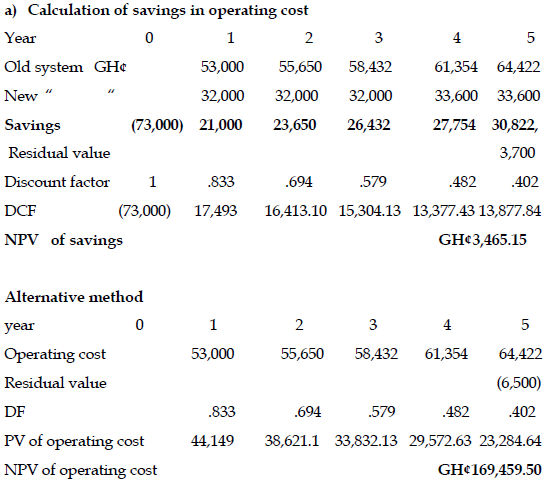

The Maintenance Manager of Prudence Ltd insists that management should maintain an old equipment that had been used for 5 years and is fully depreciated rather than buy a new one. The old equipment has a current operating cost of GH¢53,000.00 per annum. The operating cost of the equipment is expected to increase at 5% every year over the next four years, with a sale value of GH¢6,500.00 in the fifth year.

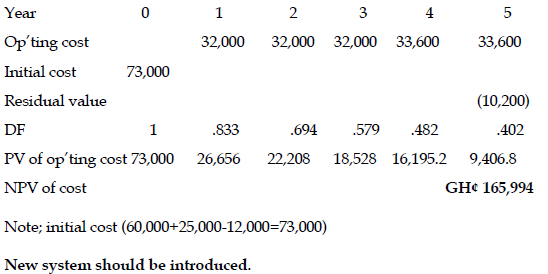

The Maintenance Manager has proposed, that a new system with enhanced technology to reduce operating cost to GH¢32,000.00 for the next three years and GH¢33,600.00 for the fourth and fifth years be introduced. The new equipment will cost GH¢60,000.00 and when introduced, a redundancy cost of GH¢25,000.00 will be paid, with the old equipment sold for GH¢12,000.00. The sale value of the new equipment will be GH¢10,200.00 after its five years’ useful life.

Required:

Using Net Present Value (NPV) method of capital appraisal with 20% cost of capital, advice management on which option Prudence Ltd should go for. (10 marks)

View Solution

NEW SYSTEM