Due to a change in Pusiga Ltd’s production plans, an item of machinery with a carrying value of GH¢11 million at 31 December 2017 (after adjusting for depreciation for the year) may be impaired due to a change in use. An impairment test conducted on 31 December 2017, revealed its fair value less cost of disposal to be GH¢5 million. The machine is now expected to generate

an annual net income of GH¢2 million for the next three years at which point the asset would be sold for GH¢2.4 million. An appropriate discount rate is 10%. Pusiga charges depreciation at 20% on reducing balance method on machinery.

Note:

- The present value of ordinary annuity of GH¢1 at 10% for one year, two years and three years are 0.909,1.736 and 2.487 respectively.

- The present value of GH¢1 at 10% for one year, two years and three years 0.909, 0.826 and 0.751 respectively

Required:

In accordance with IAS 36: Impairment of Assets, explain with justification the required accounting treatment in the financial statements of Pusiga Ltd for the year ended 31 December 2017. (3 marks)

View Solution

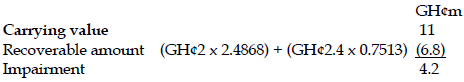

Under IAS 36 Impairment, The machinery needs to be tested for impairment.

Recoverable amount is the higher of value in use (GH¢6.8m) and fair value less costs of disposal (GH¢5m)

GH¢m GH¢m

Cr (PPE) 4.2

Dr SPLOCI – Serox 4.2