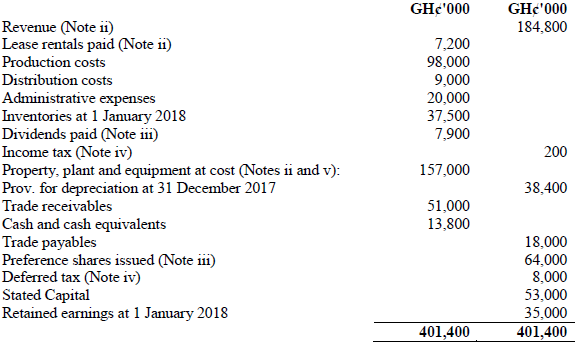

Biggs Ltd has a financial year ending 31 December. Its trial balance extracted as at 31 December, 2018 was as follows:

Additional information:

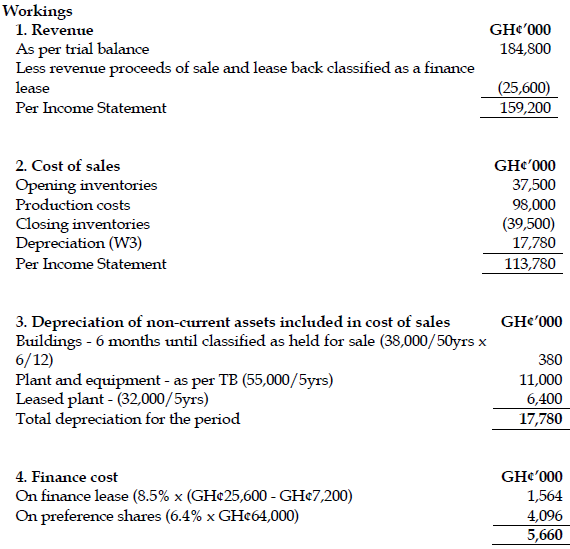

i) The carrying value of inventories at cost at 31 December 2018 was GH¢39.5 million.

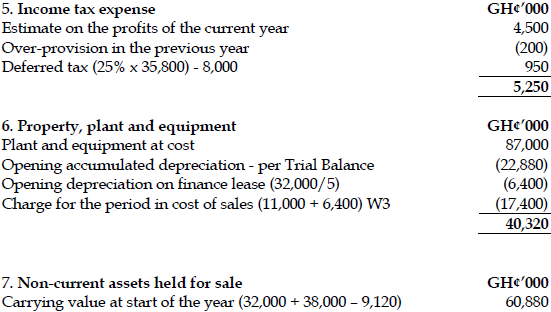

ii) On 1 January 2018 Biggs Ltd sold some of its plant and equipment to a finance company. Biggs Ltd credited the sales proceeds of GH¢25.6 million to revenue. The plant and equipment was purchased by Biggs Ltd on 1 January 2017 at a total cost of GH¢32 million and was being depreciated over its estimated useful life of five years. The cost and accumulated depreciation of the disposed asset is still included in the PPE cost and accumulated depreciation accounts.

On 1 January 2018 Biggs Ltd began to lease the plant and equipment from the finance company on a four-year lease. Lease rentals were GH¢7.2 million, payable annually in advance. If Biggs Ltd had borrowed funds from the finance company on 1 January 2018, the annual interest rate would have been 8.5%.

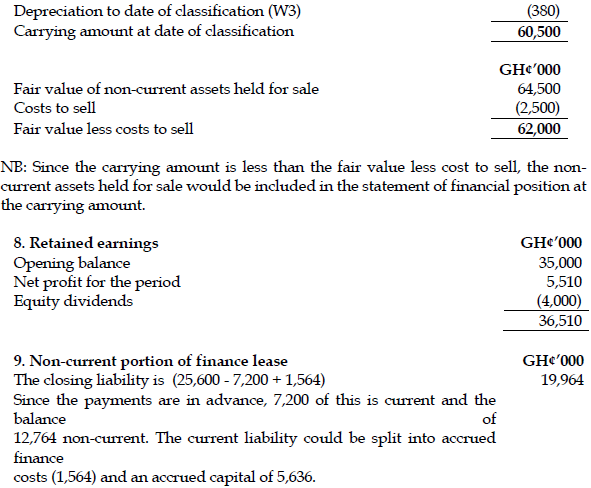

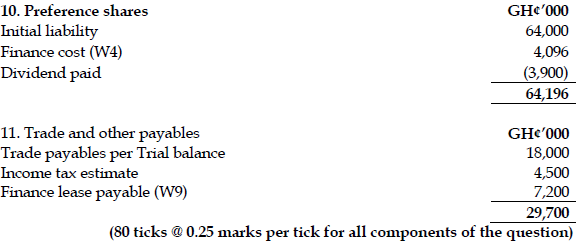

iii) On 1 January 2018 Biggs Ltd issued 200 million preference shares at 32.50 pesewas each. Costs of issue were GH¢1 million so the net proceeds of the issue were GH¢64 million. The preference shareholders will receive an annual dividend on 31 December each year of GH¢3.9 million. The shares will be redeemed at par on 31 December 2022. The effective annual finance cost attaching to these shares is approximately 6.4%. The first annual dividend was paid on 31 December 2018 and is included in dividends paid. The equity shareholders were paid a dividend of GH¢4 million in the year.

iv) The estimated income tax on the profits for the year to 31 December 2018 is GH¢4.5 million. During the year GH¢4.2 million was paid in full and final settlement of income tax on the profits for the year ended 31 December 2017. The statement of financial position at 31 December 2017 had included GH¢4.4 million in respect of this liability. At 31 December 2018 the carrying amounts of the net assets of Biggs Ltd exceeded their tax base by GH¢35.8 million. Assume an income tax rate of 25%.

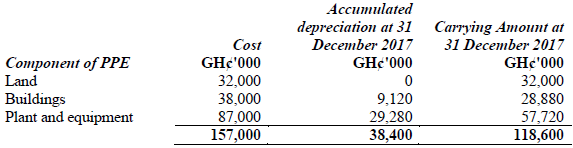

v) The details of property, plant and equipment are as follows:

Estimate of useful economic life (at date of purchase) of PPE components:

Land – nil (infinite life)

Building – 50 years

Plant and Equipment – 5 years

On 30 June 2018 the directors decided to sell the property because more suitable leasehold property had become available at a very competitive cost. They advertised the property for sale at that date at what was considered to be a realistic asking price of GH¢68 million. They estimated that costs of GH¢3 million would be necessary in order to sell the property. On 1 December 2018 they reduced the asking price to GH¢64.5 million and they sold the property at this price shortly after the year end. Costs to sell totaled GH¢2.5 million.

Required:

Prepare for Biggs Ltd,

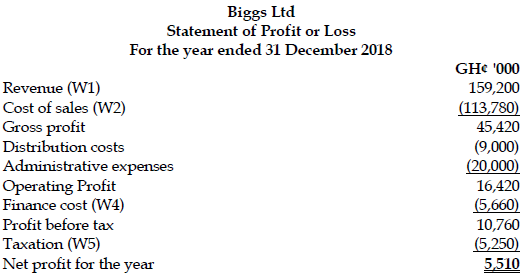

a) The Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2018. (10 marks)

View Solution

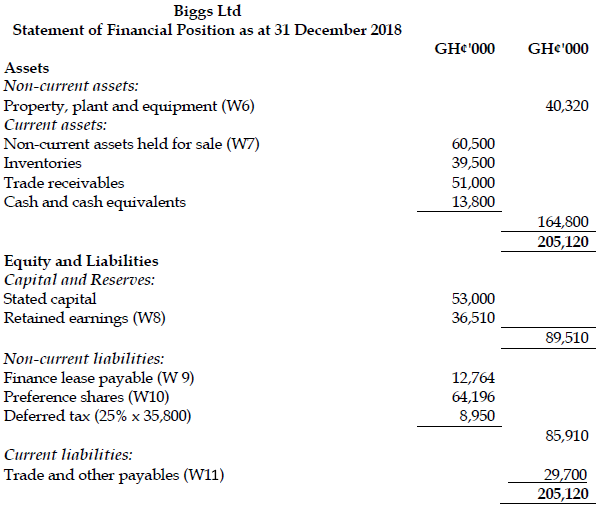

b) The Statement of Financial Position as at 31 December 2018. (10 marks)

View Solution

View All Workings