Badu Trading Ltd has prepared the following draft financial statements for your review.

Additional information:

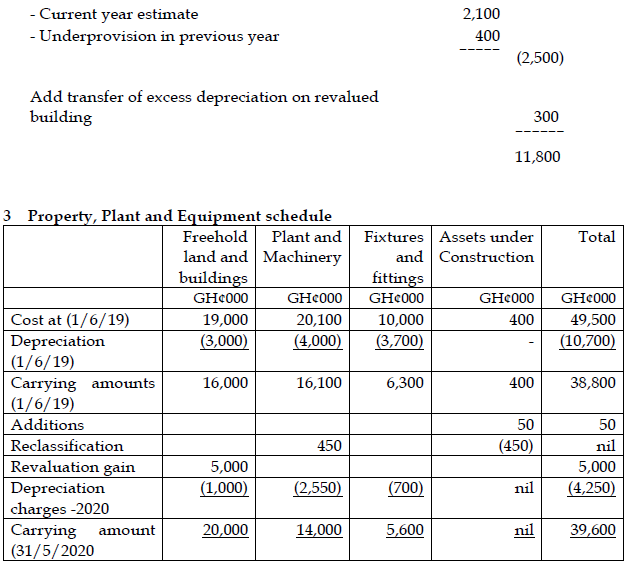

i) Income tax of GH¢2.1 million is yet to be provided for on profit for the current year. An unpaid under-provision for the previous year’s liability of GH¢400,000 has been identified on 5 June 2020 and has not been reflected in the draft accounts.

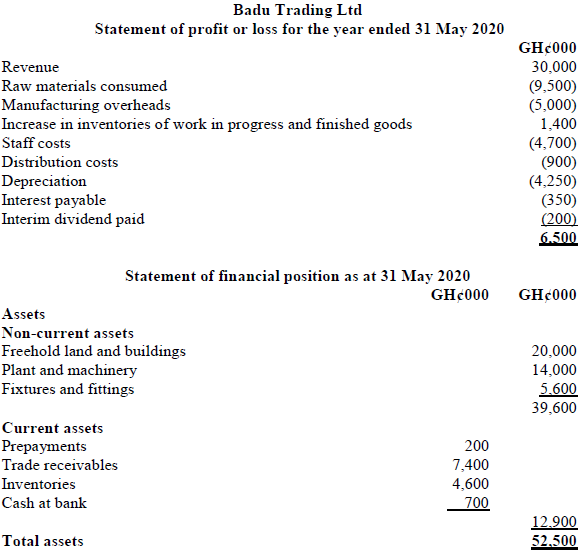

ii) There have been no additions to, or disposals of, non-current assets in the year but the assets under construction have been completed in the year at an additional cost of GH¢50,000. These relate to plant and machinery.

The cost and accumulated depreciation of non-current assets as at 1 June 2019 were as follows:

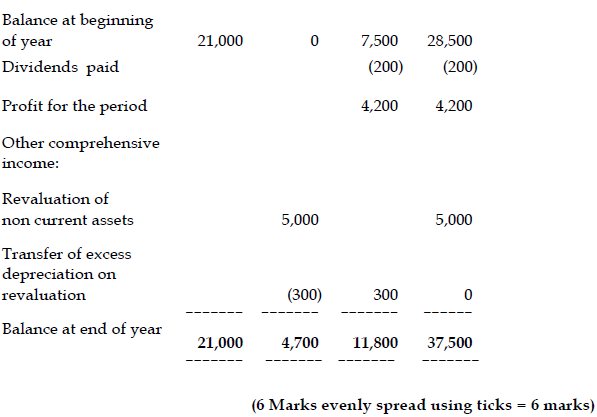

iii) There was a revaluation of land and buildings during the year, creating the revaluation reserve of GH¢5 million (land element GH¢1 million). The effect on depreciation has been to increase the buildings charge by GH¢300,000. Badu Trading Ltd adopts a policy of transferring the revaluation surplus included in equity to retained earnings as it is realised.

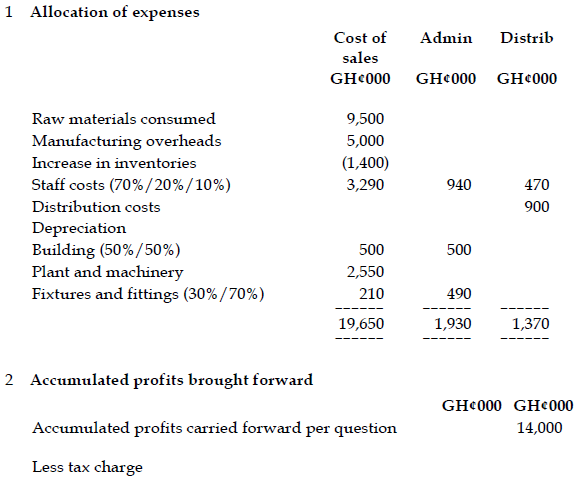

iv) Staff costs comprise 70% factory staff, 20% general office staff and 10% goods delivery staff.

v) An analysis of depreciation charge shows the following:

. GH¢000

Buildings (50% production, 50% administration) 1,000

Plant and machinery 2,550

Fixtures and fittings (30% production, 70% administration) 700

Required:

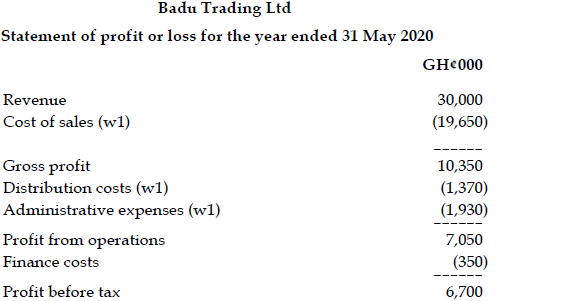

Prepare the following information in a form suitable for publication for Badu Trading Ltd’s financial statements for the year ended 31 May 2020.

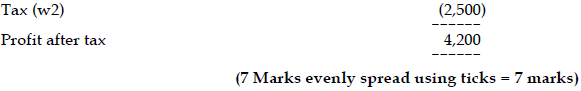

a) Statement of profit or loss (7 marks)

View Solution

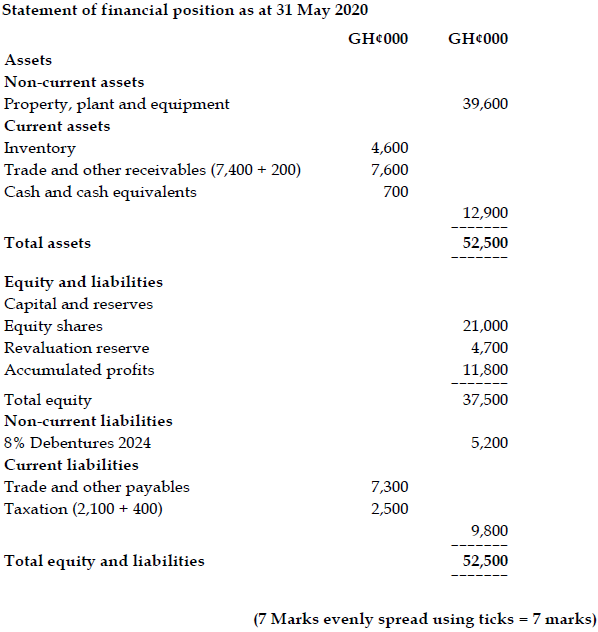

b) Statement of financial position (7 marks)

View Solution

c) Statement of changes in equity (6 marks)

View Solution

View All Workings