Graphix Communication Group Limited (GCGL) is a magazine publishing company. It comprises a number of different divisions, each publishing magazines in a different sector. GCGL is now considering publishing Financial Magazine. The Financial Magazine market is very competitive with a number of well-established titles already being published by GCGL’s competitors.

Financial Magazine is a monthly magazine.

GCGL has therefore commissioned an advertising campaign to launch its Financial Magazine. The price of the Financial Magazine has been set at full cost plus a mark-up of 20%.

Forecast variable cost per copy of the Financial Magazine:

. GH¢

Paper 0.83

Ink See note (i)

Machine cost 0.22

Other variable cost 0.15

The following additional information is available:

i) Each Financial Magazine needs 0.2 litres of ink. However, 10% of the ink input to the printing process is wasted. Ink costs GH¢5.40 per litre.

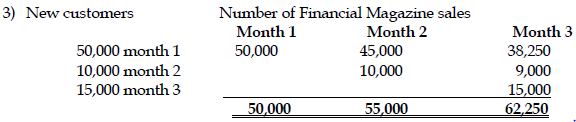

ii) In month 1, GCGL expects to sell 50,000 copies of the magazine to new customers at this price.

iii) After their first month of sales, GCGL expects 90% of first month’s customers to purchase the Financial Magazine in month 2. After the second month of purchase, GCGL expects to retain 85% of month 2 customers in subsequent months.

iv) As the magazine circulation area increases, sales to additional new customers in month 2 will be 20% of month 1 sales figure. 90% of this would be retained in month 3.

v) Sales to additional new customers in month 3 would be 30% of month 1 sales figures

vi) Fixed overhead costs are apportioned by GCGL to the Financial Magazines based on first month sales volume. Total budgeted annual fixed overhead is GH¢18,000,000 and total budgeted annual magazine sales, including the Financial Magazine, is 12,000,000 copies.

vii) The sales price of the Financial Magazine will remain unchanged throughout the first three months.

Required:

a) Discuss TWO (2) advantages and TWO (2) disadvantages of the managing director’s pricing strategy in the circumstances described above. (4 marks)

View Solution

The Managing Director’s pricing strategy is Cost-plus

Advantages

- Cost-plus pricing is suitable in such cases where the nature and extent of competition is unpredictable.

- The cost-plus method offers a guarantee against loss-making by a firm. If it finds that costs are rising, it can take appropriate steps by variations in output and price.

- It is the simplest method to decide the price for a product because one has just to add up all the cost and then add profit which you want to earn which will give the price for a product. (2 points for 2 marks)

Disadvantages

- It is not possible to accurately ascertain total costs in all cases.

- The full-cost pricing theory is criticised for its adherence to a rigid price.

- This method does not take into account the future demand for a product which should be the base before deciding the price of a product and therefore a serious limitation of this method.

- It cannot be use for decision marking as it may include sunk cost. (2 points for 2 marks)

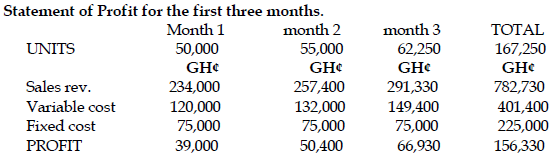

b) Produce a statement that shows the total profit for the first three months of Financial Magazine. (10 marks)

View Solution

WORKINGS:

1) Ink cost per magazine without loses GH¢1.08. However, 10% of ink wasted during printing is GH¢1.08 x (100/100-10) = GH¢1.20

2) Fixed Overhead Absorption Rate = GH¢18,000,000/12,000,000 = GH¢1.50 per Magazine

c) Calculate the number of copies of the Financial Magazine that need to be sold to achieve a profit of GH¢100,000. (6 marks)

View Solution

Quantity to produce to make a profit of GH¢100,000.

Fixed cost= 1.50 ×50,000×3 = GH¢ 225,000

Contribution margin; SP-VC (GH¢4.68-GH¢2.40) = GH¢2.28

![]()

142,544 copies to be produced to make a profit of GH¢100,000