GUSSIE PERRY LTD

Introduction

Gussie Perry Ltd (GPL) is a long-established divisionalised company with its origins in shipping. The company has been in existence for nearly 120 years and has developed a reputation for reliability and quality service.

The shipping activities in which Gussie Perry Ltd (GPL) is engaged in comprise four divisions – cruise, ferry, container and bulk shipping. The cruise division is engaged entirely in the carriage of passengers and the ferry division carries passengers and vehicles. The vehicles carried by the ferries range from motor cars to articulated trucks and buses. The container and bulk shipping divisions are engaged in the carriage of freight only.

Organisational goals

The company has stated over recent years that it aims to:

1. Increase its international business to achieve long-term profitability.

2. Provide the necessary capital investment to support its international operations.

3. Train and develop the company’s employees.

Environmental and Safety policy

Environmental protection is now a key aspect of corporate social responsibility. Pressure on Gussie Perry Ltd (GPL) for better environmental performance is coming from many quarters. The company recently implemented an environmental and safety policy, which is monitored through an audit system, in an effort to ensure that its policies are being executed. It is the aim of the company to have operational standards which match with the best industry’s standard. Training of management, staff and specialist auditors is seen as a priority within the organisation’s environmental and safety policy. This has become a major concern for the company, because of customer anxiety about the safety of the ferries.

Financial results

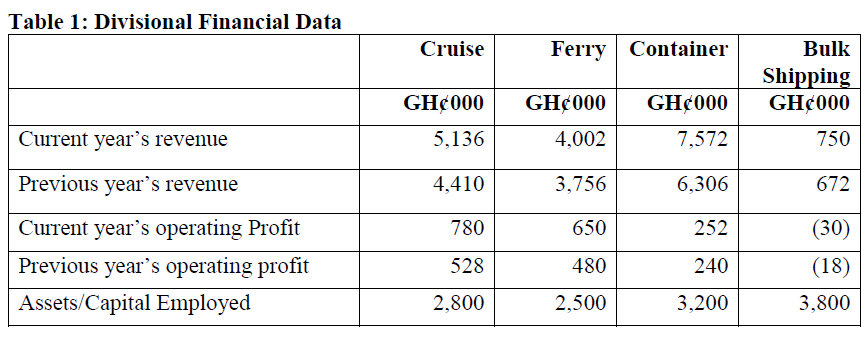

In the last financial year, earnings per share was GH¢2.12 producing a dividend cover of 1.15 times. The dividend per share paid by Gussie Perry Ltd (GPL) has remained at the same level for five years. Comparative values for divisional revenue and operating profit are shown in table 1.

During the year, general inflationary levels in the shipping industry was 14% per annum. The company’s cost of capital is 25%.

Extract from the Chairman’s statement for the financial year

In his statement, Mr. Aaron Yeboah, the Chairman of Gussie Perry Ltd (GPL), commenting on revenue and profit before the inflation adjustment, said the company achieved encouraging results, particularly in the cruise division. The company had taken delivery of a new cruise liner, at a cost of GH¢1,200,000 and has two more on order. Aaron believed that this was an expanding market and considered the company to be in a good position to take advantage of the opportunity. With regard to the ferry division, Aaron expected continued growth, although there was an expectation of potential new entrants due to increased cargo volumes. This contrasted with his view of the declining performance of the container and bulk shipping divisions as shown in table 1.

Market information

Gussie Perry Ltd (GPL) commissioned a marketing research into its cruise and ferry operations. The results of this research indicated that, in recent years, within the cruise liner industry, there has been a change in customer appeal. Traditionally, the main customer base had comprised of traders. In the last five years, the cruise division has experienced an increase in its clientele especially holiday makers. This stemmed from the promotion of domestic tourism.

Furthermore, the research showed a 15% increase in marine transport but Gussie Perry Ltd’s market share actually reduced by 4%. The report indicates that the probability of the cruise market continuing to grow was bright. However, there were uncertainties about the future potential of the container and bulk shipping divisions.

Required:

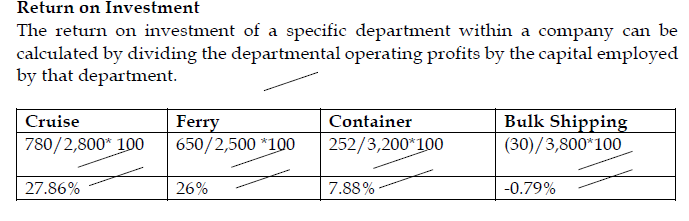

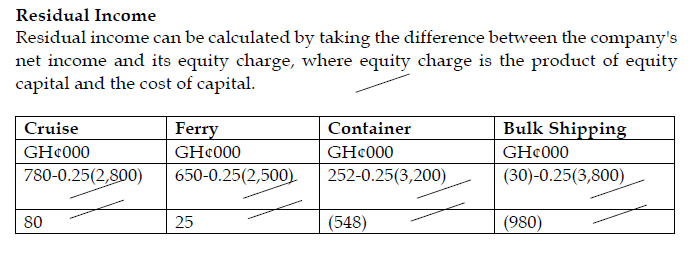

i) Calculate the current return on investment (ROI) and residual income (RI) for each division for the current year. (4 marks)

View Solution

ii) Assess the performance of each division and advise the management of Gussie Perry Ltd (GPL). (8 marks)

View Solution

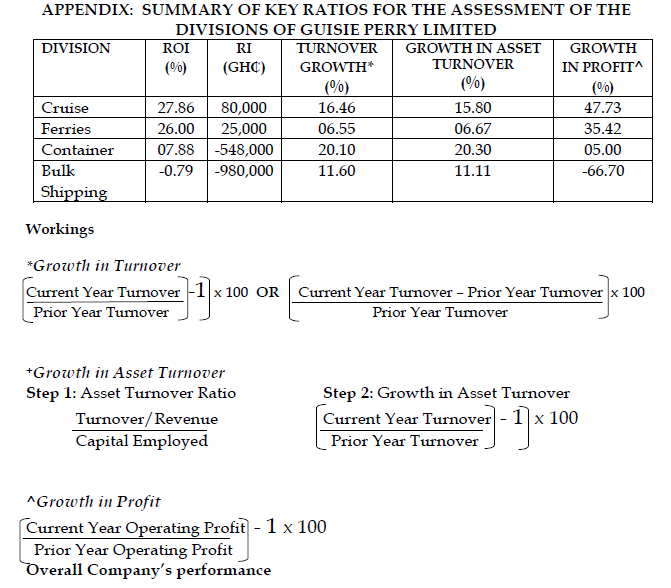

Total turnover of GUSSIE PERRY Ltd increased from GH¢ 15,144,000 to GH¢ 17,460,000 – an increase of 15.3%.Profit increased from GH¢ 1,230,000to GH¢ 1,652,000 – an increase of 34.30%.

For the company as a whole, the return on sales may be calculated as follows:

Last year – GH¢ 1,230,000 ÷ GH¢ 15,144,000 = 8.1%.

This year – GHs¢1,652,000 ÷ GH¢ 17,460,000 = 9.46%.

Returning to the individual divisions, the following table expresses the various key financial measures.

Divisional assessment

Cruise

As regards the Return on Investment and Residual Income, one could really say that the cruise division had ‘encouraging results’. The returns from its investment is able to cover its cost of capital thus a positive Residual income. Turnover growth in Cruise division is 16.45% more than the Turnover growth rate of the company as a whole thus additional investment in this area might be productive. Although, without knowing the precise market conditions and the needs of this division as regards new shipping or other facilities, the financial performance of this division is very bright to make any firm judgements on investments and capital decisions.

Advise for Cruise Division

It will be advisable to approve and fund decisions for projects and programs of different types (for example marketing programs, recruiting programs, and training programs) for this division as a higher ROI means that investment gains compare favorably to investment costs.

Ferries

Ferries division shows an improvement of 6.55% in sales but 35.42% increase in profits, this is encouraging. It has a ROI of 26%, thus is covering its cost of investment. Capital and additional investments should be approved and encouraged at this division.

Advise for Ferries

Although there was low increment in sales, it translated into a high operating profits. The company should make efforts to increase turnover through company’s pricing policies, inventory management and investment in capital assets.

Bulk Shipping and Containers

In both containers and bulk shipping, the Chairman’s statement is fairly accurate in his pointing to disappointing results in this area. Both are not able to cover its cost of investment. Both Divisions has negative residual incomes.

Advise for Bulk Shipping and Containers

A negative residual income means that the division could have done better by another, risk-free approach. Some analysts refer to residual value as Economic Value Added. If your residual value is negative, you are not truly adding value to what you are doing. There will be no value added if more funds and investments are approved at this division.