a) Percy Cool (Percy) supplied goods to Perry Hot (Perry), both are VAT registered traders. Percy issued VAT invoice accordingly on 15 February, 2019. On 20 February, 2019 Percy received a call from Perry indicating that he has lost the VAT invoice issued to him.

Required:

What should Percy do? (3 marks)

View Solution

Where, within thirty calendar days after the date of a supply, a recipient who is a taxable person claims to have lost the original tax invoice for a taxable supply, the taxable person making the supply is required to, on receipt of a request in writing from the recipient, provide a certified copy clearly marked “copy” to the recipient within fourteen calendar days of receipt after the request.

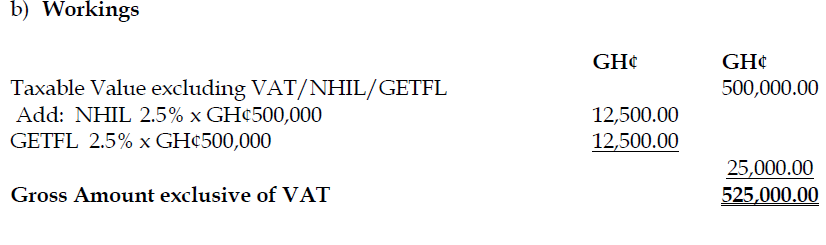

b) Akorfa Vinyo, an equipment hiring company, raises an invoice in the sum of GH¢500,000.00 in respect of hiring of equipment services to a withholding VAT agent (Sir James Enterprise). This supply excludes Value Added Tax (VAT of 12.5%), National Health Insurance Levy (NHIL of 2.5%), and Ghana Education Trust Fund Levy (GETFL of 2.5%).

Assume that this is the only supply of value-added activity done by Akorfa Vinyo in the period and payments are made in the same period.

Required:

i) Calculate the proportion of VAT that should be withheld by the agent in respect of payment of the invoice (the withholding VAT rate is 7%) (3 marks)

View Solution

Proportion of VAT that should be withheld by the agent: 7% x GH¢525,000.00 = GH¢36,750.00

ii) Calculate the output VAT to be shown on the face of Akorfa’s monthly VAT Return. (3 marks)

View Solution

Calculation of the output VAT = 12.5% X 525,000 = 65,625.00

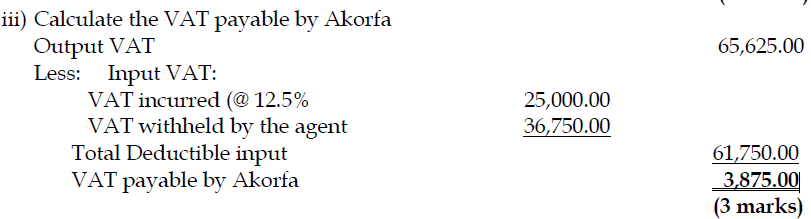

iii) Calculate the VAT payable by Akorfa, if the total input VAT incurred for the period is GH¢25,000. (3 marks)

View Solution

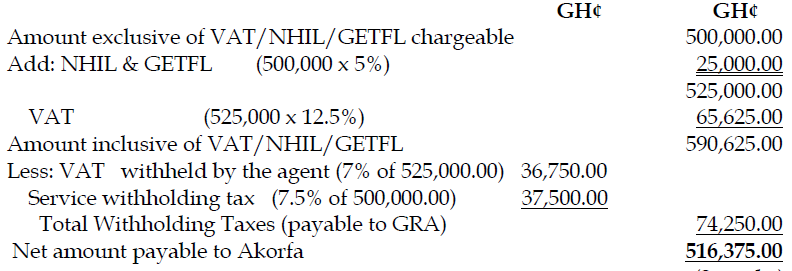

iv) Show the Payment details by the Withholding Agent for the Supply. (3 marks)

View Solution

Related Posts

Comments (02)

Leave a Reply Cancel reply

You must be logged in to post a comment.

Have this app/site been updated because I don’t see 2020 past questions?

Please it’s yet to be updated. thank you.