Nov 2017 Q5 a.

During the past year, the management of Doncat Limited faced many challenges, including several customer complaints, loss of some key customers and a high level of employee turnover. At a meeting of the Board of Directors, the Chief Executive Officer presented a report on the financial performance of the company during the period and, in his closing remarks, he said, “Overall, we have done very well, notwithstanding the challenges we faced.” Some members of the Board were not happy with these remarks and accused him of doing a “partial evaluation” of the company.

Required:

i) Explain FOUR limitations of the use of financial measures for evaluating the performance of the company. (6 marks)

View Solution

- Financial analysis often measures past performance only and does not show what is happening currently.

- It involves subjective judgments e.g. Positive or negative values or low and high values may mean different things for different industries or even organization.

- Financial analysis also only talks about the financial health of the organization and not every aspect of its performance.

- Comparing any two years may not reveal the true picture i.e. especially good or especially bad is unlikely to be repeated.

ii) Describe THREE financial measures and THREE non-financial measures that Doncat Limited may use to evaluate its performance. (9 marks)

View Solution

Financial

- Return on Capital Employed (ROCE)

ROCE is used by companies to assess the value add by investing a certain amount of capital. It aims at ensuring the efficient use of capital. It is expressed as a percentage of profit earned over the capital employed. - Economic Value Added

Economic Value Added (EVA) is used to assess ongoing performance of the organization. It helps managers to determine whether current policies are creating value. It is used to assess the company’s current position in terms of the value that has been created by the past and current strategies being employed. Basically, if a company achieves a positive EVA then the investment will have generated a surplus greater that the firm’s weighted average cost of capital and therefore created value for the shareholders. EVA = Adjusted profits after tax – (adjusted capital) invested capital x weighted av. Cost - Pay back

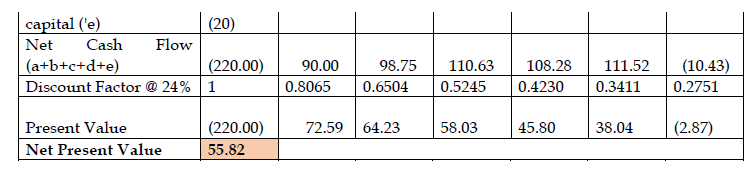

Payback simply measures the number of years it will take to recover the original investment from net cash flows resulting from a project. Typically, it is used to make an investment decision that requires a choice between two or more projects. If the payback is the sole evaluation criterion, the company would choose the option which would result in the shortest payback period. - Net Present Value

This approach is used to calculate the present value of projects. It is based on the principle that money received today is worth more than money received net year because of the opportunity to invest and consequently earn a return. There are three possible outcomes: where BPV is 0, there decision maker is indifferent. NPV is negative: The project will fail to generate sufficient funds to cover the cost of capital. NPV is positive: the project is likely to generate a return greater than the cost of capital. An investment may be considered. - Ratios (profit, sales, operational)

There are three main types of ratios: Profit ratios, Sales ratios and Operational rations. Thus, ratios are used to measure profits, sales performance and the organizations ability to generate cash.

Profit ratios: The main profit ratio is the profit margin which measures the amount of profit generated form sales. ie. Profit before interest + tax divided by sales turnover. Other profit ratios include profit generated from the use of assets (profit/net assets), gross profit generated from sales (gross profit/sales) and net profit generated from sales (net profit/sales)

Sales Ratios: The main sales ratio is asset turnover ie sales/net assets. Other ratios used by firms involve sales turnover calculated as a ratio of: fixed assets, working capital or selling cost. All these ratios either tracked over time or compared against competitors or the standards set can give a company a measure of the efficiency of their performance in these areas.

Operational Ratios: Operational ratios help a company assess its ability to generate cash on which to run the business. Without cash a company cannot operate its business, therefore the liquidity of the company and its amount of working capital will be regularly monitored. In these ratios the turnover periods in which cash will be generated are calculated, usually expressed in terms of days or how many times the business is exchanging cash.

The main liquidity ratios are: Debt collection period: level of debt/sales turn over, Stock turnover period: average stock level/ total cost of goods, sold Creditors turnover period: average trade credit/ cost of sales Current ratio: current assets/current liabilities. Any increase in any of these ratios will warn the company that cash is being tied up in funding the work in progress.

Non – Financial Measures

There are many non- financial measures and the choice of an appropriate measure depends on the critical success factors that drive performance in the market/industry. Thus, if a critical success factor is superior customer value, level of customer satisfaction and level of customer loyalty may be key measures. Some of the common non – financial measures are: - Market share – measures the percentage of the total market that an organization controls. A high market share indicates that the organization occupies a relatively high market position as compared to the others.

- Sales volume/ growth – a high sales volume suggests that the organization is doing well in terms of sales.

- Customer loyalty – demonstrates the extent to which customers are willing to continue buying the organisation’s product/service. This reflects the quality of product/service and customer service provided by the organization.

- Number of customer complaints – many customer complaints signify weak performance with regard to product/service quality, access to the products/services or challenges with the processes that customers have to go through.

- Market image and awareness levels – the image of the organization or product and level of awareness signifies the effectiveness of the organisation’s promotional efforts and level of acceptance and usage of the product/service.

- Employee motivation – the extent to which employees are willing to put in more efforts in their performance is an indication of how well the organization is treating them.

- Employee turnover – measures of employee turnover (the rate at which employees leave the organization) signify the level of their satisfaction with conditions in the organization.