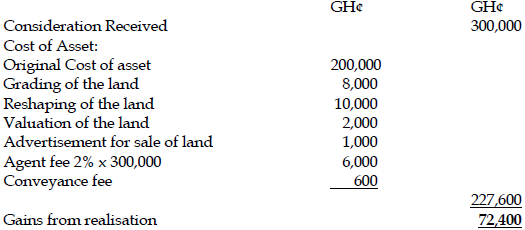

a) Mamavi Dekey (Mamavi) purchased a land in Ho in the Volta Region for a cost of GH¢200,000 in the year 2010. In 2011 she spent GH¢8,000 for grading the land. In March, 2019 she spent another GH¢10,000 to reshape the land with the intention to sell it. Mamavi engaged Kobina Ebo, a Valuer, in June, 2019 to value the land and he charged GH¢2,000. In July, 2019, she placed an advert at ‘Ho Bankoe FM’ on the sale of the land and paid GH¢1,000. In October, 2019 she sold the land through an agent for GH¢300,000 to Kalika and the agent commission was 2% of the sale value. Mamavi also paid GH¢600 for stamp duty and legal permit for conveyance of the land to Kalika.

Required:

Compute any tax payable. (5 marks)

View Solution

Tax Payable = 15% x GH¢72,400 = GH¢10,860

b) An individual may realise an asset on the death of another person, by way of transfer of ownership of the asset. What are the taxation rules on such transaction? (5 marks)

View Solution

Where an individual realises an asset on death, by way of transfer of ownership of the asset to another person:

- That individual is treated as deriving an amount in respect of the realisation equal to the market value of the asset.

- The person who acquires the asset is treated as incurring an expenditure of the amount equal to the market value of the asset.