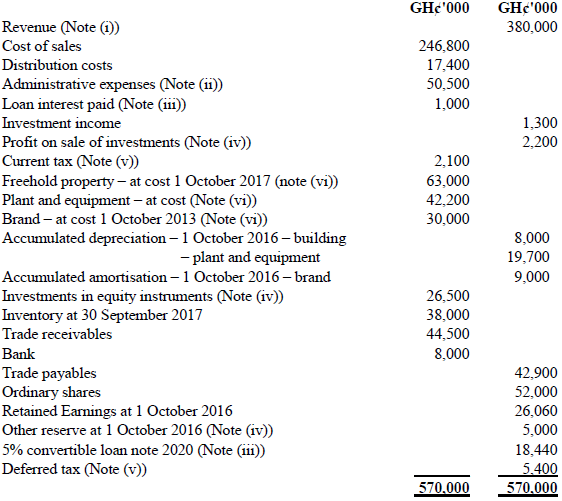

The following trial balance relates to Binkabi Ltd as at 30 September 2017:

Additional Information:

i) Binkabi Ltd’s revenue includes GH¢16 million for goods sold to Kofi on 1 October 2016. The terms of the sale are that Binkabi Ltd will incur ongoing service and support costs of GH¢1.2 million per annum for three years after the sale. Binkabi Ltd normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

ii) Administrative expenses include an equity dividend of ¢12 million paid during the year.

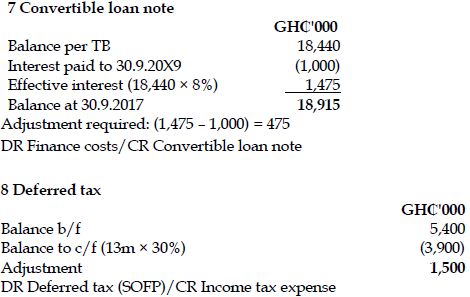

iii) The 5% convertible loan note was issued for proceeds of ¢20 million on 1 October 2015. It has an effective interest rate of 8% due to the value of its conversion option.

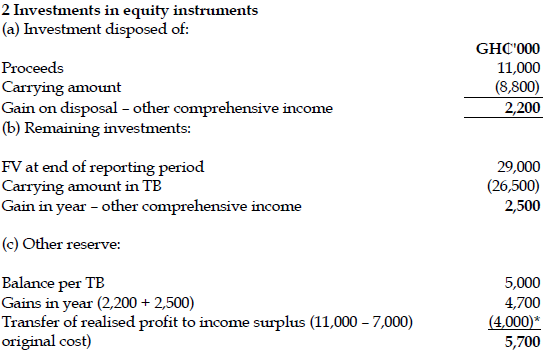

iv) During the year Binkabi Ltd sold an equity investment for GH¢11 million. At the date of sale it had a carrying amount of GH¢8.8 million and had originally cost GH¢7 million. Binkabi Ltd has recorded the disposal of the investment. The remaining equity investments (the GH¢26.5 million in the trial balance) have a fair value of GH¢29 million at 30 September 2017. The other reserve in the trial balance represents the net increase in the value of the equity investments as at 1 October 2016. Binkabi Ltd made an irrevocable decision at initial recognition of these instruments to recognise all changes in fair value through other comprehensive income, and makes a transfer of realised profit from the other reserve to income surplus on disposal of the investments. Ignore deferred tax on these transactions.

v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2016. The directors have estimated the provision for income tax for the year ended 30 September 2017 at GH¢16.2 million. At 30 September 2017 the carrying amounts of Binkabi Ltd’s net assets were GH¢13 million in excess of their tax base. The income tax rate of Binkabi Ltd is 30%.

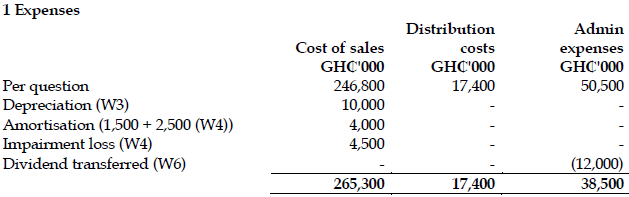

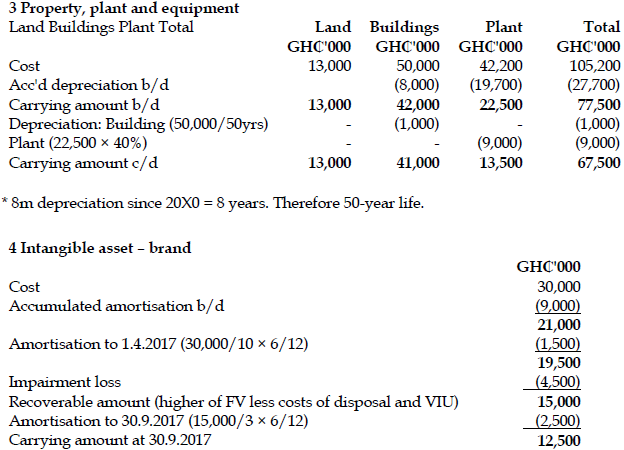

vi) Non-current assets

The freehold property has a land element of GH¢13 million. The building element is being depreciated on a straight-line basis. Plant and equipment is depreciated at 40% per annum using the reducing balance method. Binkabi Ltd’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2017 which concluded that, based on estimated future sales, the brand had a value in use of GH¢12 million and a remaining life of only three years. However, on the same date as the impairment review, Binkabi Ltd received an offer to purchase the brand for GH¢15 million.

Prior to the impairment review, it was being depreciated using the straight-line method over a 10 year life. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September 2017. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

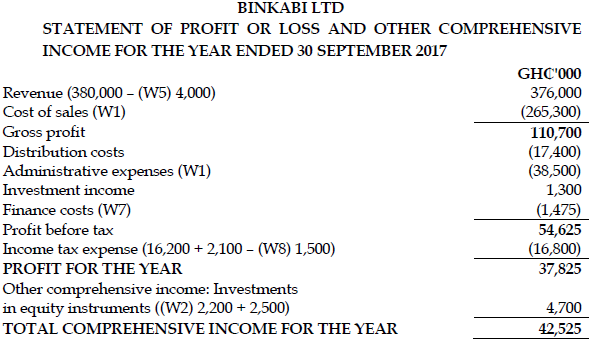

a) Prepare the statement of profit or loss and other comprehensive income for Binkabi Ltd for the year ended 30 September 2017. (8 marks)

View Solution

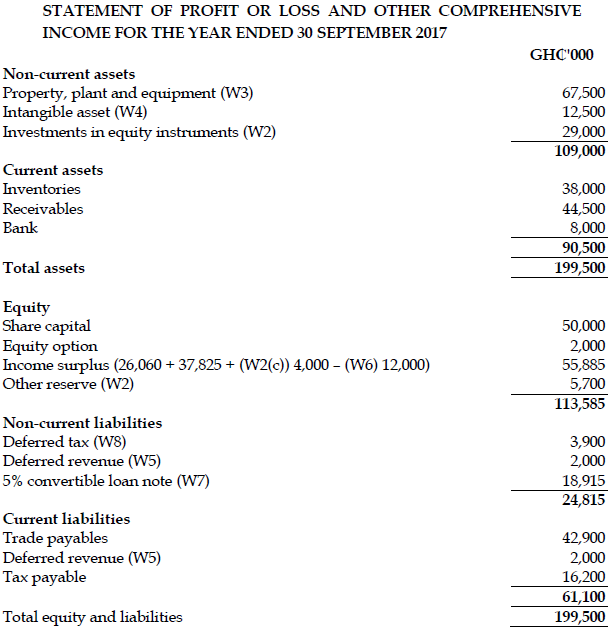

b) Prepare the statement of financial position of Binkabi Ltd as at 30 September 2017. (12 marks)

View Solution

View All Workings

* Entities are permitted to make this transfer and can choose whether or not to do so.

5. Deferred revenue

Per IFRS 15 a proportion of the revenue from sales to Binkabi Ltd should be deferred to cover the ongoing service and support costs. The costs for the year to 30 September 2017 will already have been accounted for, but revenue must be deferred to cover the costs for the remaining two years. The total amount deferred should include the 40% profit, so will be calculated as:

((1,200 × 2) × 100/60) GH₵4,000,000

This will be deducted from revenue and split 50:50 between current and non-current liabilities.

6. Dividend

GH₵12m is added back to administrative expenses and deducted from income surplus.