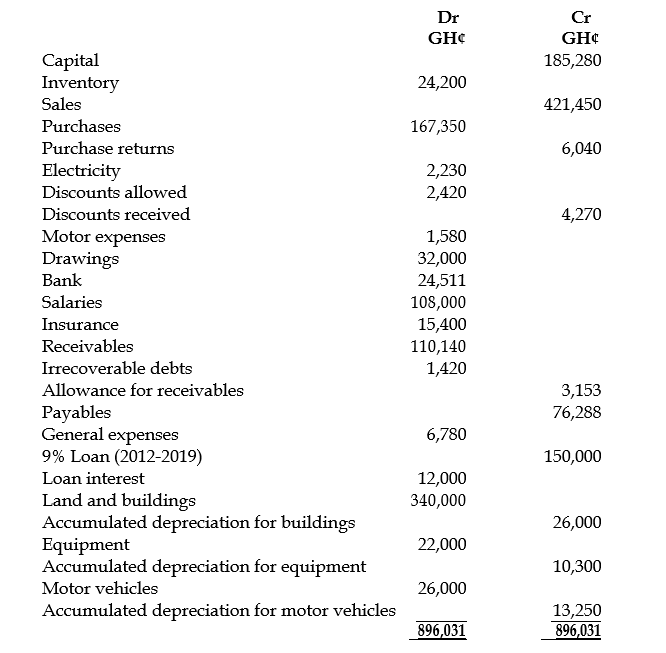

Asomdwee Enterprise is run by a sole trader. The following Trial Balance was prepared from the business accounts on 30th September 2015.

The following information is also available.

i) Only 10 months’ salaries are shown in the Trial Balance. An equal amount is paid for salaries for each month of the year.

ii) As at 30th September 2015, GH¢3,200 had been prepaid for insurance, whilst GH¢410 was owing for general expenses.

iii) GH¢4,600 had been charged to general expenses for the owner’s private holiday.

iv) As at 30th September 2015, inventory was valued at GH¢22,500.

v) A customer, owing GH¢5,040 has been declared bankrupt. This amount is to be written off in full.

vi) An allowance for receivables is to be maintained at 3% of the remaining receivables.

vii) As at 30th September 2015, the business’s land was valued at GH¢100,000. Land is not depreciated.

viii) Depreciation is to be provided as follows:

- Buildings: 4% per annum using the straight line method.

- Equipment: 25% per annum using the straight line method.

- Motor vehicles: 40% per annum using the reducing balance method.

ix) There were no additions or disposals of non-current assets during the financial year.

Required:

i) Identify the accounting concept involved in each of the footnotes/items (i), (iii) and (v). (3 marks)

ii) Explain the correct accounting treatment in each case. (3 marks)

View Solution

Item (i): Accruals/Matching concept : The matching of receipts and payments within an accounting period . Adjustments have to be made regarding early and late transactions both at the start and at the end of the accounting period . GHS21,600 of unpaid salaries has to be accrued in order to get the correct value of salaries expenses for the financial year.

Item (iii): Business Entity concept: Only the transactions of the business should be recorded in the accounts of the business. The owner’s private holiday is not a business expense and must be shown as drawings which reduces the amount of capital the owner has invested in the business.

Item (v): The Prudence concept requires a business to understate, rather than overstate, profit. Writing off an irrecoverable debt is an example of this, as this will increase expenses and thus reduce net profit. This action will also reduce the value receivables and hence current assets in the statement of financial position