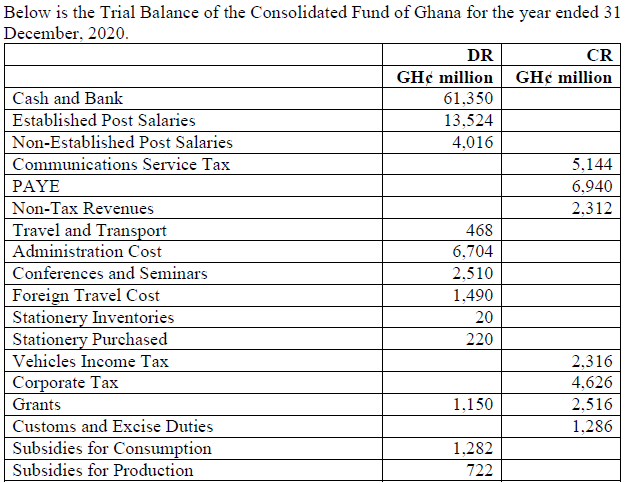

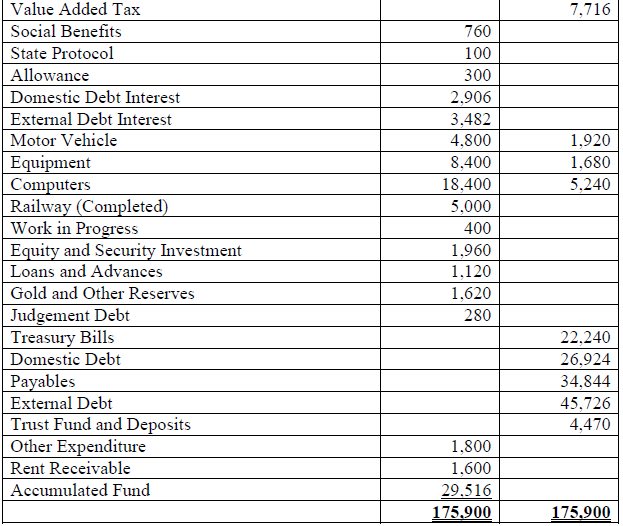

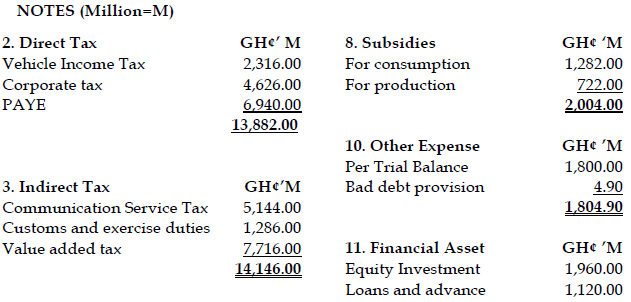

Additional information:

i) It is the policy of Controller and Accountant General to use Accrual Basis of Accounting in preparing the Public Accounts of the Consolidated Fund financial statements in compliance with Public Financial Management Act, 2016 (Act 921), Public Financial Management Regulation 2019 L.I 2378 and the International Public Sector Accounting Standards (IPSAS).

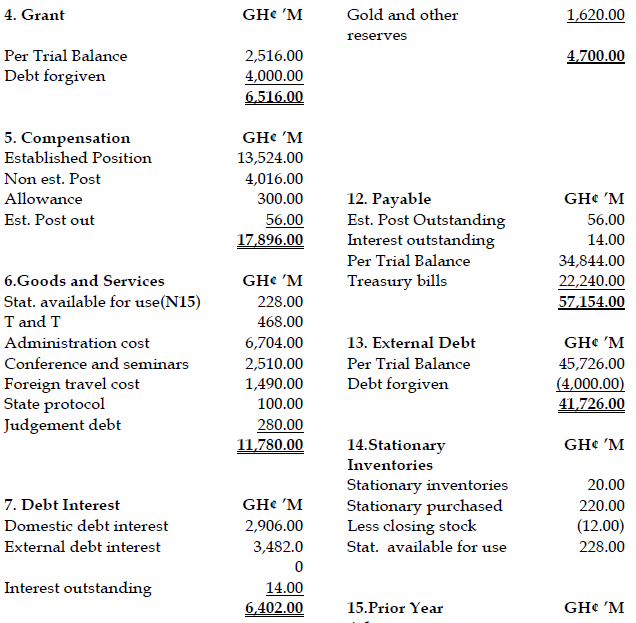

ii) Inventory in respect of stationery outstanding as at 31 December, 2020 cost GH¢18 million and has a current Replacement Cost of GH¢12 million. Meanwhile, the Net Realisable value of the Inventories is estimated at GH¢14 million. No market exists for unused inventories.

iii) An Established Post Salary in arrears as a result of salary increment in the fourth quarter of 2020 was GH¢56 million and Public Debt Interest outstanding as at 31 December, 2020 amounts to GH¢ 14 million.

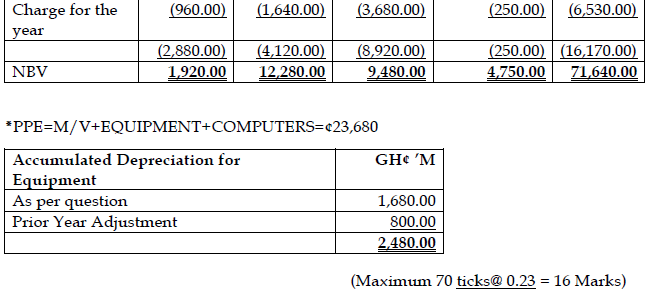

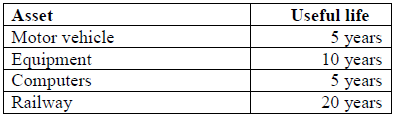

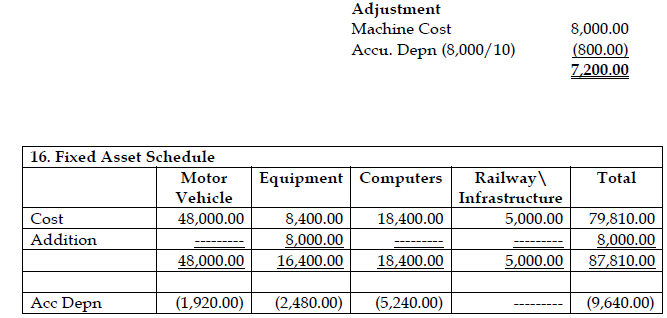

iv) Consumption of Fixed Capital is charged on Straight Line Basis for the year as follows:

v) The Multilateral Partners have extended their Debt Forgiveness policy to the Government which has resulted in the External Debt write off amounting to GH¢4 billion in the year. However, this transaction has not been accounted for in the books.

vi) In the year 2019, GH¢8 billion was spent in acquiring Equipment to boast Government project, however, these transactions were recognised in the accounts as Goods and Services Expenditure in the year 2019. This error has since not been rectified.

Required:

Prepare in a form suitable for publication and in accordance with the relevant Financial Laws and IPSAS:

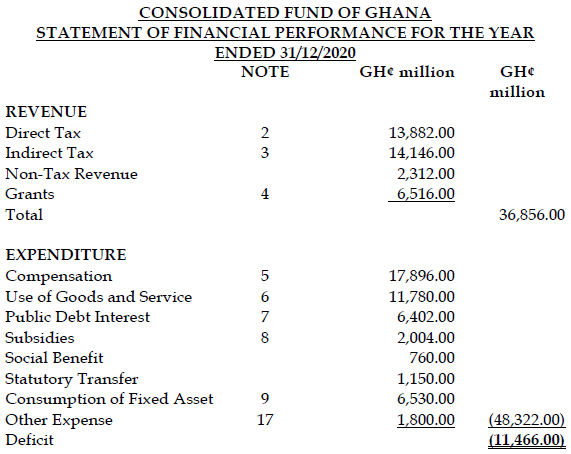

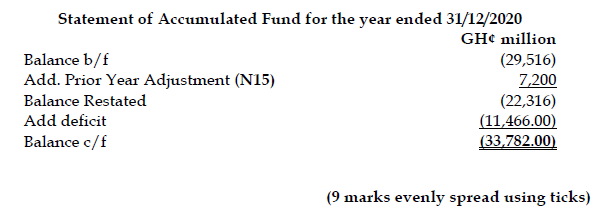

a) Statement of Financial Performance for the year ended 31 December 2020. (9 marks)

View Solution

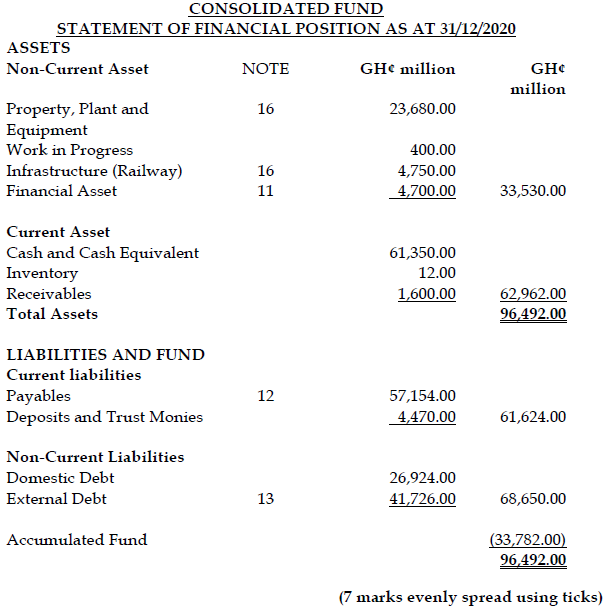

b) Statement of Financial Position as at 31 December, 2020. (7 marks)

View Solution

View Notes Here

.