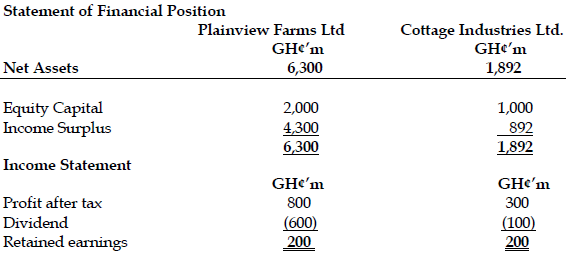

Plainview Farms Limited is considering acquiring Cottage Industries Limited. The extracts of the financial statement of the two companies is as follows:

The two companies retain the same proportion of profits each year and this is expected to continue into the future. Plainview Farms Limited return on investment is 16%, while that of Cottage Industries Limited is 21%. One year after the post-acquisition period, Plainview Farms will retain 60% of its earnings and expects to earn a return of 20% on new investment.

The dividends of both companies have been paid. The required rate of return of ordinary shareholders of Plainview Farms Limited is 12% and Cottage Industries Limited 18%. After the acquisition, the required rate of return will become 16%.

Required:

a) If the acquisition is to proceed immediately, calculate the;

i) Pre-acquisition market values of both companies. (5 marks)

View Solution

Market Value of Plainview Farm Limited:

Using the Gordon’s growth model: g = rb

Where, r = return on investment

. b = retention ratio

. g = rb, r = 0.16, b = 0.25

. g = 0.16 x 0.25 = 4%

Future Dividend in 1 year

= D1 (1 + g)

= 600 (1.04) = GH¢624million

Market Value (MV) = d/(r-g)

. = GH¢624m/(0.12-0.04)

. = GH¢7.8 billion

Market Value of Cottage Industries Limited:

r = 0.21, b = 2/3

g = rb = 0.21 x 2/3

= 14%

Future Dividend in 1 year

100 (1.14) = GH¢114 million

Market Value (MV) = d/(r-g)

. = GH¢114m/(0.18-0.14)

. = GH¢2,850 billion

ii) Maximum price Plainview Farms Limited will pay for Cottage Industries Limited. (5 marks)

View Solution

Plainview Farm Limited earning in 1 year GH¢m

. GH¢800 million x 1.04 832

Cottage Industries Limited

. GH¢300 million x 1.14 342

. 1,174

Dividend in 1 year GH¢1,174 million @ 40% = GH¢469.60m

If r = 0.2 and b = 0.6

g = 0.2 x 0.6 = 0.12

Post-Acquisition Market Value:

MV = GH¢469.6m/(0.16 – 0.12) = GH¢11740 billion

Maximum Price = GH¢11,740billion – GH¢2,850 billion

. = GH¢8,890 billion

Payable for Cottage Industries Limited is GH¢8,890 billion

b) As a Finance Manager in your company, you have been asked to produce an explanatory memo to Senior Management on the subject Mergers and Acquisition. Your memo should clearly outline what actions a target company might take to prevent a hostile takeover bid. (5 marks)

View Solution

- White Knight: A situation in which the target company looks for a friendly company where offer is more appealing for the takeover bid.

- Shark Repellant: This involves amending the company’s memorandum and articles of association in such a way that makes the takeover difficult for the acquiring company. An example is increasing the margin of majority votes required at an Annual General meeting called to approve such a takeover.

- Pac-man Defence: An anti-takeover strategy in which the target company tries to buy up the share of the acquiring company.

- Golden Parachutes: This refers to provision in the executives’ employment contract that call for payment of severance pay or other compensation should they lose their job as a result of a successful takeover.

- Poison-Pill: A strategy sometimes employed by target companies in a takeover bid to reduce the attractiveness of their securities/assets to the prospective acquiring firm. This is often done by enlarging the outstanding shares of a target company through a new issue of shares to its shareholders at a discount to the market price, thus making the takeover quite expensive to the prospective acquiring firm