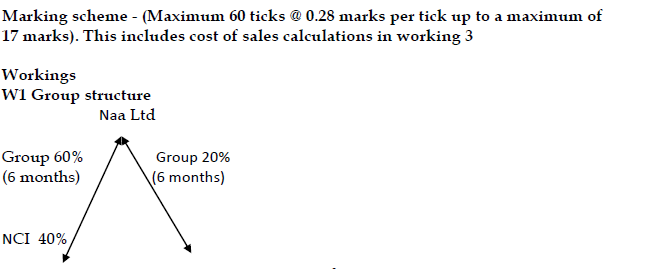

Naa Ltd on April 1, 2019 acquired 60% of the 75 million equity shares of Shormeh Ltd. The acquisition was achieved through a share exchange transaction of one share in Naa Ltd for every three shares in Shormeh Ltd. At the acquisition date, the share prices of both Naa Ltd and Shormeh Ltd were GH¢4 and GH¢2.50 each respectively. In addition, Naa Ltd will pay GH¢1.54 cash on March 31, 2020 for each share acquired. The cost of capital of Naa Ltd is 10% per annum.

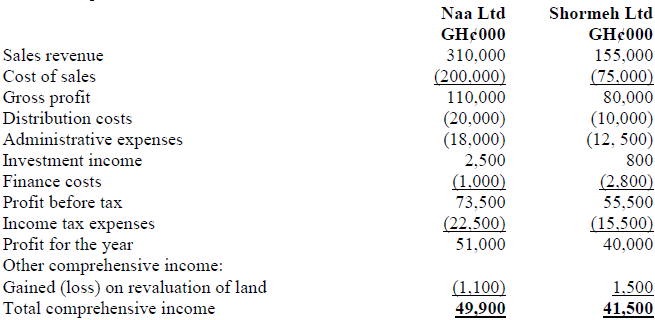

Statements of profit or loss and other comprehensive income for the companies for the year ended 30 September 2019 are stated below:

Additional relevant information:

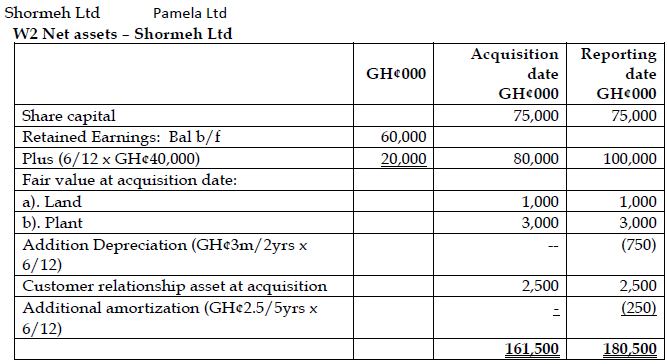

i) On April 1, 2019, a fair value exercise was conducted and concluded that the carrying amounts of Shormeh Ltd’s net assets were equal to their fair values with the exception of the following:

- The fair value of Shormeh Ltd land was GH¢1 million in excess of its carrying amount.

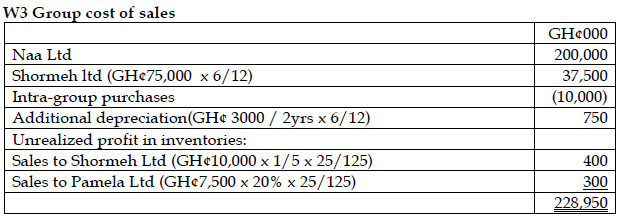

- An item of plant had a fair value of GH¢3 million in excess of its carrying amount. The plant had a remaining useful life of two years at the date of acquisition. Plant depreciation is charged to cost of sales.

ii) At acquisition date, Naa Ltd placed GH¢2.5 million on Shormeh Ltd’s good trading relationship with its customers. Naa Ltd expects that this customer relationship will last for a further 5-years. Amortisation of intangible assets is charged to administrative expenses.

iii) The group policy of Naa Ltd is to value land to market value at the end of each accounting period. Before the acquisition, Shormeh Ltd land had been valued at historical cost, but it has adopted the group policy since its acquisition. In addition to the fair value increase in Shormeh Ltd land, it had increase by a further GH¢0.5 million since the acquisition.

iv) The successful completion of the acquisition resulted in the sale of goods from Naa Ltd to Shormeh Ltd valued at GH¢10 million. At 30 September 2019, Shormeh Ltd still held one fifth of these goods in inventory. Naa Ltd charged a markup of 25% on cost.

v) On April 1, 2019, Naa Ltd also purchased 20% of Pamela Ltd equity shares. Pamela Ltd profit after tax for the year ended 30 September 2019 was GH¢5 million and during September 2019 Pamela Ltd paid a dividend of GH¢3 million. However, Shormeh Ltd did not pay any dividends in the year ended 30 September 2019.

vi) In September 2019, Naa Ltd also sold goods to Pamela Ltd for an amount of GH¢7.5 million, all of which were still in inventory as at 30 September 2019. Naa Ltd charged 25% mark-up on cost.

vii) It is the group policy of Naa Ltd to value the non-controlling interest at the acquisition date at fair value. For the purpose of this, the share price at acquisition date is representative of the fair value of shares held by the non-controlling interest.

viii) The retained earnings of Shormeh Ltd brought forward to October 1, 2018 were GH¢60 million.

ix) All items of income and expenditure are deemed to accrue evenly throughout the period unless otherwise stated.

Required:

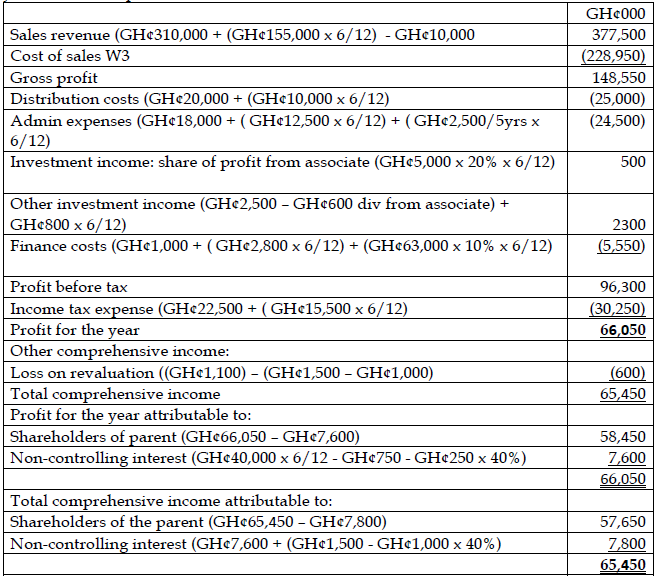

a) Prepare the consolidated statement of profit or loss and other comprehensive income for the year ended 30 September 2019. (17 marks)

View Solution

. Naa Ltd Group

Consolidated statement of profit or loss and other comprehensive income for the year ended 30 September 2019

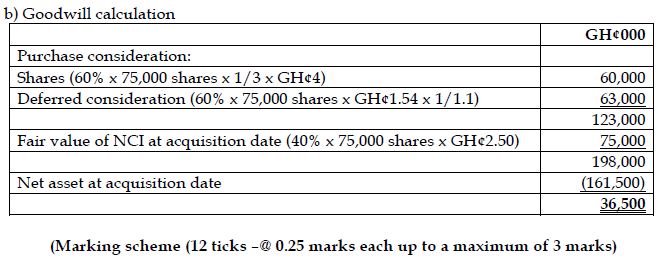

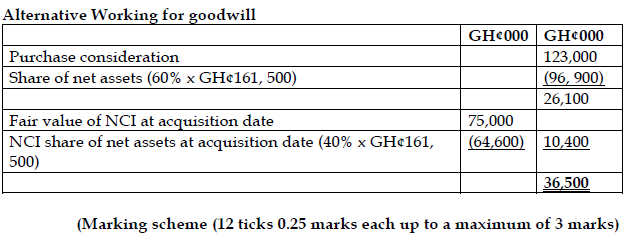

b) Calculate the consolidated goodwill that arose on the acquisition date. (3 marks)

View Solution