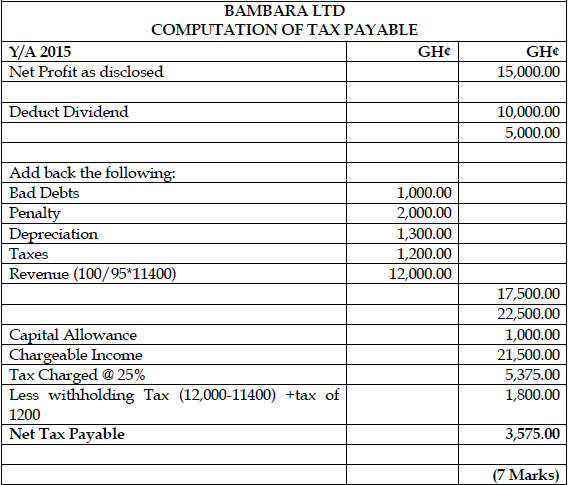

Bambara Ltd has the following summarized income statement relating to 2015 year of assessment:

Upon a closer scrutiny, the following came up:

i) Dividend net of withholding tax received from A Ltd was GH¢10,000. The amount received was added to revenue above. Bambara Ltd has 10% equity interest in A Ltd.

ii) Bad debts of GH¢1,000 was recovered. This was adjusted to the Income Surplus Account.

iii) A penalty of GH¢2,000 was paid and has been added to operating cost to determine the net profit as disclosed.

iv) Capital allowance agreed with Ghana Revenue Authority was GH¢1,000.00 and depreciation of GH¢1,300 was added to operating cost.

v) Taxes paid in previous quarters amounting to GH¢1,200 was added to operating cost to determine the net profit.

vi) It came to light that an amount of GH¢11,400 net of 5% withholding tax relating to supply of goods was not brought into the accounts at all on account of omission. The withholding tax was certified correct.

Required:

Determine the tax payable by Bambara Ltd and comment on any FOUR reasons for the inclusion and or non-inclusion of the transactions in the determination of income. (10 marks)

View Solution

Comments on inclusion and or non-inclusion:

- Dividend is subject to a final withholding tax at the rate of 8% where the receiving entity does not have the at least 25% equity in the paying entity and should not be added to income.

- Bad debts recovered should be added to income and taxed but not added to income surplus as income surplus is a recipient of residual income.

- Penalty is not an allowable deduction hence added back to income.

- Capital allowance granted instead of depreciation but depreciation disallowed.

- Taxes are non-deductible allowance.

- The revenue was not added to income because of omission but now added as it is part of assessable income. (Any 3 points)