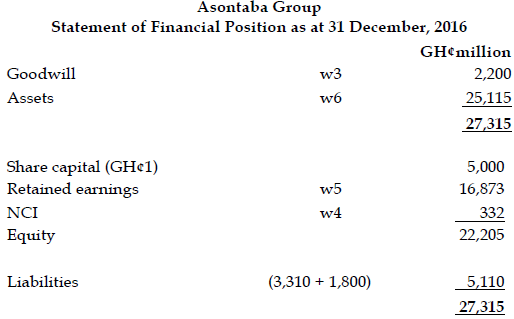

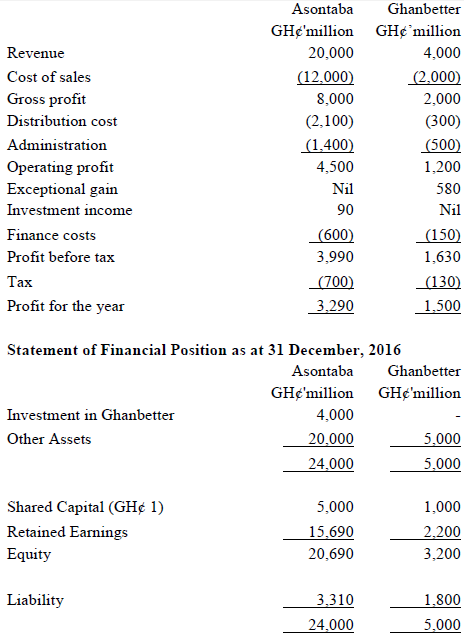

Ghanbetter is 90% subsidiary of Asonbata that was acquired one year ago for GH¢4billion when the retained earnings of Ghanbetter were GH¢800 million. Below are the financial statements of the companies.

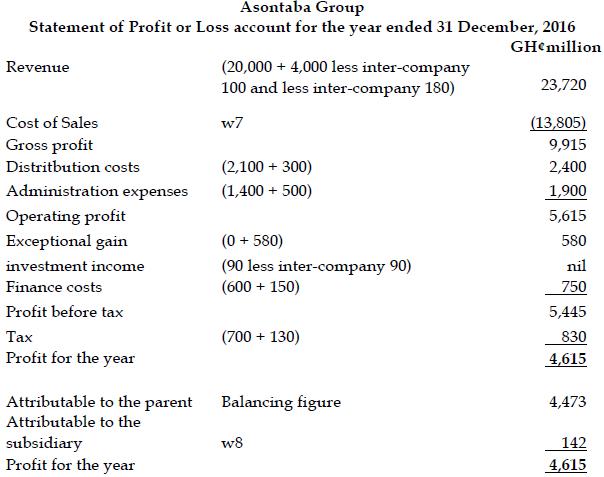

Statement of Profit or Loss for the year ended 31 December, 2016.

Additional information:

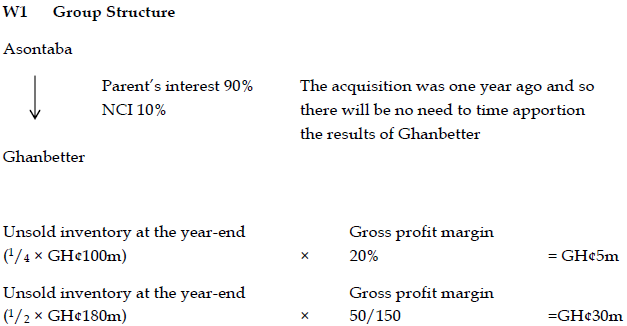

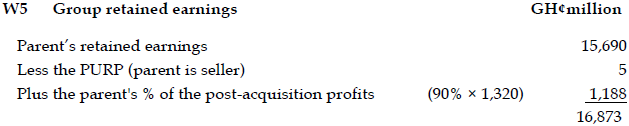

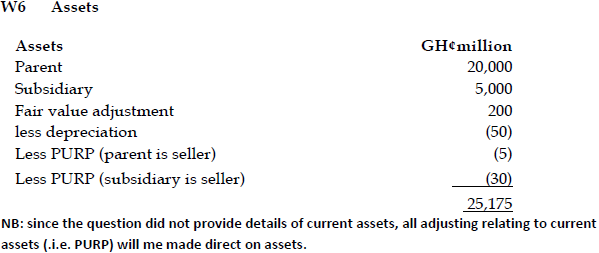

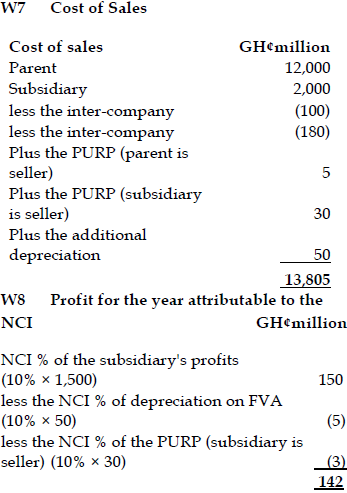

i) During the year Asonbata sold goods to Ghanbetter for GH¢100 million. These goods were sold at a margin of 20% and one quarter remained in inventory at the year-end.

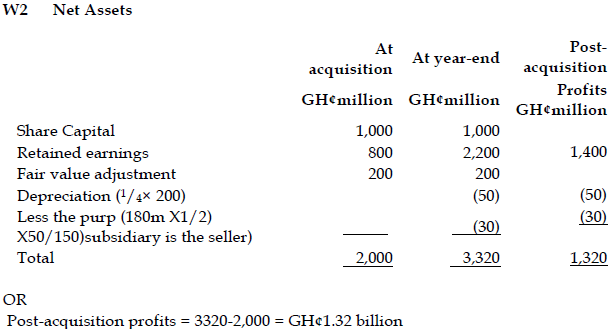

ii) During the year Ghanbetter sold goods to Asonbata for GH¢180 million. These goods were sold at a mark-up of 50% and one half remained in the inventory at the year -end.

iii) At the year-end there were no outstanding inter-company current account balances.

iv) At the date of acquisition the fair value of Ghanbetter’s net assets were equal to their carrying value with the exception of an item of plant that had a fair value of GH¢200 million in excess of its carrying value and a remaining useful life of four years.

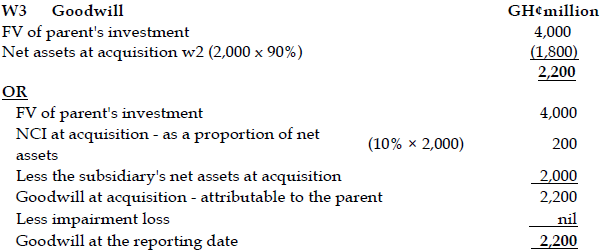

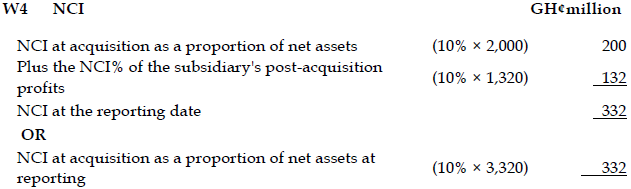

v) Goodwill is to be calculated using the proportionate basis. An impairment review at the year-end reveals that no impairment loss arose.

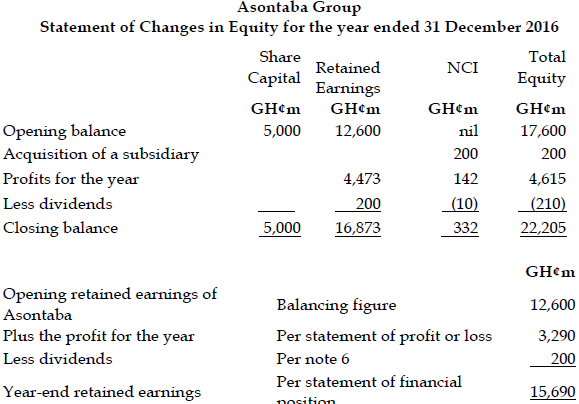

vi) Both companies have paid a divided during the year. The dividend distributed by Asonbata was GH¢200 million and that of Ghanbetter GH¢100 million. The investment income that Asonbata has recognised is the dividend received from Ghanbetter Shortly before the year-end.

Required:

Prepare the Consolidated Statement of Financial Position, Statement of Changes in Equity, and Consolidated Statement of Profit or Loss for Asonbata for the year ended 31 December, 2016. (20 marks)

View Solution