Adenta Ltd (Adenta) assembles telecommunication equipment and sells to wholesalers and retailers. The following ratios relate to the average figures for Adenta’s industry for the year ended 31 December, 2018:

Return on capital employed 20.10%

Gross profit margin 32%

Net profit (before tax) margin 12.50%

Current ratio 1.6:1

Acid-test ratio 0.9:1

Inventory turnover period 46 days

Trade receivable collection period 45 days

Debt-to-equity ratio 40%

Dividend yield 6%

Dividend cover 3 times

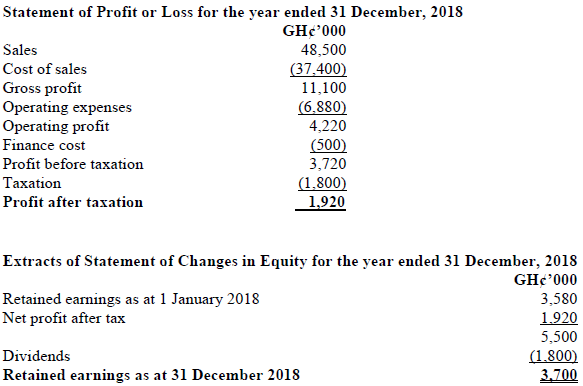

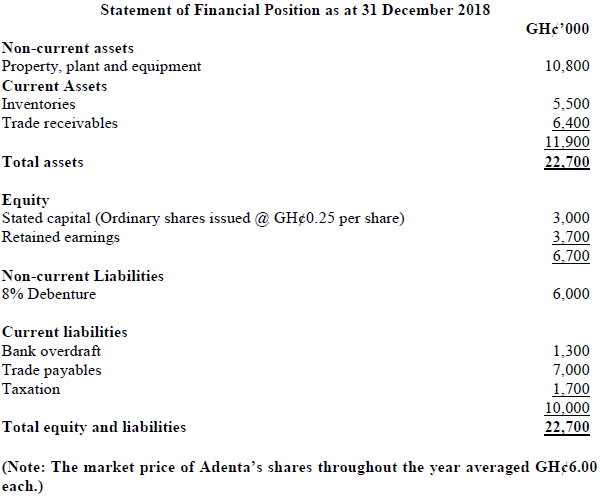

Adenta’s financial statements for the year to 31 December, 2018 are set out below:

Required:

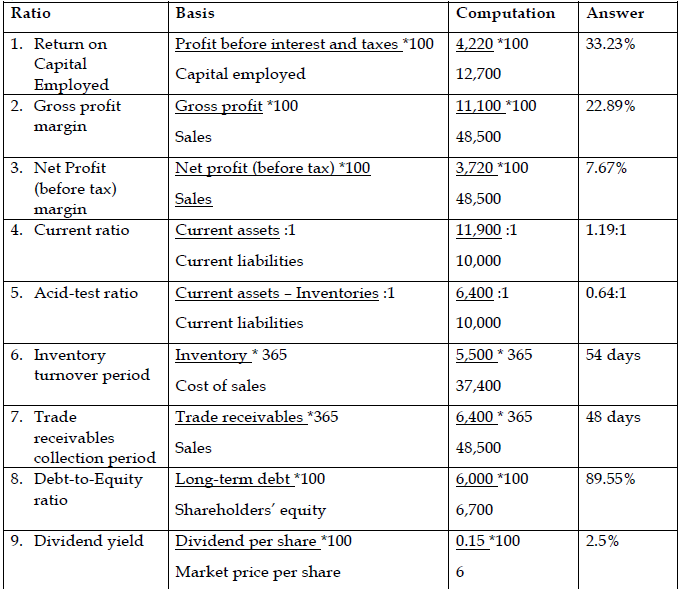

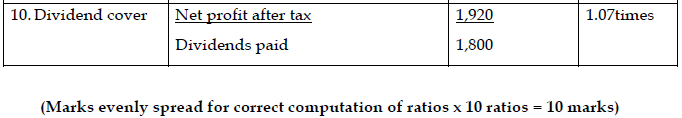

a) Calculate the ratios for Adenta Ltd equivalent to the industry averages. (10 marks)

View Solution

b) As the Financial Controller of Adenta Ltd, write a report to the Board of Directors analysing the financial performance of Adenta Ltd based on a comparison with the industry averages. (10 marks)

View Solution

Report to the Board of Directors

To: The Board

From: Financial Controller

Date: 1 November, 2019

Subject: Analysis of Adenta Limited’s financial performance compared to industry average for the year to 31 December, 2018.

Introduction

This report present an analysis of the financial performance of Adenta Ltd compared to the industry averages.

Profitability

The return on capital employed of Adenta is impressive being higher than the industry average. The company is employing its assets more efficiently and effectively in generating more revenue and hence income. However, gross profit margin and net profit margin of Adenta are comparatively lower than the industry averages. This implies that the company is incurring more costs in generating its revenue.

Liquidity

Adenta Ltd’s current and quick ratios are much worse than the industry average, and indeed far below expected norms. Current liquidity problems appear due to high levels of trade payables and a high bank overdraft. The high level of inventories constitutes to the poor acid test ratio and may be indicative of further obsolete inventories. The trade receivables’ collection figure is reasonable compared to the industry average.

Gearing

Adenta Ltd’s gearing is more than twice the level of the industry average. The company is making an overall return of 33.23% but only paying 8% interest on its loans notes. The gearing level may become a serious issue if Adenta becomes unable to maintain the finance costs. The company already has an overdraft and the ability to make further interest payments could be in doubt.

Investment Ratios

Despite reasonable profitability figures, Adenta’s dividend yield is poor compared to the sector average. From the extracts of the changes in equity it can be seen that total dividends are GH¢1.8 million out of available profit for the year of only GH¢1.92 million, hence the very low dividend cover, compared to the industry average.

Conclusion

The company compares favourably with the industry average figures for profitability, however, the company’s liquidity and gearing position is quite poor and gives cause for concern.

Signed

Financial Controller

(2 marks for the structure of the report = 2 marks)

(8 marks for analysis of performance = 8 marks)