The Ghana Cocoa Board (GCB) is contemplating borrowing one year funds in anticipation of the coming cocoa season which starts in September/October, 2017. GCB can borrow from the local financial market in Ghana or borrow a portfolio of funds made up of UK pounds and Euros. The information below is the borrowing rates, and the probabilities of expected strengthening of the international currencies vis-à-vis the cedi.

Borrowing Rates

Ghana Cedis – 18%

UK Pounds – 10%

Euros – 8%

Strengthening of UK Pounds

Probability % Change in Spot Rate

. 30% 10%

. 70% 5%

Strengthening of Euros

Probability % Change in Spot Rate

. 40% 8%

. 60% 6%

Required:

If GCB should borrow a portfolio made up of 60% UK pounds and 40% euros, determine whether GCB should borrow from the local financial market or borrow the portfolio of funds made up of UK pound and the euros. (10 marks)

View Solution

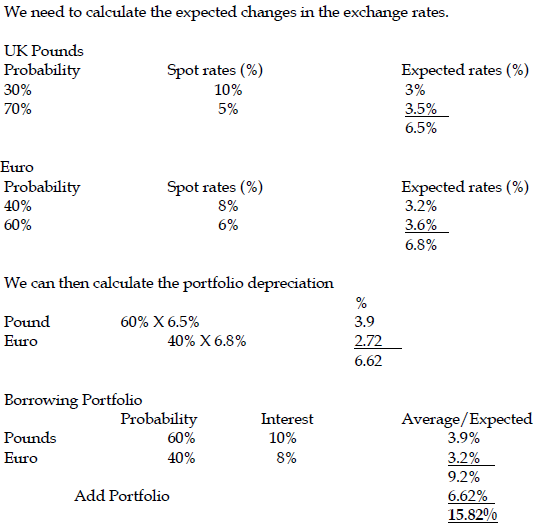

The portfolio borrowing rate is 15.82 % based on the available information.

The cedi borrowing rate is 18%. This means the portfolio borrowing rate is better than the cedi borrowing rate, ALL OTHER THINGS REMAINING CONSTANT.

This is so because it was assumed that whatever currency used, there was no effect of exchange rate differences among the cedi, euro and the pound.