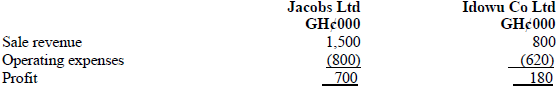

a) Jacobs Limited and Idowu Company Limited both manufacture and sell auto parts. The summarised profit and loss accounts of the two companies for 2014 are as follows:

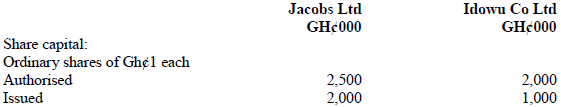

Each company has earned a constant level of profit for a number of years, and both are expected to continue to do so. The policy of both companies is to distribute all profits as dividend to ordinary shareholders as they are earned. Neither company has any fixed interest capital. Details of the ordinary share capital of the two companies are as follows:

The ordinary shares of Jacobs Ltd have a current market value of GH¢3.50 each ex div. and those of Idowu Co Limited, a current market value of GH¢1.50 each ex div.

The directors of Jacobs Limited are considering submitting a bid for the entire share capital of Idowu Co Limited. They believe that, if the bid succeeds, the combined sales revenue of the two companies will increase by GH¢60,000 per annum and savings in operating expenses, amounting to GH¢50,000 per annum, will be possible. Part of the machinery at present owned by Idowu Co Limited would no longer be required and could be sold for GH¢100,000. Furthermore, the directors of Jacobs Limited believe that the takeover would result in a reduction to 9% in the annual return required by the ordinary shareholders of Idowu Co. Limited.

Required:

On the basis of the above information calculate:

i) The maximum price that Jacobs Ltd should be willing to pay for the entire share capital of Idowu Co Limited. (6 marks)

View Solution

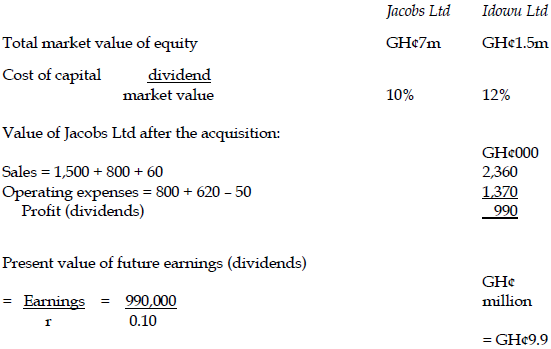

Add cash flows from sale of machines GH¢100,000 = GH¢0.1

Total value of Jacobs Ltd after acquisition = GH¢10.0

The maximum price Jacobs Ltd should pay to acquire Idowu Ltd should be the difference between its value after and its value before the acquisition = GH¢10m – GH¢7m = GH¢3.0

ii) The minimum price that the ordinary shareholders in Idowu Co Ltd should be willing to accept for their shares. (4 marks)

View Solution

The minimum price that ordinary shareholders of Idowu Ltd should accept for their shares is the market value = GH¢1.5m

b) Assume that the takeover price is agreed at the figure you have calculated in (a) (ii) above, and that the purchase consideration will be settled by an exchange of ordinary shares in Idowu Co Ltd for the ordinary shares of Jacobs Ltd, show how the entire benefit from the takeover will accrue to all the present shareholders of Jacobs Ltd. (6 marks)

View Solution

Take-over price agreed at GH¢ 1.5m

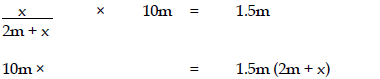

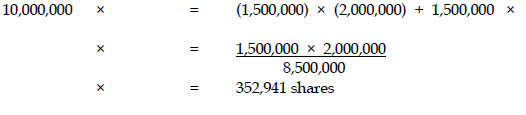

Let x represent the number of new shares to be issued to Idowu Ltd.

Total number of shares in issue will become 2m + x shares

Total value of Jacobs Ltd after acquisition = 10m.

For the entire benefit from the acquisition to accrue to all the present shareholders of Jacobs Ltd, value of Jacobs shares issued to Idowu’s shareholders must equal the agreed take-over price.

OR

The take-over ratio is 35.2941 shares in Jacobs Ltd for each 100 shares held in Idowu Ltd.

The market value per share after the acquisition or take-over

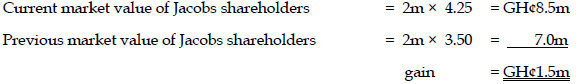

= (GH¢10,000,000/2,352,941) = GH¢4.25

Jacobs Ltd shareholders will have an increase in the market value of their shares from GH¢3.50 to GH¢4.25 = GH¢0.75 per share. The 2m shares would have increased by 2m × GH¢0.75= GH¢1,500,000

Idowu shareholders have 352,941 shares at GH¢4.25 each = GH¢1.5m (same as their previous value).

Thus the entire benefit from the take-over will accrue to the present shareholders of Jacobs Ltd.

c) Discuss briefly any other factors that the directors and shareholders of both companies might consider in assessing the worthwhileness of the proposed takeover. (4 marks)

View Solution

- The shareholders in Idowu Ltd should try to get a take-over price higher than the GH¢1.5m agreed in (b) above since this is their value and they would not benefit at all from the take-over at that price. In practice, they would have to be offered an amount in excess of their market value to induce them to sell.

- The directors of Idowu Ltd might believe from the proposal that the increase in profits after the acquisition and the sale of assets are indications that they are not effectively utilizing their assets hence may decide to put them (the assets) to better usage rather than sell them.

- The directors of Jacobs Ltd will have to reassess their estimates. How realistic is the increase in sales revenue of GH¢60,000 p.a. and at the same time a reduction in expenses of GH¢50,000. Will reduction in expenses involve retrenchment of staff and what effect will this have in morale of the remaining staff? An increase in value of GH¢3m from an investment of GH¢1.5m seems rather too high.

- What of the transaction costs of the acquisition? They have not been considered. If the take-over is resisted by the directors of Idowu Ltd or other interested buyers, then the cost of the acquisition could be quite high. Also the position of the shareholders of Idowu Ltd should be considered since their control will be greatly reduced, eg. A holder of 51% interest in Idowu Ltd will find himself owning only 7.6% in Jacobs Ltd after the acquisition.

- Whether there would be increased market power and economies of scale and scope.

- Furthermore, Jacobs and Idowu both manufacture and sell autoparts; the attitude of the government or trade unions to forestall a monopoly situation has not been considered. Finally, in as much as the acquisition looks attractive a lot more detailed information to answer the questions raised must be obtained before a final decision is taken.

- Attitude of government and trade unions must be considered.

- Elimination of inefficiencies, use of surplus cash and increased debt capacity must be considered. (Any 4 points)