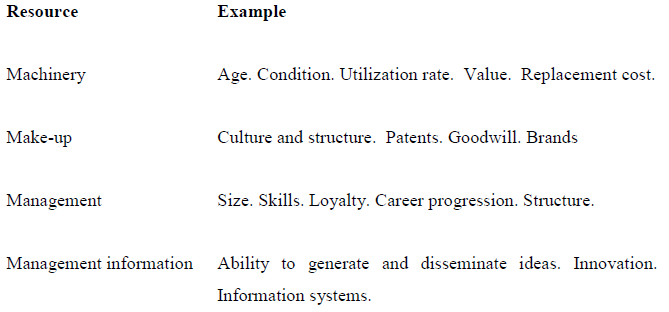

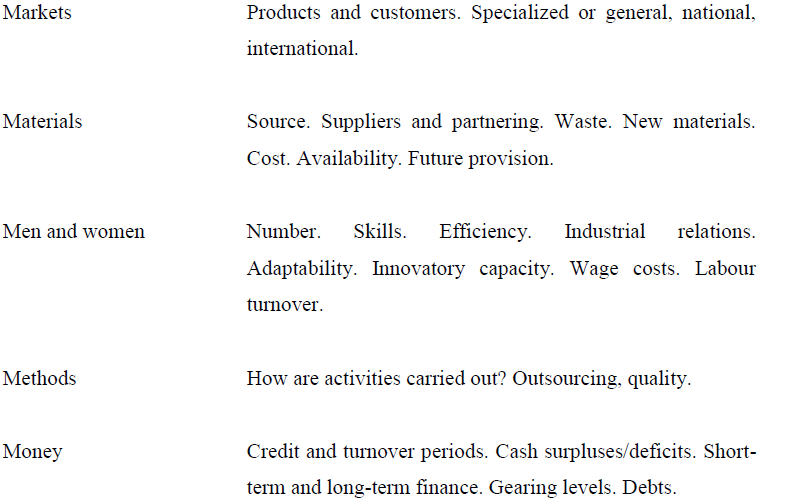

Strategy evaluation is as important as strategy formulation. One of the tools used in resource audit as part of strategy evaluation and control is the Ms Model. Identify and explain any FIVE (5) elements in the Ms Model. [5marks]

Resource audits identify human, financial and material resources and how they are deployed. A resource audit is a review of all aspects of the resources the organisation uses. The Ms Model categories the factors as follows:

A mission statement describes an organization’s basic purpose and what it is trying to achieve. It can play an important role in the strategic planning process. There is no standardized format for mission statements. However, there are common elements included in most mission statements. Outline any FIVE (5) of these elements. [5marks]

1) Stating the purpose of the organization

2) Stating the business areas in which the organization intends to operate

3) Providing a general statement of the organization’s culture

4) Acting as a guide to develop the direction of the entity’s strategy and its goals/objectives

5) Customers. Who are the enterprise’s customers?

6) Products or services. What are the firm’s major products or services?

7) Markets. Where does the firm compete?

8) Technology. What is the firm’s basic technology?

9) Concern for survival, growth, and profitability. What is the firm’s commitment towards economic objectives?

10) Philosophy. What are the basic beliefs, values, aspirations, and philosophical aspirations of the firm?

11) Self-concept. What are the firm’s major strengths and competitive advantages?

12) Concern for public image. What is the firm’s public image?

13) Concern for employees. What is the firm’s attitude toward employees?

Note: Any student who approaches this question from the Ashridge College model perspective should earn the full mark. Find below

1) Purpose: Why does the company exist? Who does it exist for?

2) Values: are the beliefs and moral principles that underlie the organisation’s culture.

3) Strategy: provides the commercial logic for the company (the nature of the organisations business), and so addresses the following questions. ‘What‘s our business? Or, what should it be?’ What are our elements of sustainable competitive advantage?

4) Policies and standards of behavior: provides guidance on how the organistaion’s business should be conducted.

Corporate governance is now a very popular and important area in strategic management. However, corporate governance is poor in a number organisation. Explain FIVE(5) symptoms of poor corporate governance [10marks]

1. Domination by a single individual

A feature of many corporate governance scandals has been boards dominated by a single senior executive with other board members merely act as a rubber stamp. Sometimes the single individual may bypass the board to action his own interests. This can result in management and directors awarding themselves remuneration and company perks that do not align with company performance or shareholder interests. This is an inherent problem in agency theory.

Even if an organisation is not dominated by a single individual, there may be other weaknesses. The organization may be run by a small group centered round the Chief Executive and Chief Financial Officer and appointments may be made by personal recommendation rather than a formal, objective process.

2. Lack of involvement of board

Boards that meet irregularly or fail to consider systematically the organization’s activities and risks are clearly weak. Sometimes the failure to carry out proper oversight is due to lack of information being provided.

3. Lack of adequate control function

Another potential weakness is a lack of adequate technical knowledge in key roles, for example in the audit committee or in senior compliance positions. A rapid turnover of staff involved in accounting or control may suggest inadequate resources, and will make control more difficult because of lack of continuity.

4. Lack of supervision

Employees who are not properly supervised can create large losses for the organization through their own incompetence, negligence or fraudulent activity. The behaviour of Nick Leeson, the employee who caused the collapses of Barings bank was not challenged because he appeared to be successful, whereas he was using unauthorized accounts to cover up his large trading losses. Leeson was able to do this because he was in charge of dealing and settlement, a systems weakness of lack of segregation of key roles that featured in other financial frauds.

5. Lack of independent scrutiny

External auditors may not carry out the necessary questioning of senior management because of fears of losing the audit, and internal audit do not ask awkward questions because the Chief Financial Officer determines their employment prospects. Often corporate collapses are followed by criticisms of external auditors, such as the Barlow Clowes affair were poorly planned and focused audit work failed to identify illegal use of client monies.

6. Lack of contact with shareholders

Often, board members grow up with the company and lose touch with the interests and views of shareholders. One possible symptom of this is the payment of remuneration packages that do not appear to be warranted by results.

7. Emphasis on short-term profitability

Emphasis on success or getting results can lead to the concealment of problems or errors, or manipulation of accounts to achieve desired results.

8. Misleading accounts and information

Misleading figures are often symptomatic of other problems (or are designed to conceal other problems) but clearly poor quality accounting information is a major problem if markets are trying to make a fair assessment of the company’s value. Giving out misleading information was a major issue in the Enron scandal as discussed previously.

The role of Audit Committee in corporate governance cannot be overemphasized.

i) What should be the composition of an Audit Committee? [4marks]

1) The audit committee should comprise at least three directors, the majority of whom should be non-executive.

2) The membership of the audit committees should ideally comprise directors with adequate knowledge of finance, accounts and the basic element of the laws under which the corporate body operates or is subject to.

3) The chairman of the committee should be a non-executive director.

4) The managing director/chief executive officer , the finance director, the head of internal audit and a representative of the external auditors should ordinarily be invited to attend meetings

ii) Explain FOUR (4) functions of an Audit Committee. [6marks]

1) Recommend the appointment of the external auditors of the corporate body;

2) Liaise with the external auditors for the purposes of maintaining and ensuring audit quality, effectiveness, risk assessment, interaction with internal auditors and dealing with situations governing the resignation of the external auditors and dealing with situations governing the resignation of the external auditors;

3) Review with the auditors their report on the financial statements of the corporate body;

4) Review the adequacy of systems and internal controls and of the degree of compliance with material policies, laws and the code of ethics and business practices of the corporate body;

5) Provide a direct channel of communication between the board and the external and internal auditors of the corporate body, accountants and compliance officers (if any) of the corporate body;

6) To report to the board on all issues of significant extraordinary financial transactions;

7) To assist the board in developing policies that would enhance the controls and operating systems of the corporate body.

Business activities, in general, were formerly regarded as problem for the environmental movement, but the two are now increasingly complementary. There has been an increase in the use of green approach to market products.

Explain in FOUR (4) ways how physical environmental conditions are important for strategic planning. [10marks]

Physical environmental conditions are important for strategic planning.

i. Resource inputs. Managing physical resources successfully (e.g. oil companies, mining companies) is a good source of profits.

ii. Logistics. The physical environment presents logistical problems or opportunities to organisations. Proximity to road and rail links can be a reason for sitting a warehouse in a particular area.

iii. Government. The physical environment is under the control of other organisations.

1. Local authority town planning departments can influence where a building and necessary infrastructure can be sited.

2. Governments can set regulation about some of the organization’s environmental interactions.

iv. Disasters. In some countries, the physical environment can pose a major ‘threat’ to organisations.

Managers have a duty to aim for profit. At the same time, modern ethical standards impose a duty to guard, preserve and enhance the value of an enterprise for the good of all touched by it, including the general public.

Explain FOUR (4) ethical problems managers face in dealing with stakeholders. [10marks]

In the area of products and production, managers have responsibility to ensure that the public (consumers) and their own employees are protected from danger. Attempts to increase profitability by cutting costs may lead to dangerous working conditions or to inadequate safety standards in products. In the United States, product liability litigation is so common that this legal treat may be a more effective deterrent than general ethical standards.

Another ethical problem concerns payment by companies to government officials who have power to help or hinder the payers’ operations. Some of the issues which exist in this area are:

i. Extortion. Foreign officials have been known to threaten companies with the complete closure of their local operations unless suitable payments are made.

ii. Bribery. This refers to payments for services to which a company is not legally entitled. There are some fine distinctions to be drawn; for example, some managers regard political contributions as bribery.

iii. Grease money. Multinational companies are sometimes unable to obtain services to which they are legally entitled because of deliberate stalling by local officials. Cash payments to the right people may then be enough to oil the machinery of bureaucracy.

iv. Gifts. In some cultures (such as Japan) gifts are regarded as an essential part of civilized negotiation, even in circumstances where to Western eyes they might appear ethically dubious. Managers operating in such a culture may feel at liberty to adopt the local customs.

v. Discrimination against an employee or any group of employees based on gender, religion, beliefs, etc.

vi. Environmental pollution and degradation

vii. Failure to provide the right working environment and conditions of service for employees (e.g. unfair labour practices on the part of management-which can result in legal actions and avoidable cost for the company).

CASE STUDY: GRACE TELECOM LIMITED

Introduction

Grace Telecom Ltd. is a well-established company which is providing telecommunications services both nationally and internationally. Its business has been concerned with telephone calls, the provision of telephone lines and equipment, and private telecommunication networks. Grace Telecom Ltd. has supplemented these services recently by offering mobile phone, which is an expanding market worldwide

The company maintains a diverse customer base, including residential users, multi-national companies, government agencies and public sector organisations. The company handles approximately 100,000 million calls each working day, and employs nearly 140 personnel.

Strategic development

The Chairman of Grace Telecom Ltd stated within its latest Annual Report that there were three main areas in which the company aimed to develop in order to remain a world leader in the telecommunications market. He believes that the three main growth areas reflect the evolving nature of the telecommunications market and will provide the scope for development.

The areas in which development is planned are:

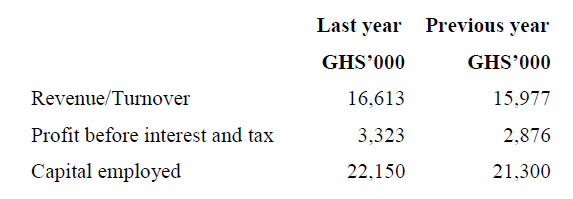

The company estimates its cost of capital to be approximately 18%.

The Chairman expressed satisfaction with the increase in turnover and stated that cost efficiencies were now being generated following the completion of a staff reduction programme. This would assist the company in achieving a target return on capital employed (ROCE) of 20% in this market over the next three years.

Business opportunities

The Chief Executive of Grace Telecom Ltd. has stated that the major opportunities for the company lie in the following areas:

the increasing freedom from government control of worldwide telecommunication services.

An extensive television and poster advertising campaign has been used by the company. This was in order to penetrate further the residential market segment by encouraging greater use of the telephone with various charging incentives being offered to residential customers.

To further the objective of increasing long-term shareholder value, the company is actively considering an investment of GHS200 million in each of the next three years in new technology and quality improvements in its national market. Because of its specialist technical nature, the investment is not expected to have any residual value at the end of the three-year period.

Following the investment, the directors of Grace Telecom Ltd. believe that its rate of profit before interest and tax to turnover in its national telecommunications market will remain constant. This rate will be at the same level as last year for each of the three years of the investment.

Markets and competition

The company is currently experiencing an erosion of its market share and faces increasingly strong competition in the mobile phone market. While Grace Telecom Ltd. is the leader in its national market, with an 85% share of the telecommunications business, it has experienced a reduced demand for the supply of residential lines in the last five years as competition has increased.

The market for the supply of equipment in the national telecommunications market is perceived to be static. The investment of GHS200 million in each of the next three years is estimated to increase Grace Telecom Ltd.’s share of this market to a level of 95%. The full improvement of 10% is expected to be received by Grace Telecom Ltd. next year, and its market share will then remain at this level for the full three-year period. It is anticipated that unless further investment is made after the three-year period, Grace Telecom Ltd.’s market share will revert to its current level as a consequence of the expected competitive response.

Industry regulation

The government has established an industry regulatory organisation to promote competition and deter anti-competitive behaviour.

As a result of the activities of the regulator and aggressive pricing strategies, it is anticipated that charges to customers will remain constant for the full three-year period of the new investment.

All cash flows can be assumed to occur at the end of the year to which they relate. The cash flows and discount rate are in real terms.

Future outlook

The business still remains under family control, but the board is considering an expansion programme for which and that the family would need to raise GH¢200 million in equity or debt finance. One of the possible risks of expansion lies in the fact that the market for fixed telephone lines is falling. New income is being generated by expanding the product range to include mobile money transfer. The key to profit growth for Grace Telecom is the ability to generate sales growth, but the company recognizes that it faces stiff competition from large telecom companies in respect of the prices charged.

In planning its future, Grace Telecom is advised to look carefully at a number of external factors which may affect the business including government economic policy. In recent months the following information has been published in respect of key economic data.

i) Bank base rate has been reduced from 22% to 20%, and the forecast is for a further 0.5% reduction within six months.

ii) The annual rate of inflation is now 12%, down from 14% in the previous quarter, and 16% 12 months ago. No further falls in the rate are expected over the medium term.

iii) Personal and corporate tax rates are expected to remain unchanged for at least twelve months.

Required:

Explain the nature of the political, economic, social, and technological forces which will influence Grace Telecom Ltd. in developing its business and increasing its market share. [8 marks]

Economic factors

There are three main economic elements that Grace Telecom Ltd. needs to consider. These are;

– Shareholder wealth – Grace Telecom Ltd.’s shareholders are a major stakeholder group who will have economic objectives of profit maximization and rising share value. This is crucial especially as the company plans of obtaining public funds from the stock exchange.

– The contribution of the telecommunications industry to the national economy – The telecommunications industry plays a major role in contributing towards economic growth and prosperity. Grace Telecom Ltd. has a responsibility to develop new technology and to provide a reliable, value for money service to its users.

– The economies of foreign countries – the economic conditions in each foreign country that Grace Telecom Ltd. operates in should be considered e.g. foreign currency exchange rates and national economic boom and slump cycles.

– National Economic Indicators– Considering the propose investment in technology for Grace Telecom Ltd. and considering the favorable national economic indicators within the external environment, the company can capitalize on the reducing interest rate to acquire cheaper debt capital towards its anticipated expansion programmes. The operational expansion could be supported by increasing demand within the economy due to falling inflation- however, this would largely depend on the elasticity of the products and services supplied Grace Telecom.