a) Santasi and Patasi are in partnership sharing profits and losses in the ratio 3:2. They decided to amalgamate their firm with that of another partnership Bremang and Asafo as at 30 June 2015. Bremang and Asafo share profits and losses in the ratio 2:1.

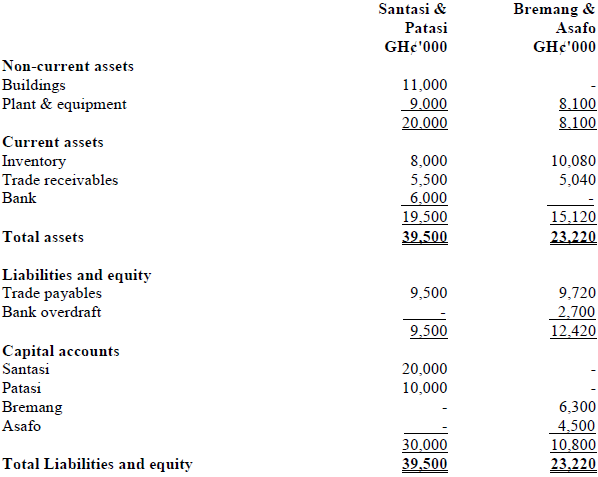

The following were their statement of financial position as at that date:

Additional information:

The terms of the amalgamation which was concluded by 30 June 2015 were as follows:

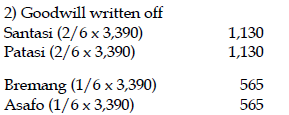

i) Profits and losses were to be shared in the ratio of Santasi: Patasi: Bremang: Asafo = 2:2:1:1 respectively.

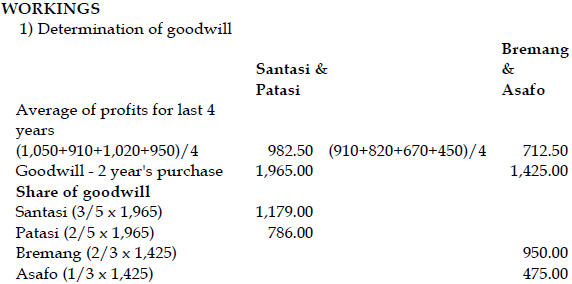

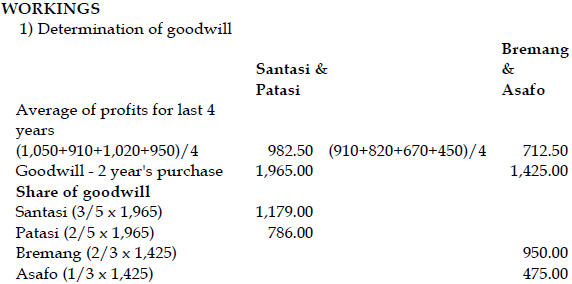

ii) The values of goodwill of the two firms were agreed to be valued at two year’s purchase of the average profits of the last four accounting years to the year of amalgamation. No goodwill account is to be maintained in the books.

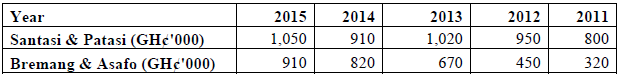

Profits of the firms for the past five years ending 30 June are as follows:

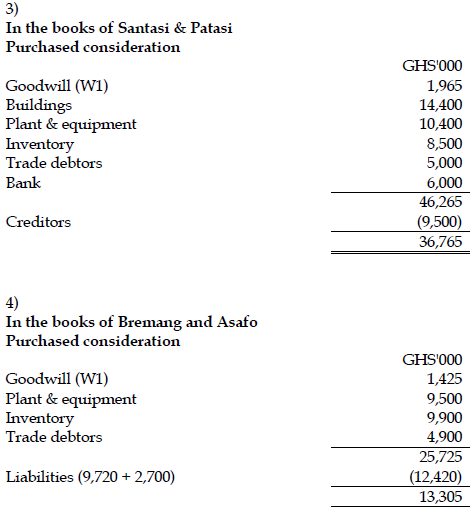

iii) The new firm was to take over all the assets and liabilities of Santasi and Patasi. The following assets of Santasi and Patasi were revalued: buildings GH¢14,400,000; plant and equipment GH¢10,400,000; inventory GH¢8,500,000; trade receivables GH¢5,000,000.

iv) The new firm was to take over all the assets and liabilities of Bremang and Asafo at the following agreed values: plant and equipment GH¢9,500,000; inventory GH¢9,900,000; trade receivables GH¢4,900,000.

v) The capital of the new firm was to be GH¢60,000,000, contributed according to their profit and loss sharing ratio. The balance due to or from the partners will be settled through the bank account of the new firm.

Required: (15 marks)

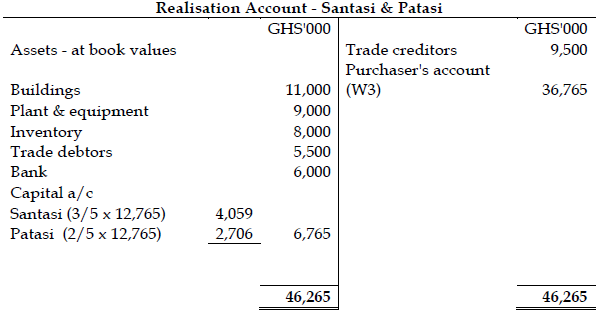

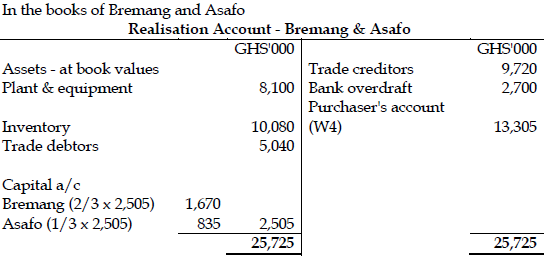

i) Prepare Realisation account in the books of each of the old firms as at 30 June 2015.

View Solution

In the books of Santasi and Patasi

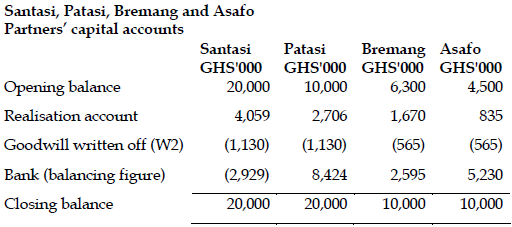

ii) Prepare the partners’ capital accounts in a columnar form, for the period to 1 July 2015.

View Solution