CASE STUDY: ALPHA MINERAL WATER LIMITED

Introduction

Alpha Mineral Water Limited is one of the many companies producing bagged and bottled mineral water. The company was established in 2010 and has grown rapidly. Mr. Kwasi Kwakye has served as the managing director since the inception of the company. He is an accomplished entrepreneur and has received many awards both at home and abroad.

The Industry

The competition in the bagged and bottled water industry revolves around pricing as each producer attempts to use penetration pricing strategy in order to capture maximum market share. Most of the materials used in the industry are imported.

A decade ago, the industry had few players. Currently, there are numerous companies with low exit rate. The industry for most part of its existence, has remained unregulated and does not require huge initial capital. Since the inception of production of bagged and bottled mineral water, the government has been battling rubber pollution in major urban centres. The drainage systems are often choked with used plastic materials, which are not biodegradable. To address this menace, government is considering a special tax to raise money to clear the waste. Again, a bill is before parliament which when passed into law would require all to use biodegradable materials for packaging their products.

Based on the concern expressed by the government over the years, a new body known as Plastic Waste Regulatory Authority was set up early 2015 to regulate the industry. The regulator is expected to enforce certain minimum standards to sanitise the industry and minimise the effect of its activities on the environment. This measure, according to the experts, will restrict new producers entering the sector.

The bagged and bottled mineral water produced is sold to corporate bodies in the form of water dispensers and bottled water. Also, they supply water to households and retailers through key distributors. The margins of the key distributors are very low and only make reasonable profit on huge volumes. As a result, the key distributors tend to resist any price hikes by the producers. The past experience shows that anytime price increases, demand slows down as alternative sources of drinking water are sought by consumers. Again, some bulk distributors who perceive producers as raking in so much profit have ventured into production of bagged and bottled water in the past. Corporate clients are also cutting their expenditure on water. There are some companies that have commenced importation of bottled mineral water for their own use.

Most of the companies in the industry depend on only two sources of water – Ghana Water Company (GWC) or bore hole. The industry water demand constitute 8% of GWC output. The producers have also not formed any association to deal with issues affecting them collectively. The water supply is increasingly becoming erratic, unreliable and very expensive with the withdrawal of government subsidies, further squeezing the margins of the sector. The working conditions of most of the workers in the sector is nothing to write home about and it has been difficult negotiating for better conditions, since they did not belong to any labour union. However, with the passage of the new labour law, it has become easier for the workers to join existing labour unions. As a result, most of the workers now belong to Industrial Workers Union.

The producers within the sector have a fair share of the market and no single company dominates the market. The market survey conducted indicates that the highest market share of the leading companies is 10%.

Expansion Plans

Alpha Mineral Water Ltd currently has presence only in Accra and its surrounding settlements. The company is proposing to expand its operations to four regional capitals in the country. The details of the proposed investment is presented as follows:

The company has estimated investment outlays of GH¢200,000 fixed capital items. This outlay includes GH¢25,000 to be expended to acquire the land for the factory. The rest of the amount will be incurred on water processing and packaging plant that will be depreciated on straight-line basis over five years with scrap value. At the end of fifth year, the company will sell off the assets for GH¢60,000. Additional initial investment is expected to be made in receivables and inventory of GH¢50,000 and the short-term payables of GH¢20,000 will be generated by the project. No further investment would be made in working capital during the project life and the initial investment would be recouped at the end of the fifth year.

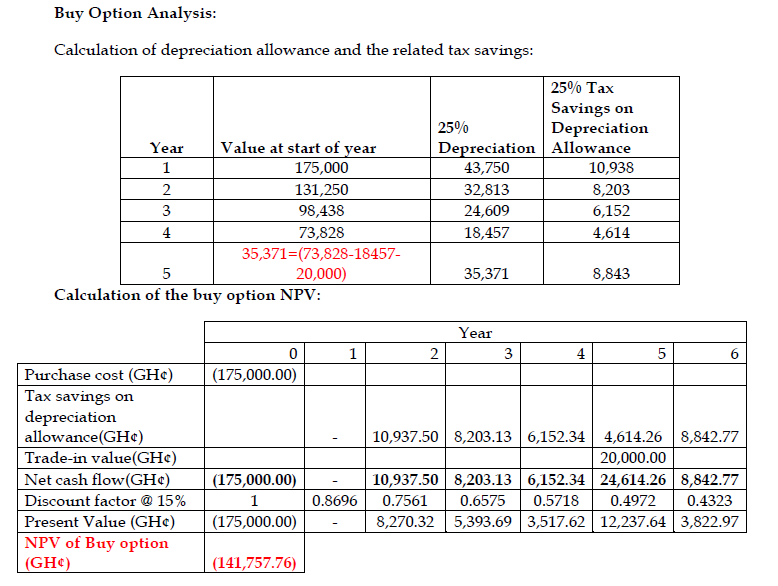

The Board of Directors have tasked the Finance Director to advise the Board on whether to lease or buy the plant using a bank loan.

The company could purchase the plant for cash using a bank loan on which the current rate of interest is 20% before tax. The trade-in value is GH¢20,000. If the plant is purchased, the company can claim tax depreciation allowance of 25%, on a reducing balance basis over the plant’s five year life.

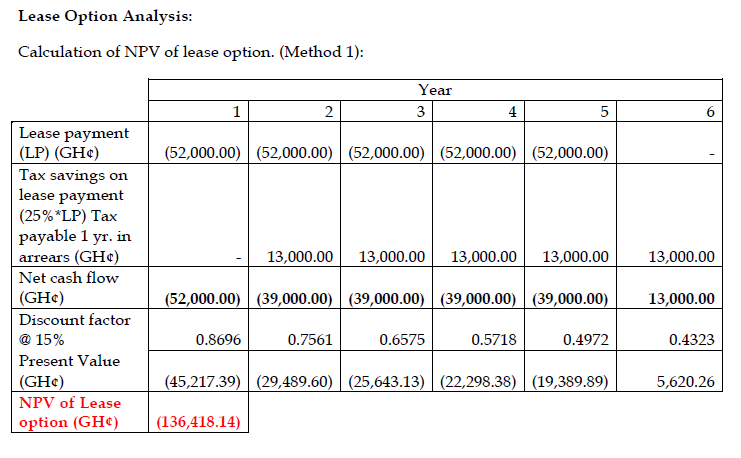

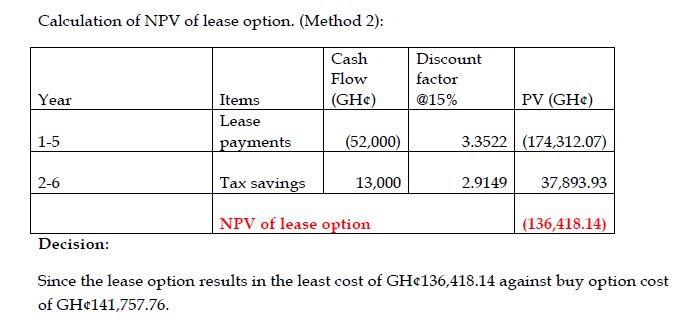

The company could lease the plant under an agreement which would entail payment of GH¢52,000 at the end of each year for the next five years. The tax authorities allow lease payment for tax purposes.

The corporate rate of tax is 25% and tax is payable one year in arrears. The company’s required rate of return is 15%.

Required:

c) Advise management on the best option between lease or buy. Support your advice with relevant calculations. (12 marks)

View Solution

d) Explain TWO other factors you will consider in reaching your conclusion in (c) above. (4 marks)

View Solution

Lease or buy are not purely a matter of calculations. The following are qualitative considerations in arriving at a decision:

- Effect on cash flow – the organisations liquidity at the time the decision is made may be important. If the business is suffering cash flow difficulties, lease payments may offer a smoother cash flow than one big lump sum.

- Cost of capital – the decision on whether to obtain use of the asset may be dependent upon appraisal method or cost of capital used. A decision not to invest taken using the company’s overall cost of capital may be reversed if a significantly lower cost of leasing is used in the cash flow.

- Running expense – lease or buy calculations normally assume that running costs are the same under each alternative. This may not be so. Expenses like maintenance and insurance may differ between the alternatives.

- Trade in value – the organisation will gain (uncertain) benefits of a trade-in value if it chooses the purchase option.

- Effect on reported profit – annual profits are reported on accrual basis, after the deduction of depreciation. The effect of the alternatives on reported profits should be considered since this could, if significant, affect dividend policy and valuation of shares.

- Alternative uses of funds – Lease or buy decision will not be taken in isolation. If the business has limited funds available, there may be better uses for those funds than obtaining the asset, even if the asset does yield net positive cash flows.