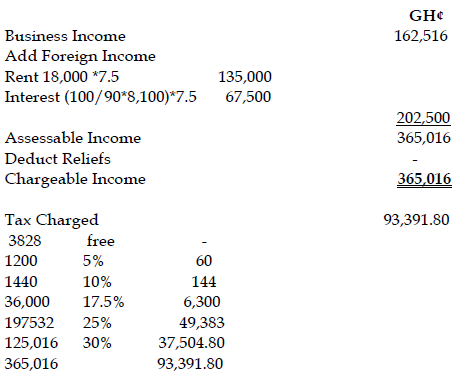

Andrew Soweah recently relocated to Ghana to commence his business after retirement from TaskForce (UK) Ltd, a security company he served for over 20 years. The nature of the business was to provide private security to diplomats and the very affluent.

Before coming to Ghana, he rented out his apartment in the UK for a yearly rent of £18,000. He also maintained a healthy balance in his account with Diamond Bank in London.

His income for 2019 year of assessment is summarized as follows:

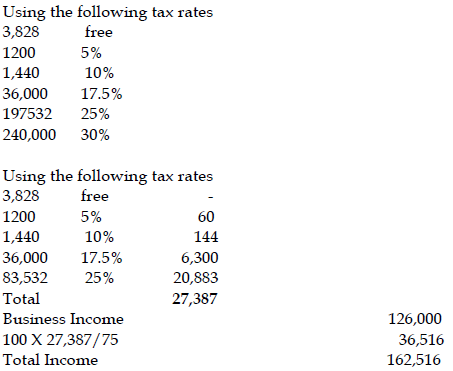

- Business Income (net of all taxes) GH¢126,000.

- Dividend received from Faithful Ltd, a resident company at gross amount was GH¢18,000.

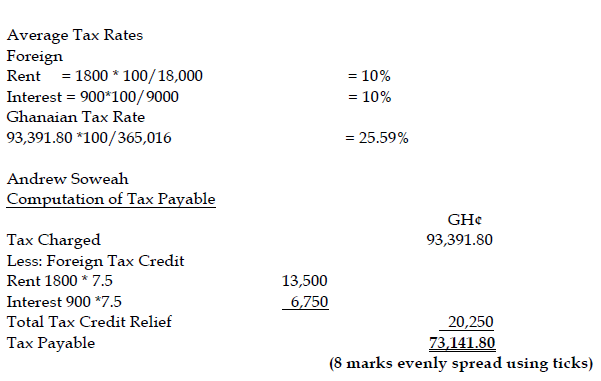

- Rent of £16,200 was paid into his account with Diamond Bank. Withholding tax amounting to £1,800 had been deducted.

- Diamond bank credited his account with net of £8,100 bank interest. UK tax rate on interest is 10%.

Additional information:

The exchange rate is GH¢7.5 for £1.

Andrew Soweah does not contribute to social security in Ghana.

Required:

Compute his tax liability as an individual for the relevant year of assessment while granting him relief for double taxation under the Ghana/UK Double Taxation Agreement using the credit method. (8 marks)

View Solution

Andrew Soweah

Computation of Tax payable