GHANA’S FOOTWEAR MANUFACTURING INDUSTRY

Introduction

The footwear industry has many players including artisanal shoemakers, local and foreign manufacturers, with local representatives, producing a wide range of footwears. In Ghana, the footwear industry is making headway in the local market, with most of the shoes being produced in Kumasi. The Kumasi Shoe Manufacturing Company focuses on making footwear for almost all the security agencies in Ghana, as well as some private security companies. The local market is also filled with individual artisans and small startup companies who make footwear for sale in the country. The other regions in the country such as the Greater Accra Region and the Northern Region also have a few individuals who are into footwear manufacturing but on a smaller scale.

Foreign produced footwears are of superior quality and attract skimming pricing compared to the locally produced ones. The sector is projected to have high growth potential with most of its forecasted sales to emanate from low income segment with marginal and flat growth from middle and high-income segments respectively. The growth, among other things, will be fueled by the government’s free school uniform and sandals policy which is expected to be sourced from local manufacturers. In Ghana, luxury shoes are usually European or Amercian brands. The luxury footwear production in Ghana is still a virgin market with a lot of potential once people start to believe in the high quality these Ghanaian brands can offer.

On the average, it takes three to five years for local manufacturers to ramp up production significant enough to drive down average fixed cost and attain utilization of full capacity due to intense competition and difficulty accessing the major wholesale and retail outlets trading in footwears. The foreign as well as a good number of local manufacturers sign 5 to 10 years contract with major outlets in all the major urban centres for exclusive rights to sell their footwears.

The artisanal shoemakers generally produce based on customer orders. In the Footwear industry, customers easily source from many available alternatives. The key customers of foreign and local manufacturers are the various wholesale and retail outlets. There are emerging online shops providing information on prices of goods and services from different manufacturers including footwears free of charge and consumers can easily access that information. The profit margins for the outlets are generally low. There have been recent acquisitions of some local footwear manufacturing companies by some major wholesale and retail distributors in Ghana and the experts are predicting more of such transactions.

In Ghana, there is a cartel of few major importers, controlling approximately 90% of high quality natural and synthetic leather market, from whom many local manufacturers and artisanal shoemakers procure their raw materials. These importers source their supplies largely from Europe which compares favourably, in terms of quality and price, to those available in neighbouring countries. A recent consumer survey indicates that footwear produced with inputs from Europe are durable, of good quality and able to stand high temperature conditions locally hence consumers preference.

Footwear Ventures Ltd (FVL)

Footwear Ventures Ltd (FVL) was founded by Peter Legubo, who graduated with bachelor’s degree in Fine Arts, from a public university in Ghana. Prior to starting the company, Peter met one of his schoolmates, who owned a business that specialized in traditional handicrafts including footwear. He was able to convince him to join FVL. The schoolmate’s hands-on experience coupled with Peter’s competence in drawing and designing will be complementary and indispensable to gaining competitive edge. The initial capital for the company was raised from personal savings and severance package received by Peter from his former employment. He was able to acquire requisite tools and machines for the production of footwear.

Based on the determination and ambition of the founder, FVL out doored its first production line with four different products including shoes and sandals for men, women, children as well as boots for security personnel. The products were well received by the public. The company continued production but it could hardly produce the quantity required by its retailers due to inadequate funding. Peter, therefore, approached some banks for credit facility but due to lack of credit history he was unsuccessful. Peter Legubo decided to turn to his friend, Kingsford Yeboah, who lived in Germany and had earlier expressed interest in investing in the business. Kingsford provided the business with substantial amount of cash. The capital injection was used to buy more tools and machines in a bid to significantly automate the production process. Additional hands were engaged bringing the total number of employees to 100. Currently, the company produces on the average 2,200 pair of shoes per month.

The main raw materials for footwears, including natural and synthetic leather, synthetic sole and adhesive, are sourced from local importers. FVL is contemplating diversifying its raw materials. The shoes produced by the company are largely distributed through major retail shops dotted across major urban centres since FVL does not have the required resources to open its own sales outlets. The company also does direct sales to students on campuses of some tertiary institutions in the country.

On strategic approach, Peter believes the company should continue to exclusively rely on engagement of experienced hands from the industry and should waste no time in formalizing and documenting the company’s strategy. Kingsford Yeboah also believe that the company should institutionalize a strategic approach that should focus on the strategy process, financial planning and forecasting as well as sources of finances.

Financial planning and forecasting

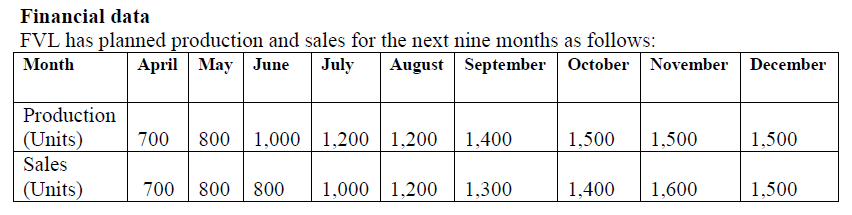

FVL has the potential of becoming a leading producer of footwear in the Ghanaian market. It is however faced with liquidity challenges. The management of FVL has decided to prepare a six-month budget in order to better manage its liquidity needs and avoid any shortages especially in the light of limited access to bank credit.

During the period, the business plans to advertise so as to achieve the projected sales. Payments for advertising of GH¢12,000 and GH¢18,000 will be made in June and September respectively. The selling price per unit will be GH¢120 throughout the period. 40% of sales are normally made on two months’ credit. The other 60% are settled within the month of the sale.

Raw materials used for the footwear will be held for one month before they are taken into production. Purchases of raw materials will be on one month’s credit. The cost of raw materials is GH¢60 per unit of production. Other direct production expenses, including labour, are GH¢25 per unit. These will be paid in the month incurred. Various production overheads, which during the period to 30 May had run at GH¢21,600 a month, are expected to rise to GH¢24,000 each month from 1 June to 30 September. These are expected to rise again from 1 October to GH¢28,800 a month and to remain at that level for the foreseeable future. These overheads include a steady GH¢4,800 each month for depreciation. Overheads are planned to be paid 80% in the month of production and 20 per cent in the following month.

To help meet the planned increased production, a new item of plant will be bought and delivered in July. The cost of this item is GH¢79,200; the contract with the supplier will specify that this will be paid in three equal instalment in August, September and October. Raw materials inventories are planned to be 1,000 units on 1 June. The balance at the bank on the same day is planned to be GH¢89,000. The company earns 5% interest on the closing balance which is paid in the following month.

Required:

Prepare a report to the Director of FVL on the process of strategic management. (8 marks)

View Solution

REPORT ON THE PROCESS OF STRATEGIC MANAGEMENT

Introduction

The strategic management process means defining the organization’s strategy. It is also defined as the process by which managers make a choice of a set of strategies for the organization that will enable it to achieve better performance.

Strategic management is a continuous process that appraises the business and industries in which the organization is involved; appraises its competitors; and fixes goals to meet all the present and future competitor’s and then reassesses each strategy.

Strategic Management Process

Strategic management process has following four steps:

Environmental Scanning– Environmental scanning refers to a process of collecting, scrutinizing and providing information for strategic purposes. It helps in analyzing the internal and external factors influencing an organization. After executing the environmental analysis process, management should evaluate it on a continuous basis and strive to improve it.

Strategy Formulation– Strategy formulation is the process of deciding best course of action for accomplishing organizational objectives and hence achieving organizational purpose. After conducting environment scanning, managers formulate corporate, business and functional strategies.

Strategy Implementation- Strategy implementation implies making the strategy work as intended or putting the organization’s chosen strategy into action. Strategy implementation includes designing the organization’s structure, distributing resources, developing decision making process, and managing human resources.

Strategy Evaluation- Strategy evaluation is the final step of strategy management process. The key strategy evaluation activities are: appraising internal and external factors that are the root of present strategies, measuring performance, and taking remedial / corrective actions. Evaluation makes sure that the organizational strategy as well as its implementation meets the organizational objectives.

Conclusion

These components are steps that are carried, in chronological order, when creating a new strategic management plan. FVL that is in the process of institutionalizing a strategic approach will revert to these steps as per the situation’s requirement, so as to make essential changes.