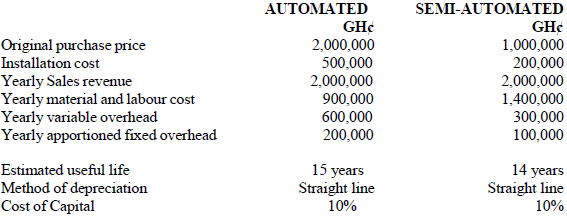

Pagsana Company plans to introduce a new product line for production of its local drink in Walewale. The company therefore, decided to acquire either semi-automated plant or an automated plant. The relevant data for the two proposed plants are as follows:

Required:

i) Select the appropriate plant on the basis of:

- Payback Period (4 marks)

View Solution

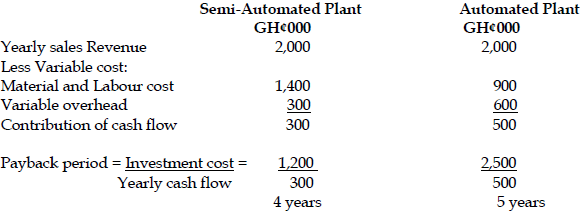

Pay Back Period is defined as the period, usually expressed in years, which it takes the cash flows from a capital investment project to equal the cash flows generated.

Decision:

Semi-automated plant is considered more suitable because of PBP of 4 years as against 5 years for an automated plant.

- Net Present Value (7 marks)

View Solution

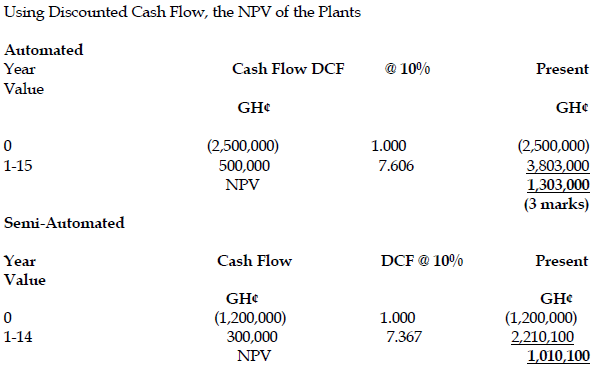

Decision:

It is advisable to select automated plant that gives a higher NPV though the capital requirement of the plants differs.

ii) Explain TWO (2) advantages of discounted cashflow method of investment appraisal. (4 marks)

View Solution

- It uses the time value of money.

- It uses the cost of capital.

- Uses cash flow instead of accounting profit.

- Considers the entire life of the project. (Any 2 points)