The trial balance of Alabar Ltd extracted from the company’s general ledger as at 31 December 2017 showed a development costs balance of GH¢12.8 million. The development costs consist of amounts capitalised in 2015 and 2016 relating to a new product development. No additional development expenditure was incurred in the year ended 31 December 2017. The product began commercial production on 1 July 2017, and the company estimated at that date that, the product’s useful life was four years due to its technological nature.

Sales of the product did not achieve the amount expected during the second half of 2017, and so, at 31 December 2017, management performed an impairment test on the development expenditure. The estimated net cash flows are (at 31 December 2017 prices):

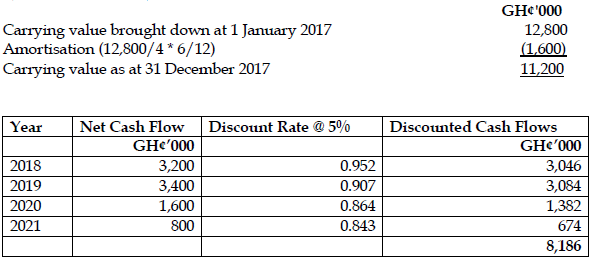

Year to 31 December 2018 GH¢3.2 million

Year to 31 December 2019 GH¢3.4 million

Year to 31 December 2020 GH¢1.6 million

6 months to 30 June 2021 GH¢0.8 million

All cash flows occur on the final day of each period mentioned. An appropriate annual discount rate (adjusted to exclude the effects of inflation) is 5%. The fair value of the development expenditure asset was expected to be less than the sum of the discounted cash flows.

The company recognises amortisation and impairment losses on development expenditure in cost of sales.

Required:

Set out the accounting treatment as the above information permits in the financial statements of Alabar Ltd for the year 31 December 2017. (6 marks)

View Solution

Development expenditure

Value in use= GH¢8,186,000

Impairment loss (GH¢11,200,000 – GH¢8,186,000) = GH¢3,014,000.

Expense Amortisation = GH¢1,600,000 in the statement of profit or loss

Expense Impairment = GH¢3,014,000 in the statement of profit or loss.

Capitalise Development costs in the statement of financial position = GH¢8,186,000