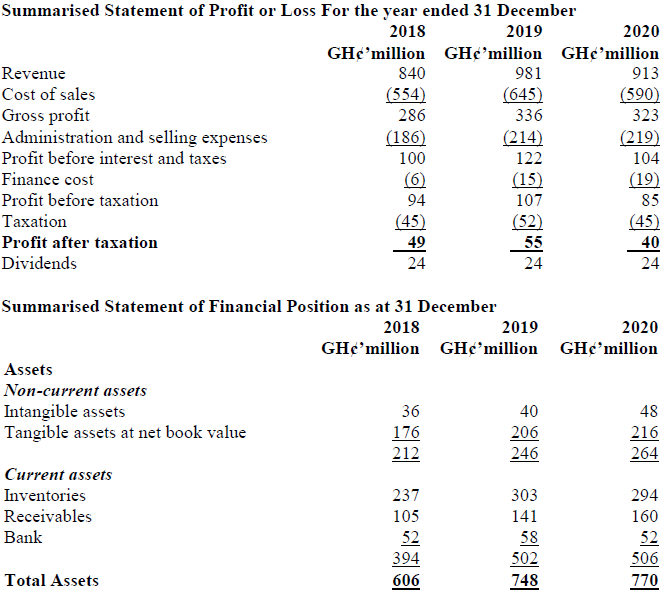

You are the Financial Controller of Konka Ltd. Zeus Ltd is a competitor in the same industry, and it has been operating for 20 years. Summaries of Zeus Ltd’s statements of profit or loss and financial position for the previous three years are given below.

Required:

Write a report to the Chief Executive Officer of Konka Ltd:

a) Analysing the performance and position of Zeus Ltd and showing any calculations in an appendix to this report. (15 marks)

View Solution

To : Chief Executive Officer

From : Management accountant

Subject : Performance Analysis of Konka Ltd from 2018 to 2020

Introduction

This performance report relates to the financial statements of Konka Ltd for the period 2018 to 2020. The report covers the profitability, operating efficiency, liquidity and solvency positions of Konka Ltd over the period under review. An appendix is attached to this report which shows the ratios calculated as part of the performance review.

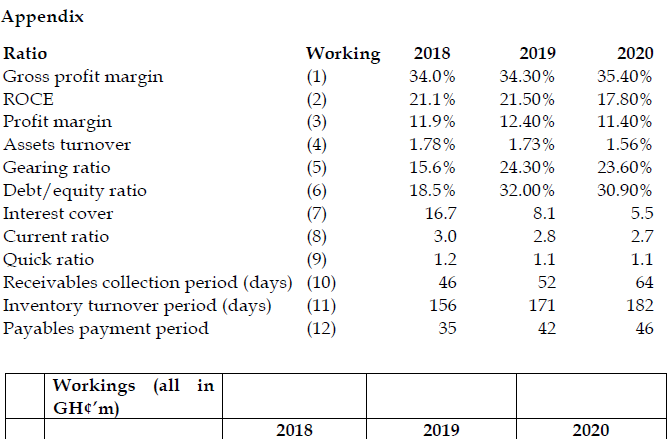

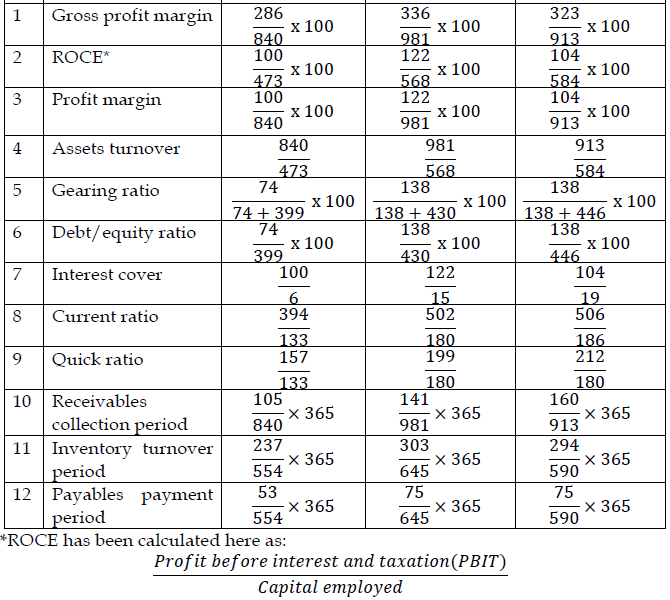

Profitability

The gross profit margin has remained relatively static over the three years, although it rose by approximately 1% in 2018. ROCE, while improving very slightly in 2019 to 21.5%, has dropped dramatically in 2020 to 17.8%. The net profit margin has also fallen in 2020, despite the improvement in the gross profit margin. This marks a rise in expenses which suggests that they are not well controlled. The utilisation of assets compared to the turnover generated has also declined, reflecting the drop in trading activity between 2019 and 2020.

Operating Efficiency

It is apparent that there was a dramatic increase in trading activity between 2019 and 2020, but then a significant fall in 2020. As a result, revenue rose by 17% in 2019 but fell by 7% in 2020. The reasons for this fluctuation are unclear. It may be the effect of some kind of one-off event, or it may be the effect of a change in product mix. Whatever the reason, it appears that improved credit terms granted to customers (receivables payment period up from 46 to 64 days) have not stopped the drop in sales.

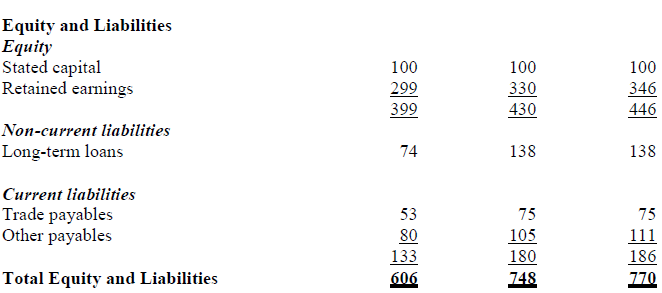

Liquidity

Both the current ratio and quick ratio demonstrate an adequate working capital situation, although the quick ratio showed a slight decline. This is because there has been an increased investment over the period in inventories and receivables, which has been only partly financed by longer payment periods to trade payables and a rise in other payables (mainly between 2019 and 2020).

Solvency

The level of gearing of the company increased when a further GH¢64 million was raised in long-term loans in 2020 to add to the GH¢74 million already in the statement of financial position. Although this does not seem to be a particularly high level of gearing, the debt/equity ratio rose from 18.5% to 32.0% in 2020. The interest charge has increased to GH¢19 million from GH¢6 million in 2019. The 2020 charge was GH¢15 million, suggesting that either the interest rate on loan is flexible or that the full interest charge was not incurred in 2020. The new long-term loan appears to have funded the expansion in both fixed and current assets in 2020.

Capital employed = shareholders’ funds plus payables falling due after one year and any long-term provision for liabilities and charges. It is possible to calculate ROCE using net profit after taxation and interest, but this admits variations and distortions into the ratios which are not affected by operational activity.

2 marks for the structure of the report = 2 marks

2 marks for analysis of performance x 4 areas covered = 8 marks

4 marks for Appendix (12 ratios computed: 4 ratios x 3 years) = 4 marks

1 mark for the orderly presentation of computation of ratios = 1 mark

b) Summarising FIVE (5) areas that require further investigation, including reference to other pieces of information which would complement your analysis of the performance of Zeus Ltd. (5 marks)

View Solution

i) Long-term loan: There is no indication of why this loan was raised and how it was used to finance the business. Further details are needed of interest rate(s), security is given and repayment dates.

ii) Trading activity: The level of sales has fluctuated in quite a strange way, requiring further investigation and explanation. Factors to consider would include pricing policies, product mix, market share and any unique occurrence which would affect sales.

iii) Further analysis: It would be useful to break down some of the information in the financial statements, perhaps into a management accounting format. Examples would include the following.

- Sales by segment, market or geographical area

- Cost of sales split into raw materials, labour and overheads

- Inventory broken down into raw materials, work in progress and finished goods

- Expenses analysed between administrative costs, sales and distribution costs.

iv) Accounting policies: Accounting policies may have a significant effect on certain items. In particular, it would be useful to know what the accounting policies are in relation to intangible assets (and what these assets consist of) and whether there has been any change in accounting policies.

v) Dividend policy: Konka Ltd has maintained the dividend payments to shareholders during the three years. Presumably, Konka Ltd would have been able to reduce the amount of long-term debt taken on if it had retained part or all of the dividend during this period. It would be interesting to examine the share price movement during the period and calculate the dividend cover.