You have received a prize amount of GH¢5,000 and you wish to invest it for five years. The two alternatives are to use a bank account where the 14% per annum gross rate is compounded monthly or a savings fund where the 14.5% per annum gross rate is compounded annually.

Required:

i) Calculate the size of each fund at the end of the five years. (Ignore tax considerations). (8 marks)

View Solution

14% a year compounded monthly

After five years, there will have been 60 interest payments.

Fund = 5,000(1+ 14/1,200)60 = GH₵10,028.05

14.5% a year compounded annually

After five years, there will have been five interest payments.

Fund = 5,000(1+14.5/100)5 = GH₵9,840.05

ii) Calculate the effective annual interest rate of the bank account investment. (4 marks)

View Solution

14% a year compounded monthly

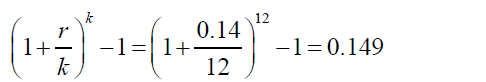

After one year, GH₵1 would become GH₵1+(1+14/1,200)12 + GH₵1.149, so the effective annual interest rate is 14.9%.

iii) Advise your client on the basis of your calculations. (2 marks)

View Solution

The return on the bank account investment (14.9%) exceeds the return on the savings fund (14.5%), so other things being equal the bank account investment is better.

Alternatively: