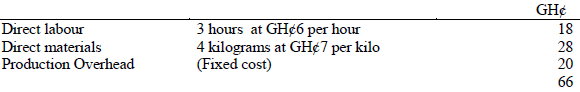

Bosco Ltd makes and sells one product. Currently, it uses absorption costing to measure profits and inventory values. The budgeted production cost per unit is as follows:

Normal output volume is 16,000 units per year and this volume is used to establish the fixed overhead absorption rate for each year. Costs relating to sales, distribution and administration are:

Variable 20% of sales value

Fixed GH¢180,000 per year.

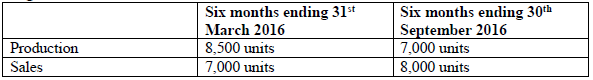

There were no units of finished goods inventory at 1st October 2015. The fixed overhead expenditure is spread evenly throughout the year. The selling price per unit is GH¢140. For the two six-monthly periods detailed below, the number of units to be produced and sold are budgeted as follows:

The entity is considering whether to abandon absorption costing and use marginal costing instead for profit reporting and inventory valuation.

Required:

i) Calculate the budgeted fixed production overhead costs for each of the six-monthly periods. (3 marks)

View Solution

Budgeted production overhead expenditure = Normal production volume × Absorption rate per unit

. = 16,000 units × GH¢20 = GH¢320,000.

Since expenditure occurs evenly throughout the year, the budgeted production overhead expenditure is GH¢160,000 in each six-month period.