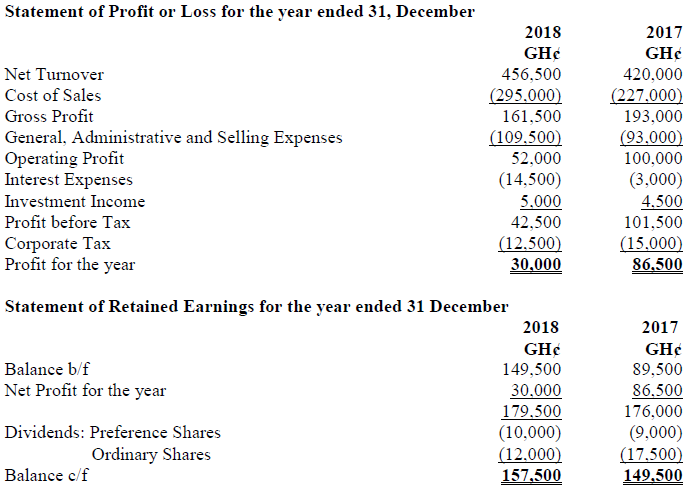

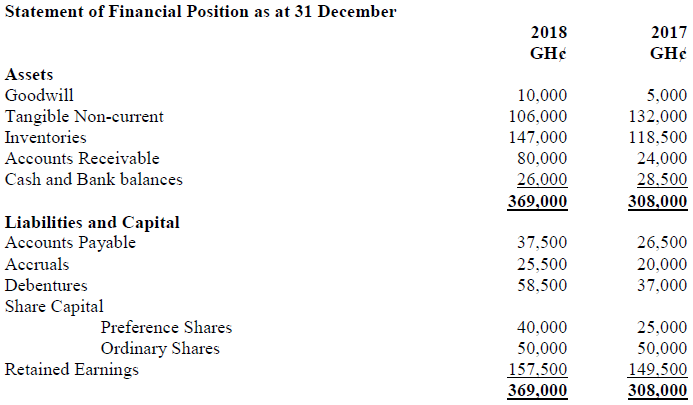

As a newly employed Accountant of Spring Ltd, you have been presented with the following financial statements:

Required:

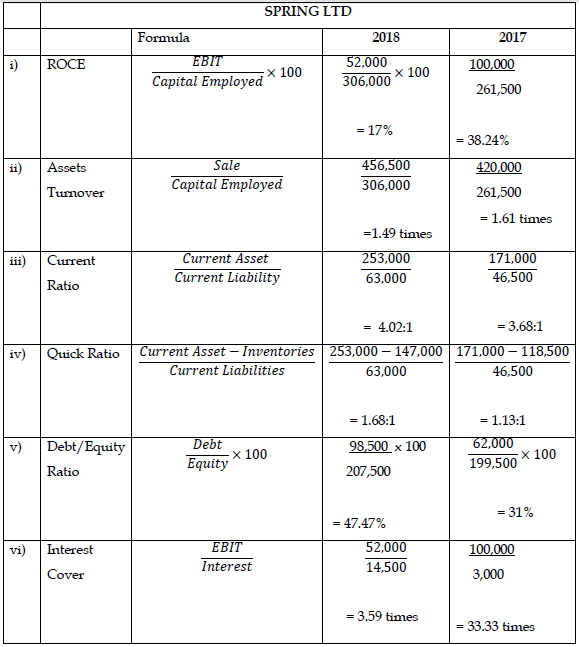

a) Compute, for the two years, the following ratios:

i) Return on Capital Employed

ii) Assets Turnover

iii) Current Ratio

iv) Quick Ratio

v) Debt/Equity Ratio

vi) Interest Cover (6 marks)

View Solution

b) Write a report to the Finance Director commenting on the financial performance and position of the company. (10 marks)

View Solution

Report

To: Financial Director

From: Accountant

Date: 1 November 2019

Subject: Financial Performance and Position of Peace Ltd

Following the discussions on the above subject, I wish to submit this report for your study and consideration.

Financial Performance

The financial performance of the entity is measured in terms of its profitability in relation to resources deployed during the period. Over the two years, the profit level has declined, using return on capital as a measure. ROCE compares the returns earned for a period to the net assets or capital employed used in generating that returns. There was a decline in ROCE from 38.24% for 2017 to 17% in 2018. This shows that management was not able to utilize assets more efficiently to generate higher returns.

Assets turnover which is the revenue per cedi of long-term capital used declined marginally from 1.61 times in 2017 to 1.49 times in 2018. This means that management ability to regenerate revenue for every one cedi of capital used declined in 2018.

Financial Position

The financial position of the firm is measured in terms of the short-term liquidity and long-term solvency position of the firm. In terms of liquidity, there has been an improvement in the company’s ability to settle its current liabilities from its current assets from 3.68:1 (2017) to 4.02:1 (2018). Over the period the company has more equity than prior charged capital. But the proportion of capital to prior charged capital has increased from 31% (2017) to 47.47% (2018).

Conclusion

Generally, the company has experienced declining trends in its performance with the exception of liquidity.

Signed

Accountant

c) Earnings per share is a financial ratio, and it’s usually the first ratio investors look at when analyzing a company. Although earnings per share is a very popular performance measurement tool, it is not without its drawback and limitations.

Required:

Identify FOUR (4) limitations of Earnings per share. (4 marks)

View Solution

- Management knows investors rely on using EPS as a guidance for company performance so they’ll naturally want the EPS figure to appear as high as possible in the short term. They may make decisions to maximise the EPS figure in the short term, which may damage the entity’s prospects in the long term.

- EPS also doesn’t consider cash flow. Management may focus so much on increasing the earnings figure, they start selling to bad customers who don’t pay or sell at lower margins. If the company can’t earn cash to pay its bills, no matter how large the earnings are, it may be insolvent.

- EPS also ignores inflation, the price of goods and services generally may be increasing, so this could be contributing to the good EPS figure, but this growth might be misleading if the company can’t buy as many goods this year as it could last year.

- Also, each company has different accounting policies; this makes it harder to compare individual companies on a like for like basis.

(1 mark for each limitation well explained x 4 limitations = 4 marks)