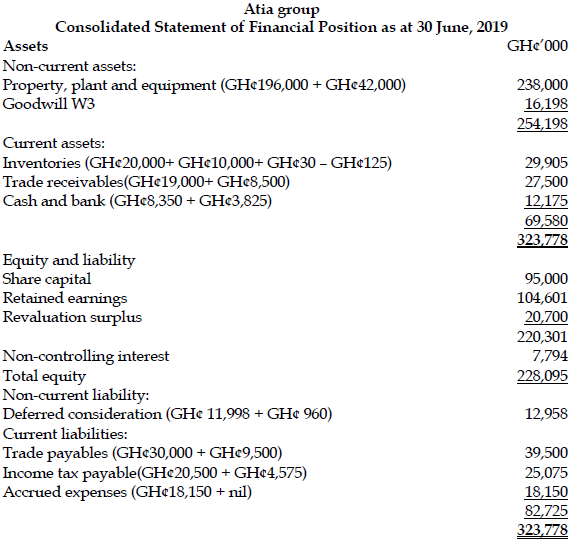

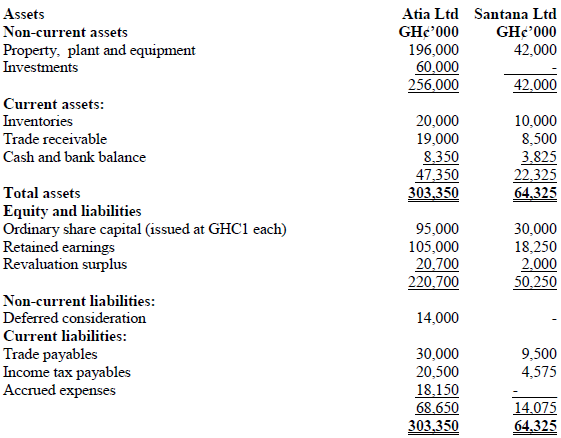

The draft statements of financial position of Atia Ltd and that of Santana Ltd as at 30 June 2019 are as follows:

Additional relevant information:

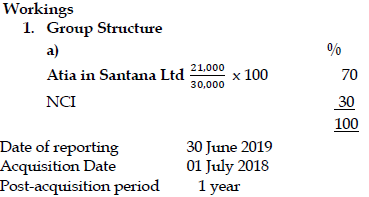

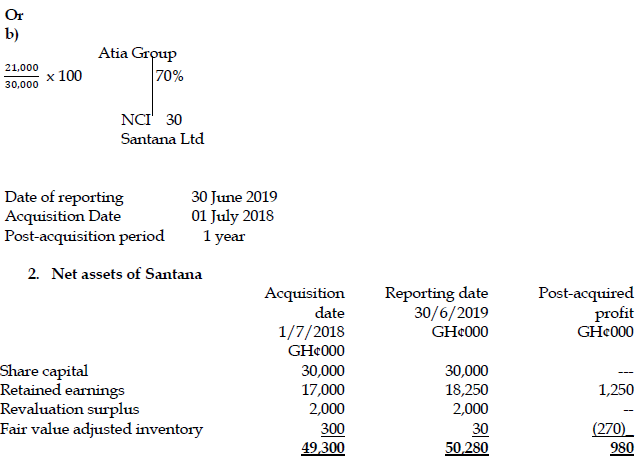

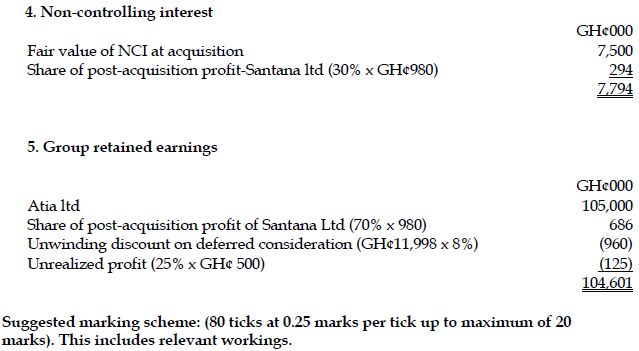

i) On July 1, 2018, Atia Ltd purchased 21 million shares of Santana Ltd. At this date the retained earnings of Santana Ltd were estimated at GH¢17 million whereas the revaluation surplus was GH¢2 million respectively.

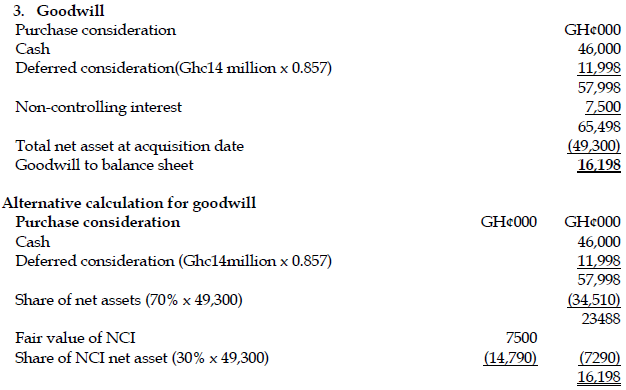

ii) Atia Ltd paid an initial amount of cash of GH¢46 million and agreed to pay the shareholders of Santana Ltd a further GH¢14 million on July 1, 2020. The financial accountant has recorded the full amounts of both elements of the consideration in the investments as shown in the statement of financial position.

iii) Atia Ltd has a cost of capital of 8% per annum.

iv) During the accounting period, Atia Ltd sold goods totaling an amount of GH¢4 million to Santana Ltd at a gross profit margin of 25%. At 30 June 2019, Santana Ltd still had a total of GH¢0.5 million of these goods in inventory. Atia Ltd has a normal margin usually to third party customers at 45%.

v) On the acquisition date, the fair values of Santana Ltd’s net assets were equal to their carrying amounts with the exception of some inventory, which had cost GH¢ 1.5 million but had a fair value of GH¢1.8 million. On 30 June 2019, 10% of these goods remained in the inventories of Santana Ltd.

vi) It is the policy of Atia Ltd to value the non-controlling interest using the fair value method. For this purpose, the value of the non-controlling interest at acquisition date is estimated at GH¢7.5 million.

vii) Impairment test was conducted at the year end and no goodwill impairment occurred.

Required:

Prepare the consolidated statement of financial position of the Atia group as at 30 June 2019. (20 marks)

View Solution