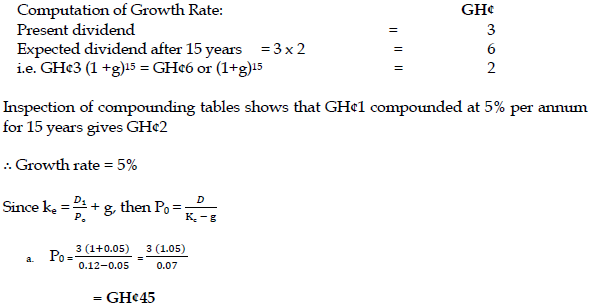

Rosa Kurablah Ltd (Kurablah) plans to invest in ordinary shares for a period of fifteen years, after which she will sell out, buy a lifetime room and board membership in a retirement home and retire. She feels that Senchi Ltd (Senchi) is currently, but temporarily, undervalued by the market. Kurablah expects Senchi’s current earnings and dividend to double in the next fifteen years. Senchi’s last dividend was GH¢3, and its stock currently sells for GH¢35 a share.

Required:

i) If Kurablah requires a 12 percent return on her investment, will Senchi be a good buy for her? (3 marks)

View Solution

Since the shares are selling for GH¢35, yet have a computed value of GH¢45, they are a good buy for Kurablah.

ii) What is the maximum that Kurablah could pay for Senchi and still earn her required 12 percent? (2 marks)

View Solution

She could pay up to GH¢45 per share and still earn her required 12% return

iii) What might be the cause of such a market undervaluation? (3 marks)

View Solution

- Investors, as a group, may not perceive the future growth aspect of Senchi Ltd, as being quite high as does Kurablah.

- Other investors may perceive greater risk to future returns from Senchi Ltd, than does Kurablah, and consequently may require a higher return than 12% on their investments.

- Other features about the shares, such as low marketability or irregular or fluctuating dividends may cause investors to request a higher rate of return.

- Other factors might include:

*General market recession

*General instability of economy

*Risk-averse nature

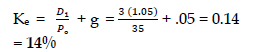

iv) Given Kurablah’s assumptions, what market capitalisation rate for Senchi does the current price imply? (2 marks)

View Solution

Implied market capitalisation rate: