Atta Moses is a trader who prepares account to 31st December each year. The following transactions with regard to Assets have taken place.

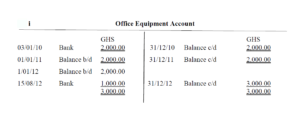

i. 3rd January, 2010 purchased one Office Equipment (Laptop) for GH¢2,000.

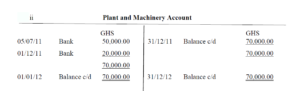

ii. 5th July, 2011 purchased Plant and Machinery costing GH¢50,000.

iii. 1st December, 2011 purchased Plant and Machinery for GH¢20,000

iv. 15th December, 2012 bought Office Equipment (Printer) for GH¢1,000.

Mr. Atta maintains its Fixed Assets at cost and depreciates its Asset at a constant rate of 20% using the straight line method of providing for depreciation for all Assets. Assets purchased attract full depreciation charge in the year of purchase, whilst any asset disposed off attracts no depreciation charge.

You are required to prepare the following: (6 marks)

i. Office Equipment Account.

View Solution

ii. Plant and machinery Account.

View Solution

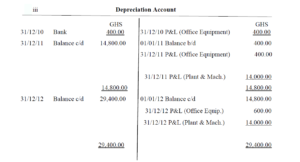

iii. Provision for Depreciation Account.

View Solution