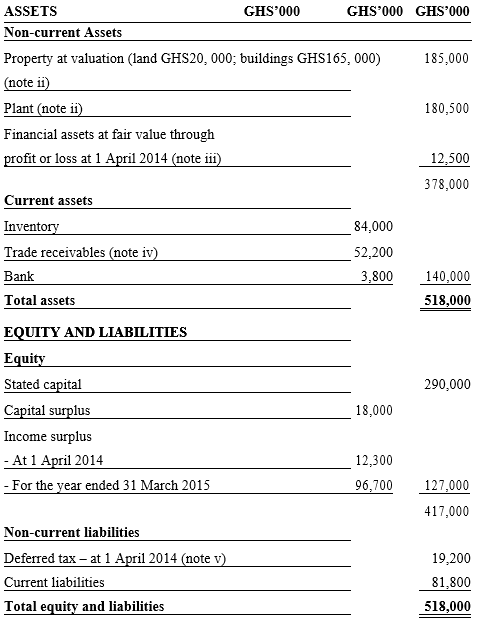

Below is the summarised draft statement of financial position of DX Ltd, a company listed on the Ghana Stock Exchange, as at 31 March, 2015:

The following information is relevant:

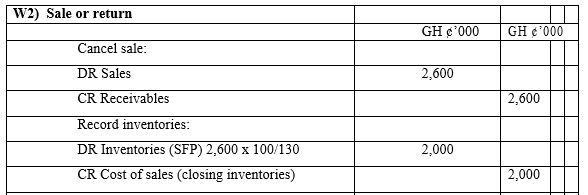

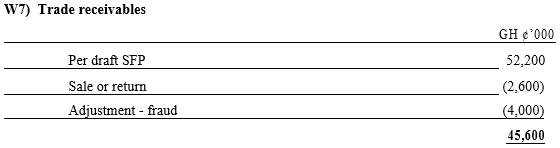

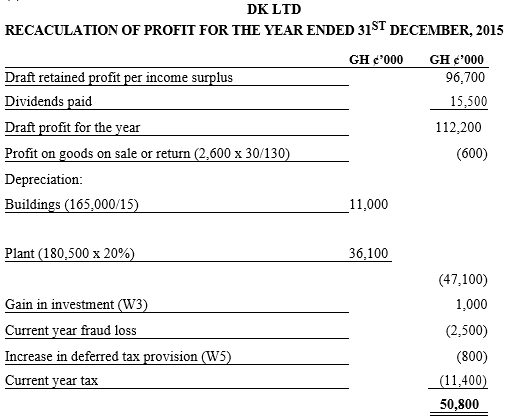

(i) DX Ltd’s statement of profit or loss includes GHS8million of revenue for credit sales made on a ‘sale or return’ basis. At 31 March 2015, customers who had not paid for the goods, had the right to return GHS2.6million of them. DX Ltd applied a mark-up on cost of 30% on all these sales. In the past, DX Ltd’s customers have sometimes returned goods under this type of agreement.

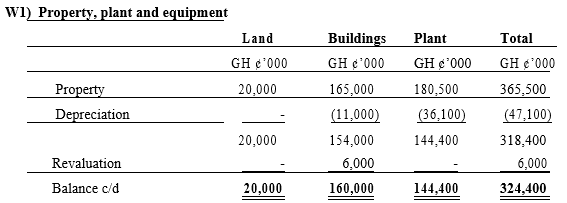

(ii) The non-current assets have not been depreciated for the year ended 31 March 2015.

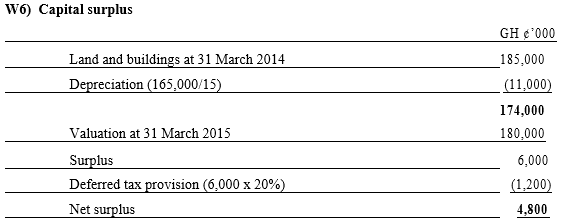

DX Ltd has a policy of revaluing its land and buildings at the end of each accounting year. The values in the above statement of financial position as at 1 April 2014 when the building had a remaining life of 15 years. A qualified surveyor has valued the land and buildings at 31 March 2015 at GHS180million.

Plant is depreciated at 20% on the reducing balance basis.

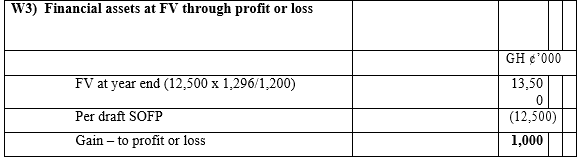

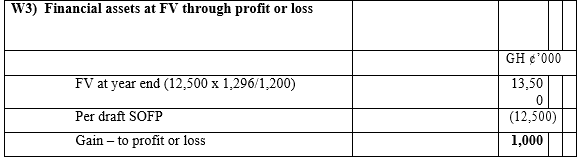

(iii) The financial assets at fair value through profit or loss are held in a fund whose value changes directly in proportion to a specified market index. At 1 April 2014 the relevant index was 1,200 and at 31 March 2015 it was 1,296.

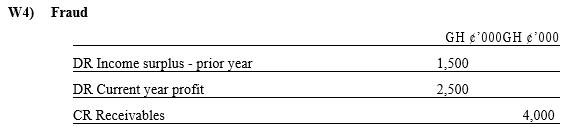

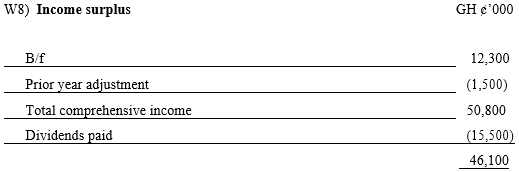

(iv) In late March 2015 the directors of DX Ltd discovered a material fraud perpetrated by the company’s credit controller that had been continuing for some time. Investigations revealed that a total of GHS4million of the trade receivables as shown in the statement of financial position at 31 March 2015 had in fact been paid and the money had been stolen by the credit controller. An analysis revealed that GHS1.5million had been stolen in the year to 31 March 2014 with the rest being stolen in the current year. DX Ltd is not insured for this loss and it cannot be recovered from the credit controller, nor is it deductible for tax purpose.

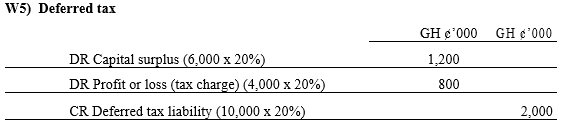

(v) During the year, the company’s taxable temporary differences increased by GHS10miiion of which GHS6million related to the revaluation of the property. The deferred tax relating to the remainder of the increase in the temporary differences should be taken to profit and loss. The applicable income tax rate is 20%.

(vi) The above figures do not include the estimated provision for income tax on the profit for the year ended 31 March 2015. After allowing for any adjustments required in terms (i) to (iv), the directors have estimated the provision of GHS11.4million (this is in addition to the deferred tax effects of item (v).

(vii) During the year, dividends of GHS15.5million were paid. These have been correctly accounted for in the above statement of financial position.

Required:

Taking into account any adjustments required by items (i) to (vii) above:

(Notes to the financial statements are not required).

(a) Prepare a statement showing the recalculation of DX Ltd’s profit for the year ended 31 March 2015; and (7 marks)

View Solution

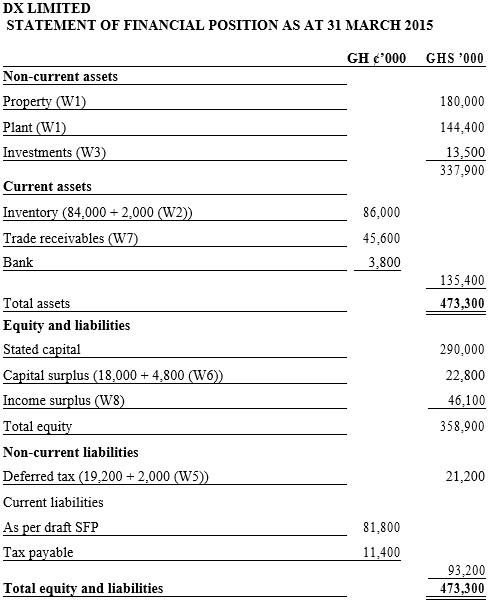

(b) Redraft the statement of financial position of DX Ltd as at 31 March 2015. (13 marks)

View Solution