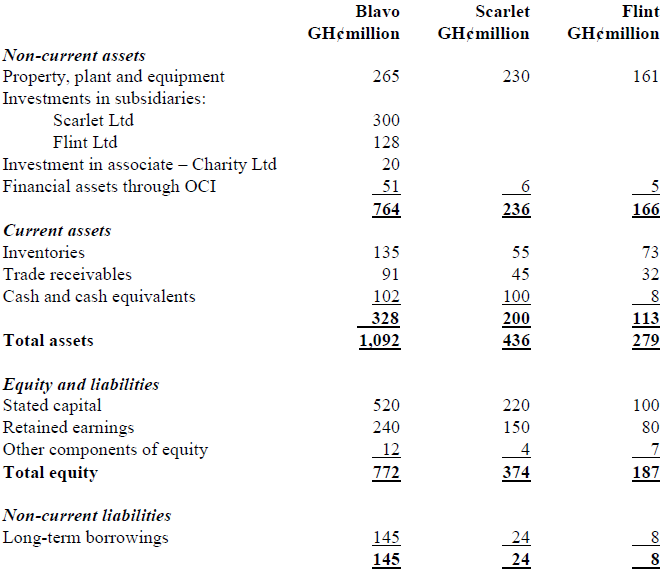

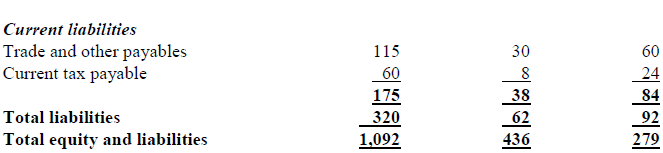

Blavo Ltd (Blavo), a government business entity has acquired two subsidiaries and an associate. The draft statement of financial position for each entity as at 31 May 2020 is as follows:

The following information is relevant to the preparation of the group financial statements:

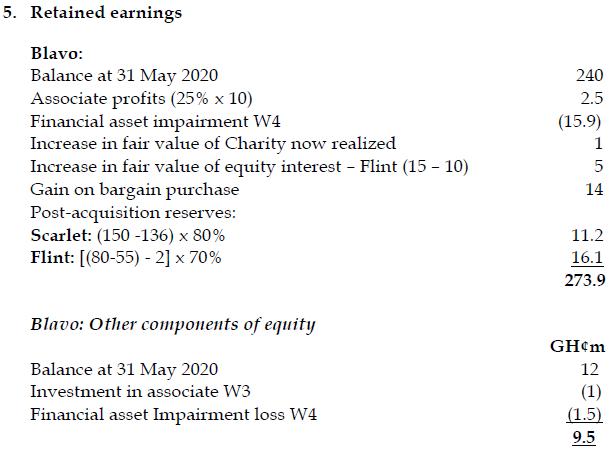

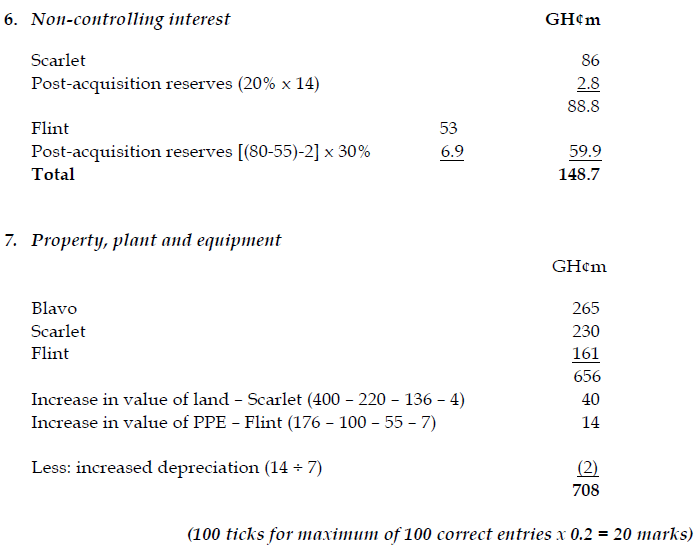

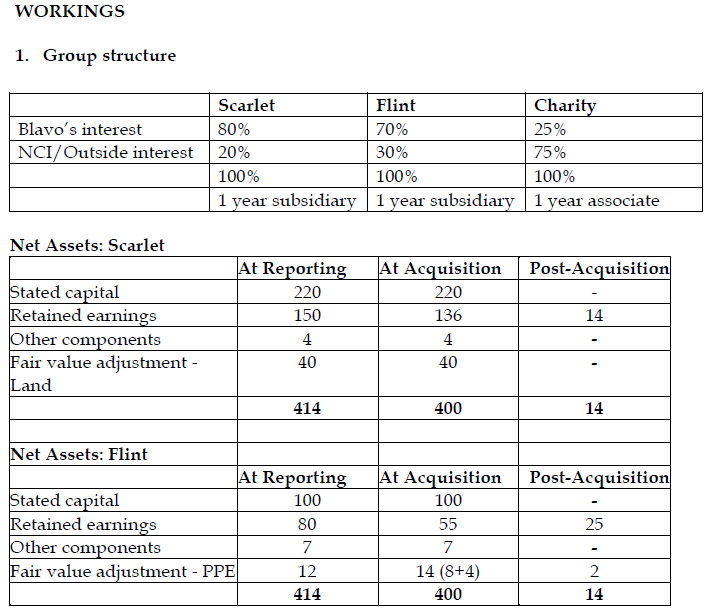

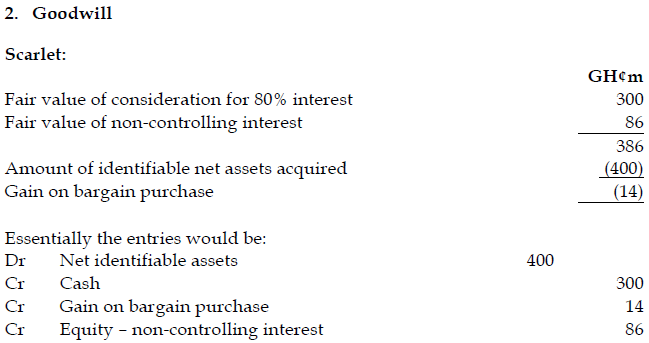

i) On 1 June 2019, Blavo acquired 80% of the equity interests of Scarlet Ltd (Scarlet), a private entity. The purchase consideration was cash of GH¢300 million. The fair value of the identifiable net assets of Scarlet was GH¢400 million, including any related deferred tax liability arising on acquisition. The owners of Scarlet had to dispose of the entity for tax purposes by a specified date and, therefore, sold the entity to the first company to bid for it, which was Blavo. An independent valuer has stated that the fair value of the non-controlling interest in Scarlet was GH¢86 million on 1 June 2019. Blavo does not wish to measure the non-controlling interest in subsidiaries based on the proportionate interest in the identifiable net assets but hopes to use the ‘full goodwill’ method. The retained earnings of Scarlet were GH¢136 million, and other components of equity were GH¢4 million at the date of acquisition. There had been no new issue of capital by Scarlet since the date of acquisition and the excess of the fair value of the net assets is due to an increase in the value of non-depreciable land.

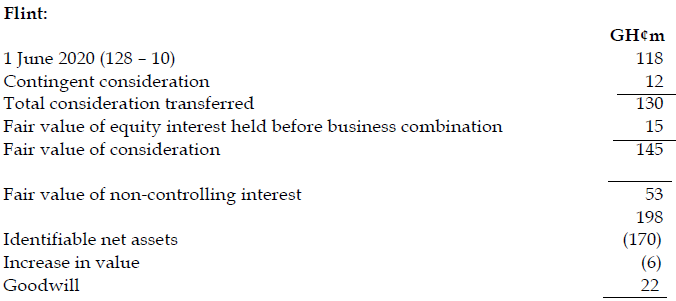

ii) On 1 June 2018, Blavo acquired 6% of the ordinary shares of Flint Ltd (Flint). Blavo had treated this investment as a financial asset through OCI in the financial statements to 31 May 2019 but had restated the investment at cost on Flint becoming a subsidiary. On 1 June 2019, Blavo acquired a further 64% of the ordinary shares of Flint and gained control of the company. The consideration for the acquisitions was as follows:

. Holding Consideration

. % GH¢’million

1 June 2018 6 10

1 June 2019 64 118

. 70 128

Under the purchase agreement, on 1 June 2019, Blavo is required to pay the former shareholders 30% of the profits of Flint on 31 May 2021 for each of the financial years to 31 May 2020 and 31 May 2021. The fair value of this arrangement was estimated at GH¢12 million on 1 June 2019, and on 31 May 2020, this value had not changed. This amount has not been included in the financial statements.

On 1 June 2019, the fair value of the equity interest in Flint held by Blavo before the business combination was GH¢15 million. The fair value of the non-controlling interest in Flint was GH¢53 million.

The fair value of the identifiable net assets at 1 June 2019 of Flint was GH¢170 million, and the retained earnings and other components of equity were GH¢55 million and GH¢7 million, respectively. There had been no new issue of share capital by Flint since the date of acquisition, and the excess of the fair value of the net assets is due to an increase in the value of property, plant and equipment (PPE). The fair value of the PPE was provisional pending receipt of the final valuations for these assets. These valuations were received on 1 December 2019, and they resulted in a further increase of GH¢6 million in the fair value of the net assets at the date of acquisition. This increase does not affect the fair value of the non-controlling interest. PPE is depreciated on a straight-line basis over seven years. Ignore any tax implications.

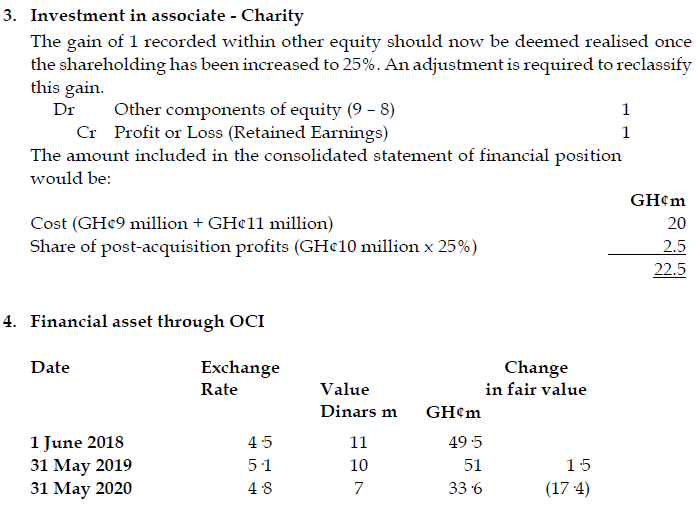

iii) Blavo acquired a 10% interest in Charity Ltd, a government business entity, on 1 June 2018 for GH¢8 million. The investment was accounted for as a financial asset through OCI, and on 31 May 2019, its value was GH¢9 million. On 1 June 2019, Blavo acquired an additional 15% interest in Charity for GH¢11 million and achieved significant influence. Charity made profits after dividends of GH¢6 million and GH¢10 million for the years to 31 May 2019 and 31 May 2020.

iv) On 1 June 2018, Blavo purchased a foreign equity instrument of 11 million dinars at its fair value. The instrument was classified as a financial asset through OCI. The relevant exchange rates and fair values were as follows:

. GH¢ to dinars Fair value of instrument – dinars million

1 June 2018 4.5 11

31 May 2019 5.1 10

31 May 2020 4.8 7

Blavo has not recorded any change in the value of the instrument since 31 May 2019.

The reduction in fair value as at 31 May 2020 is deemed to be as a result of impairment.

v) There is no impairment of goodwill arising on the acquisitions.

Required:

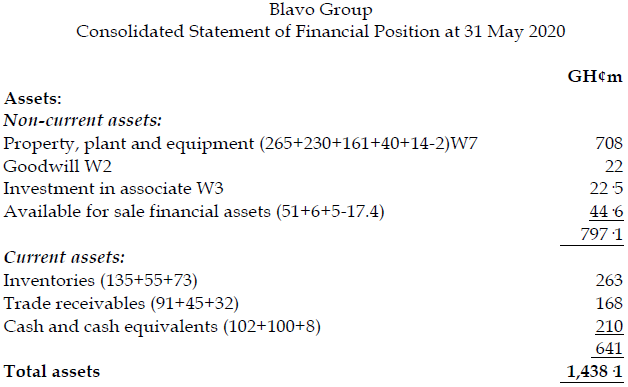

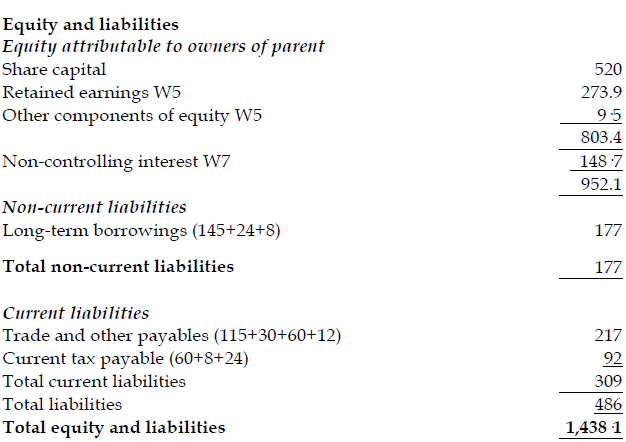

Prepare a consolidated statement of financial position as at 31 May, 2020 for the Blavo Group. (20 marks)

View Solution

The asset’s fair value in the overseas currency has declined for successive periods. However, no impairment loss is recognised in the year ended 31 May 2019 as there is no loss in the reporting currency (GH¢). The gain of GH¢1·5 million would be recorded in equity. However, in the year to 31 May 2020 an impairment loss of GH¢17·4 million will be recorded as follows:

Dr Other components of equity 1.5

Dr Profit or loss 15.9

Cr Financial asset through OCI 17.4