Kantanka Ltd adopts the revaluation model of IAS 16 Property, Plant & Equipment and the fair value model of IAS 40 Investment Property. Kantanka Ltd chooses to recognise any fair value gains or losses arising on its equity investments in ‘other comprehensive income’ as permitted by IFRS 9 Financial Instruments. The following transactions relate to Kantanka Ltd for the year ended 31 March 2017.

i) Kantanka Ltd owns a piece of property it purchased on 1 April 2014 for GH¢3.7 million. The land component of the property was estimated to be GH¢1.2 million at the date of purchase. The useful economic life of the building on this land was estimated to be 25 years on 1 April 2014. The property was used as the corporate head office for two years from that date. On 1 April 2016, the company moved its head office to another building and leased the entire property for five years to an unrelated tenant on an arm’s length basis in order to benefit from the rental income and future capital appreciation. The fair value of the property on 1 April 2016 was GH¢4.1 million (land component GH¢1.9 million), and on 31 March 2017, GH¢4.8 million (land component GH¢2.1 million). The estimated useful economic life remained unchanged throughout the period. Land and buildings are considered to be two separate assets by the directors of Kantanka Ltd.

Required:

Advise Kantanka Ltd on how to account for the above transaction in accordance with relevant accounting standards. (5 marks)

View Solution

This property was an IAS 16 property until 1 April 2016 and an IAS 40 investment property after this date. The accounting treatment therefore changes on the date it became an investment property. Any revaluation gains or losses up to that date are accounted for under IAS 16, and any arising since are accounted for under IAS 40.

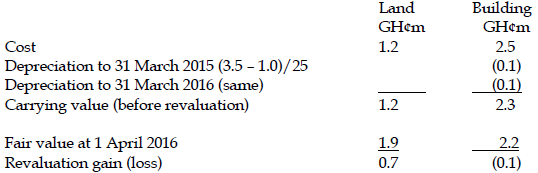

The carrying value of the property at 1 April 2016 was as follows:

The revaluation gain would be taken to OCI and the revaluation loss to profit or loss as they were recognised in the financial year ended 31 March 2017. The depreciation relates to previous years, so its recording is not the subject of the requirement.

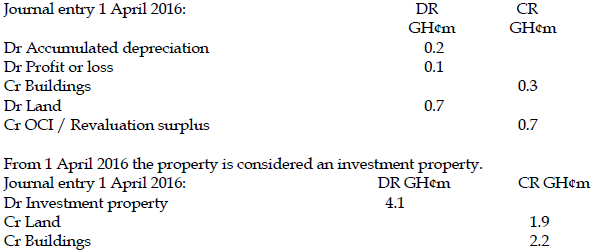

Under IAS 40, investment property is not depreciated and is revalued to fair value at each reporting date. Any gains or losses are taken to profit or loss.

Investment property

. GH¢m

Fair value 1 April 2016 4.1

Fair value 31 March 2017 4.8

Fair value gain 0.7

Journal entry 31 March 2017: DR GH¢m CR GH¢m

Dr Investment property 0.7

Cr Profit or loss 0.7