Brofre limited retails fertilizer to farmers in Ghana. The company has approached its Bankers to provide funding for next year’s operations and three months master budget has been requested for review by the bankers.

You have been approached by the management as a consultant to prepare the 1st quarter budget for the banker’s consideration for its next year’s operations.

End of Accounting year December 2014

GHS

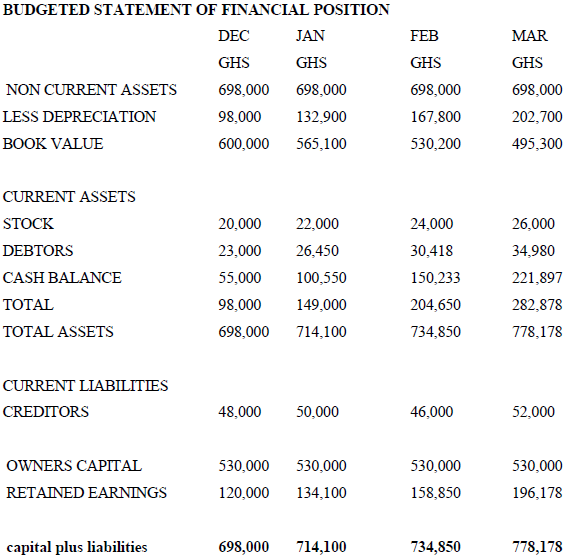

Debtors 23,000

Bank balance 55,000

Fixed asset at cost 698,000

Provision for depreciation balance 98,000

Creditors Balance 48,000

Operating expenses for the month December 60,000

Sales for the month of December 2014 400,000

December Ending inventory 20,000

Retained earnings 120,000

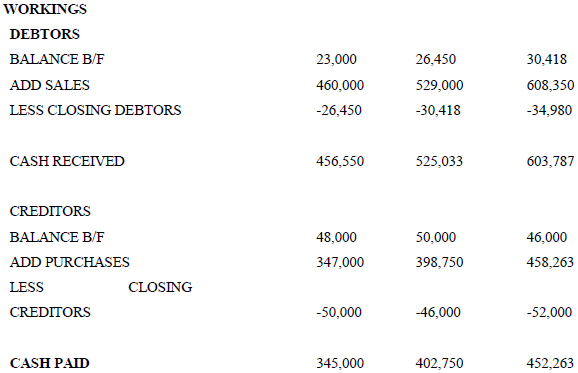

The following additional information was also provided to assist your work.

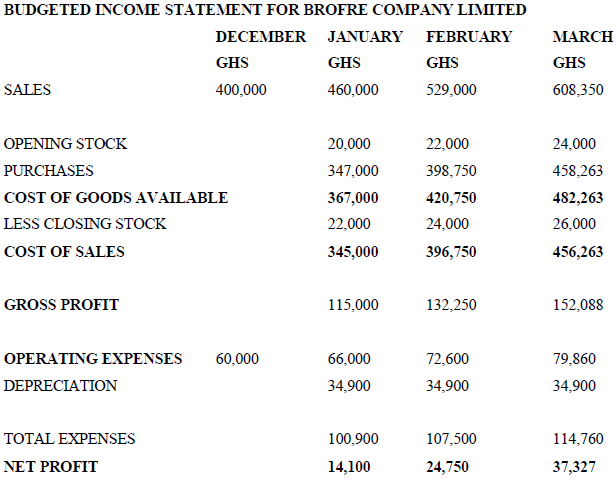

i) Depreciation is provided at the rate of 5% on cost of non-current assets

ii) Closing inventory is expected to increase by GHS 2000 in January from December levels. This is expected to increase by the same figure in February from the projected figure in January. It is expected that in March closing inventory is desired to be GHS 26,000

iii) The company makes a profit of 25% on its sales.

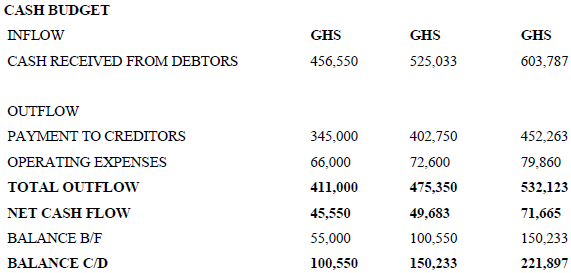

iv) Operating expenses is expected to increase by 10% from that of December and this is projected to increase at the same growth rate to March.

v) Sales is projected to grow by 15% from December until March.

vi) The Debtors figure is desired to be proportional to the sales values.

vii) Creditors value for the three months are expected to be as follows

January – GHS 50,000; February – GHS 46,000 and in March – GHS 52,000

You are required as a consultant for Brofre Company limited to prepare for their Bankers:

a) The budgeted income statement for the three months. (7 marks)

View Solution

b) The budgeted statement of financial Position for the three months. (7 marks)

View Solution

c) The cash budget for the three months. (6 marks)

View Solution

However if a student depreciate the asset at 5 per the quarter divided by 3 to obtain 11,633 it should be accepted as a correct answer. This will affect profit, depreciation and accumulated depreciation.