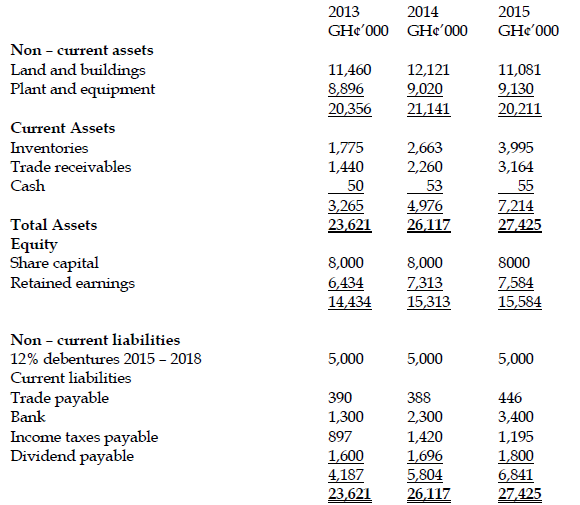

ANN Co is considering acquiring an interest in its competitor IB Co LTD. The managing director of ANN Co has obtained the three most recent statements of financial position of IB Co Ltd as shown below.

IB CO Ltd- Statement of financial position at 31st December.

Required:

Prepare a report for the managing director of ANN Co. commenting on the financial position of IB Co Ltd. and highlight any areas that require further investigation (using gearing and liquidity ratios only). (15 marks)

View Solution

To : MD of ANN Co

From : Accountant

Date : XX.XX.XX

Subject : The financial position of IB Co LTD

Introduction

This report has been prepared on the basis of the three most recent income statements and balance sheets of IB Co Ltd covering the years 2013 to 2015 inclusive. Ratio analysis used in this report is based on the calculations shown in the appendix attached.

Debt and liquidity

The debt ratio measures the ratio of a company’s interest bearing debt finance to its equity finance (shareholders’ funds). Although we have no information as to the norm for the industry as a whole, the debt ratios appear reasonable. However, it should be noted that it has risen substantially over the three year period.

When reviewing IB Co’s liquidity the situation has improved over the period. The current ratio measures a company’s ability to meet its current liabilities out of current assets. A ratio at least 1 should therefore be expected IB Co Ltd did not meet this expectation in 2013 and 2014.

This ratio can be misleading, as inventory is included in current assets. Because inventory can take some time to convert into liquid assets a second ratio, the quick ratio, is calculated which excludes inventories. As can be seen, the quick ratio, although improving, is low and this shows that current liabilities cannot be met from current assets if inventories are excluded. As a major part of current liabilities is the bank overdraft, the company is obviously relying on the bank’s continuing support with both short and long-term funding. It would be useful to find out the terms of the bank funding and the projected cash flow requirements for future funding.

Conclusion

The review of the three year financial statements for IB Co Ltd has given rise to a number of queries which need to be resolved before a useful conclusion can be reached on the financial position of IB Co Ltd. It may also be useful to compare IB Co’s ratios to those of other companies in the same industry in order to obtain some idea of the industry norms.

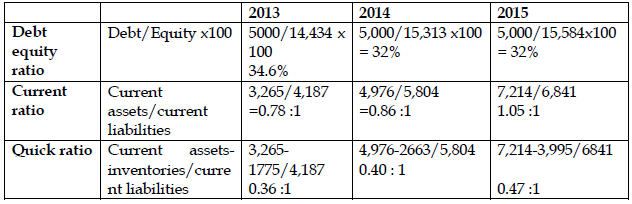

Workings-Calculation of relevant ratios: