Sofoline Ltd has a plant which cost GH¢40,000 and was purchased on 1 January 2013 with a useful life of 10 years. The plant was being used as part of its business operating capacity. On 30 June 2015, Sofoline Ltd made a decision to classify the plant as held for sale and an agent was appointed for the sale of the plant that have started advertising the plant at a selling price of GH¢29,000 which was considered to be its fair value. The selling expenses are estimated to be GH¢1,500. The asset has not yet been sold by the year end of 31 December 2015 and it has a fair value less cost to sell of GH¢24,000 on this date.

Required:

Discuss how this will be accounted for in the financial statements of Sofoline Ltd for the year ended 31 December, 2015 in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. (5 marks)

View Solution

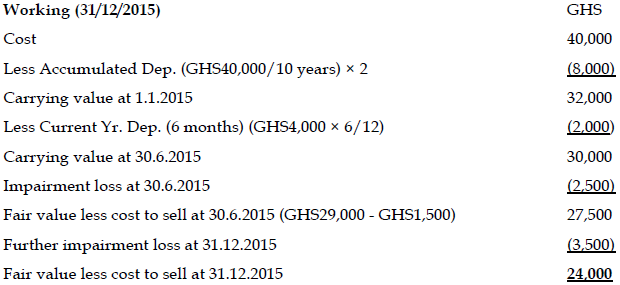

As the plant appears to have met the criteria to be classified as held for sale on 30 June 2015, it will be classified as held for sale on 30 June 2015at lower of:

Carrying value on the date of classification

Its fair value less cost to sell on the same date

If fair value less cost to sell is lower than the carrying value of asset on the date of classification the difference will be impairment loss.The asset classified as held for sale is not depreciated after being classified as held for sale.The asset will be presented separately from other assets, as a separate line item in the statement of financial position under current assets at GHS24,000.